Eurozone data that was released in the first half of the day, although indicated a decrease in activity in the service sector, did not affect purchases of the European currency, which continued after Friday's demand.

However, despite the fact that the bulls have already managed to block the entire fall of EURUSD, which, surprisingly, was formed last week after the Federal Reserve lowered interest rates, it is still too early to speak about the formation of a more protracted upward trend. The situation with Brexit and weak economic data on the eurozone are likely to force the European Central Bank to change its monetary policy this September and announce the resumption of the asset repurchase program, which will put pressure on risky assets in the future.

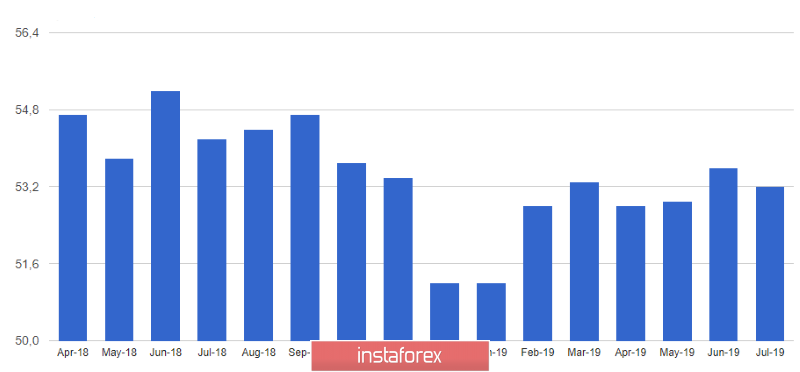

If the manufacturing sector has long slipped down, the service sector continues to stay above 50 points, but this, of course, is not enough for the European regulator to change its views on the future prospects of economic growth.

According to the data, the PMI procurement managers index for the Italian services sector rose to 51.7 points in July this year, when in June it was at 50.5 points. Italy is perhaps the only country where activity in the service sector continued to grow. Economists had expected the index to be 50.6 points.

The PMI procurement managers index for the French services sector fell to 52.6 points in July, when it was 52.9 points in June, and was forecasted at 52.2 points.

In Germany, a similar index also fell to 54.5 points in July against 55.8 points in June. Economists had expected the index at 55.4 points.

It can be seen that the slowdown in overall economic activity affects the services sector, which in the summer period always shows more powerful growth. So, the general index of PMI procurement managers for the eurozone services sector fell to 53.2 points in July against 53.6 points in June. The index was projected at 53.3.

The total composite eurozone PMI, which includes the manufacturing and services sectors, fell to 51.5 points in July against the forecast of 51.5 points. Let me remind you that this index was at the level of 52.2 points in June.

As for the technical picture of the EURUSD pair, further growth will be limited by the large resistance of 1.1185, which I noticed in the morning. After testing this range, buyers of risky assets will obviously retreat from the market, which will lead to a downward correction to the support area of 1.1110, from which it will be possible to build a new lower boundary for the current upward channel, which will indicate the formation of a new trend.

GBPUSD

The British pound continues to stagnate in one place, and data on the UK services sector once again came to the aid of buyers, which did not make it possible for a major bearish trend to resume and to break through the low of the year in the area of 1.2080.

According to the data, the index of purchasing managers for the UK services sector rose to 51.4 points in June this year from 50.2 points in June. Economists had expected the index to reach 50.2 points in July. However, given the low performance in the manufacturing sector and the situation with Brexit, so far we can only say that the Bank of England manages to avoid a recession in the economy. But without a real change in the monetary policy course, which many world central banks are now resorting to, it will be extremely difficult to influence the current situation.

As for the technical picture of the GBPUSD pair, bulls still have problems with resistance 1.2165, only a breakthrough of which will be able to reach a high of 1.2250. On the other hand, any negative Brexit news will return the pound to a steep downward peak again, and a break of support of 1.2080 will easily provide this.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română