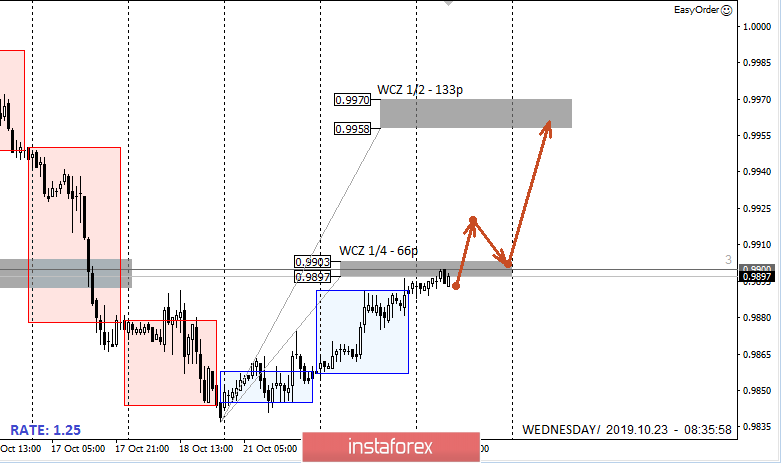

Test WCZ 1/4 0.9903-0.9897, which is happening at the moment, will be decisive for today's trading plan. The opening of trading of the European session above this zone will make it possible to consider purchases whose goal will be WCZ 1/2 0.9970-0.9958. It is important to understand that this movement will be corrective relative to the fall of last week, which indicates the need to record purchases with the WCZ 1/2 test.

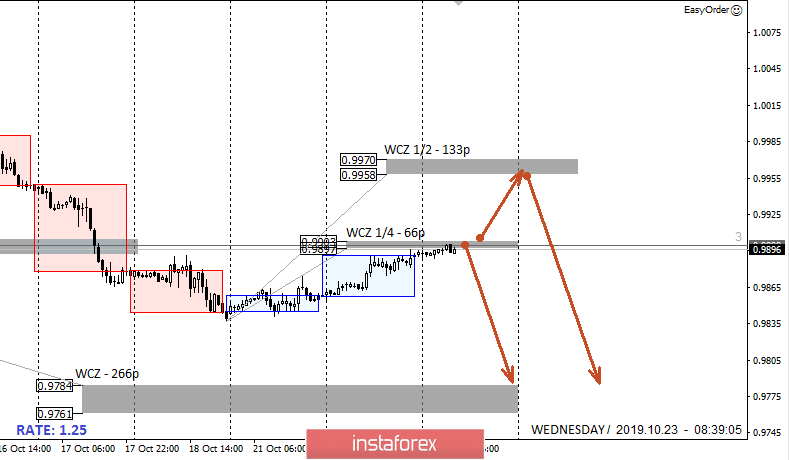

Work within the framework of the last downward movement allows us to search for sales at significant resistance, which are WCZ 1/4 and WCZ 1/2.

Selling from current marks will be possible in the event of the formation of a false breakout pattern of yesterday's high. This will make it possible to keep sales to the main goal - weekly control zone 0.9784-0.9761. The reduction range is large enough, which makes it possible to obtain a favorable risk-to-reward ratio. The most favorable selling prices are within WCZ 1/2.

Daily CZ - daily control zone. The area formed by important data from the futures market, which change several times a year.

Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română