To open long positions on GBP/USD, you need:

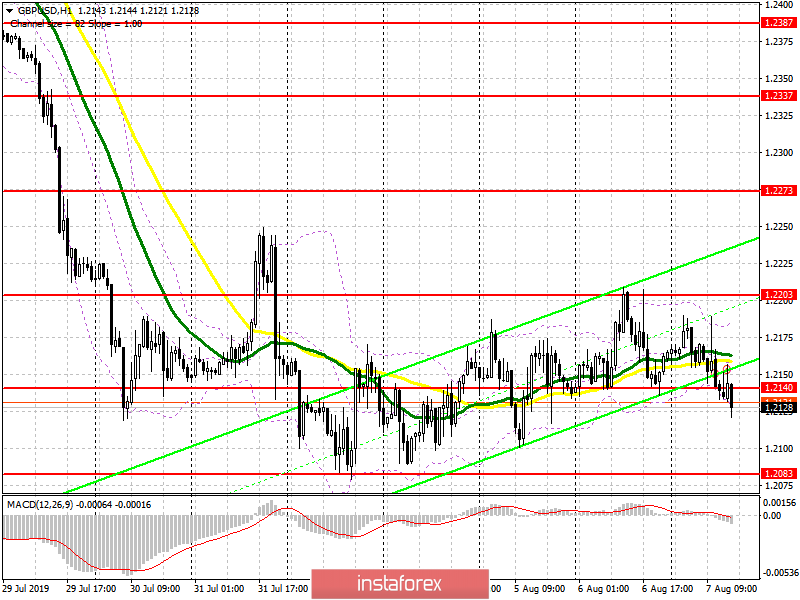

In the morning, I paid attention to the support level of 1.2140, the formation of a false breakdown at which should have led to a return of demand for the British pound. At the moment, as you can see on the chart, the market remains in the side channel, but there are no people who want to buy a pair of GBP / USD, as well as those who want to sell it. Bulls should try to close the day above the support of 1.2140, which will keep the hope for an upward correction to the resistance area of 1.2203 and to update the new maximum in the area of 1.2273, where I recommend taking the profit. If the pressure on the pound continues, which is more likely against the background of the lack of good news on Brexit, it is best to consider new long positions after the formation of a false breakout in the support area of 1.2083, or buy a rebound from a larger level of 1.2040.

To open short positions on GBP/USD, you need:

Sellers need a return and consolidation under the level of 1.2140, as only after that it will be possible to talk about their advantage. The absence of news on Brexit is likely to continue to keep the pair in the side channel, but the main task of the bears will be the minimum in the area of 1.2083, the breakthrough of which will strengthen the trend and lead to an update of supports 1.2040 and 1.1985, where I recommend taking the profit. If the demand for the pound returns in the second half of the day, amid the lack of important fundamental data, it is best to consider new short positions after the resistance update of 1.2203, or sell on a rebound from the maximum of 1.2273.

Indicator signals:

Moving Averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market.

Bollinger Bands

The break of the upper limit of the indicator in the area of 1.2193 may lead to a larger upward correction in the British pound.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română