To open long positions on GBP/USD, you need:

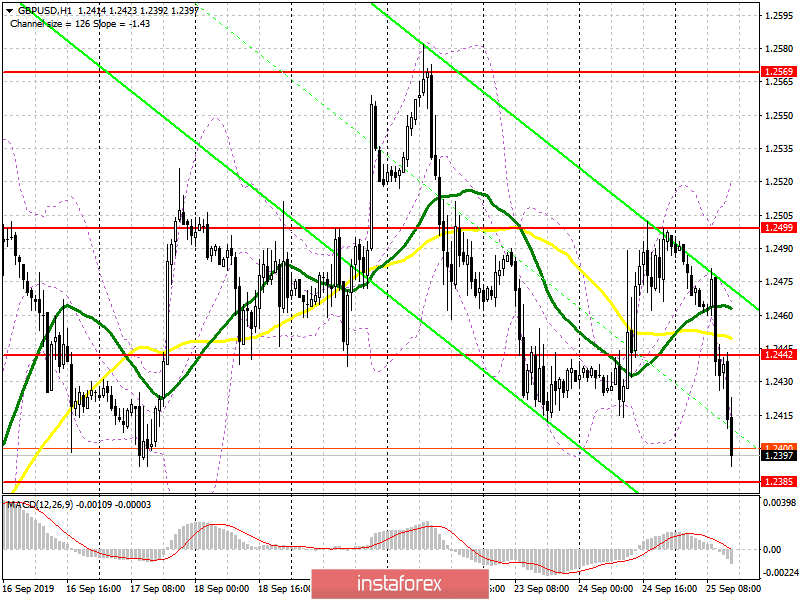

Even despite yesterday's decision of the UK Supreme Court, buyers of the pound are in no hurry to return to the market, and the breakthrough of the morning support of 1.2442 further aggravated the situation. The retail sales index, according to the Confederation of British Industrialists, also did not help the bulls very much, despite its slight increase. At the moment, it is best to consider new long positions in the pound only after the formation of a false breakdown in the support area of 1.2385, but I recommend postponing larger purchases until the minimum of 1.2323 is updated. The bulls' task in the afternoon will also be a return to the resistance of 1.2442, since only after that it will be possible to discuss the formation of an upward correction in the pair and continued growth.

To open short positions on GBP/USD, you need:

Bears coped with the morning task and managed to return to the level of 1.2442, which previously acted as support. At the moment, their new target is a minimum of 1.2385, the breakthrough of which will lead to the demolition of a number of stop orders of bulls and further downward correction of GBP/USD in the area of lows of 1.2323 and 1.2238, where I recommend fixing the profits. If the bulls manage to build an upward correction from the support of 1.2385 in the second half of the day, it is best to consider new short positions for a rebound from the resistance of 1.2442, just above which the upper limit of the current downward channel passes. It is important to note that the lower border of this channel is located between the levels of 1.2323 and 1.2385 in the range of 1.1240, from where the market will also be able to observe profit-taking on short positions.

Signals:

Moving Averages

Trading is below 30 and 50 daily averages, indicating a resumption of the bearish trend.

Bollinger Bands

In the case of an upward correction, the resistance will be the middle of the indicator at 1.2465.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română