On Thursday morning, the panic wave subsided after China released encouraging data on foreign trade in July. The Shanghai Composite Index shows + 0.95 %, and + 0.38 % from the Japanese Nikkei 225 as of 5.50 Universal time. On the other hand, gold went into correction after the explosive growth. Also, there is a decrease in demand for bonds.

The stalling of the global economy into a recession is postponed. Investors are catching their breath, but apparently, the positivity will not last long because global tensions tend to escalate.

USDCAD

The Canadian dollar is under strong pressure due to rapidly falling oil, but the loonie's exchange rate is relatively stable, as the main macroeconomic parameters still look convincing as before.

PMI in production rose in July to 50.2p, although a decrease was predicted. The Ivey's index also increased to 54.2p unexpectedly.

Economic activity in Canada is on the rise, which reduces the chances of stimulation by the Bank of Canada, and therefore, the growing yield spread supports the loonies even against the backdrop of falling oil.

On Friday, the report for July employment will be published. The forecasts are positive, and thus, the loonie has good chances to stay in the range. Support level is 1.3266, in case of decrease, it is possible to move to the level of 1.3222, where there will be a good opportunity to buy and try to return to the recent high of 1.3344.

USDJPY

The results of the meeting of the Bank of Japan on July 29-30 had a slight impact on the markets, since they completely coincided with the forecasts. However, the changes in recent days associated with the escalation of the trade war between the United States and China, have led to the fact that the prospects for the yen have changed markedly.

The Bank of Japan promised that it would not hesitate to take additional measures to soften the monetary policy if necessary, after which the Fed lowered the rate by 0.25%, and the RBNZ altogether by 0.5%. The escalation of tension led to a decline in oil and a sharp increase in demand for protective assets. The gold, for the first time in 6 years, overcame the line of $ 1,500 per ounce. Also, the demand for the yen increased.

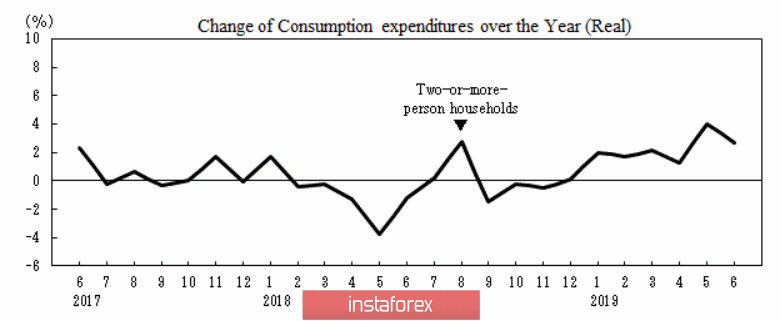

Internal factors do not cause concern yet. Wages rose in June, and household spending is also rising, which supports inflation.

The balance of payments and the balance of foreign trade are also still in surplus, although serious external factors have been added in the last week.

A sharp increase in the yen will inevitably lead to a drop in the income of exporters and bring BoJ closer to fulfilling the promise. However, it should be borne in mind that in addition to the tension of the United States - China and Japan - South Korea, the probability of an increasing tension along the line of the United States and Japan is also growing. The negotiations that took place last week in Washington did not bring the parties closer to the deal, and in late August, new ministerial meetings should be held to try to agree on the main parameters of the deal between the US and Japan for Abe's visit to Washington by late September.

Meanwhile, the latest signals indicate that Trump intends to use all possible levers of pressure on Japan to extract concessions. If the demand for a fivefold increase in spending to support the US military presence is likely to be met without serious resistance, any attempts to weaken BoJ's policies increase the risk that Japan, after China, may be declared a "currency manipulator". This concern is already openly voiced by analysts at major Japanese banks, in particular, Mizuho predicts increased pressure on the yen in the coming weeks.

Therefore, Japan may lose the ability to influence the yen, which is what the US needs first of all. The development of panic will contribute to the growth of demand for protective assets, and the Bank of Japan will lag behind the Fed in its actions, which may lower the yen below 100.

Today, the fall of USDJPY is unlikely. What is more likely is the formation of a local base and trade in the range of 105.48 / 55 - 106.50 / 65.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română