The corporate reporting season led to the growth of US stock indices and supported the dollar. Thus, companies show an average higher results than forecasted by the market.

Today, volatility may increase by the end of the day. In the USA, updated data on orders for durable goods and PMI will be published according to Markit and from the UK, you can expect a new revelation about the progress of the negotiations on Brexit.

At the same time, the growth of quotes of the oil, against the background of an unexpected reduction in reserves and the threat of copper shortages, are supported by commodity currencies, which may stay in the lateral range amid growing demand for the dollar. However, euro and franc look weaker and may decline by the end of the day.

EUR/USD

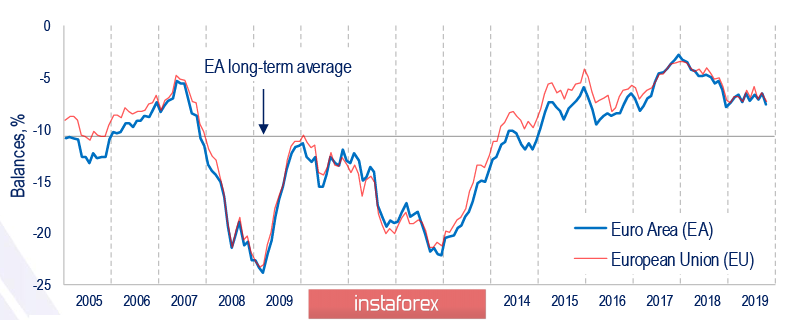

Today, Markit will publish preliminary data on business activity in the eurozone in October. The data last September turned out to be disastrous, and there are fears that the weakness of the manufacturing sector will begin to flow into the services sector. The European Commission reported on the dynamics of consumer confidence. The decline to -7.6p from -6.5p a month earlier is stronger than forecasts, thus, the likelihood of a decline in PMI in the services sector is high. Despite the stability of the fall, the safety margin has not been exhausted, since the current value is still above the long-term average.

At today's meeting of the ECB and the last press conference for Mario Draghi, no significant changes are expected. The dynamics of bond yields in Germany and France are weak, that is, expectations of the market do not imply a strong reaction. Thus, the probability of a euro decline by the end of the day increases. Draghi, in turn, can allow himself to call for more aggressive steps during his closing speech to support the European economy, given the weak inflation and reduced business activity, which can lead to limited sales of the euro.

Nevertheless, a rate reduction is not expected, since such a step will distort the already planned changes - the introduction of a new approach to deposit rates from October 30 and asset purchases from November 1. These previously announced measures are significant, and it will take time to assess their impact on the economy of the eurozone, and therefore, Christine Lagarde will decide on the rate at subsequent ECB meetings.

Accordingly, we expect a slight decline in the euro at the end of the day as part of the implementation of the most likely scenario. Immediate support for 1.1108 during the first test has survived, but the probability of a repetition remains high. Thus, it is possible to reduce the euro in the support zone of 1.1061 / 81, which will allow you to stay in the upward channel, but will mean loss of momentum and a transition to the lateral range.

GBP/USD

The Brexit saga continues to control the pound and the general mood in the markets. Prime Minister Boris Johnson suspended the implementation of the Brexit agreement in the British Parliament, as he lost the ability to maintain the necessary pace. Now, the solution to the issue depends on the success of the negotiations between Johnson and Labor leader Corbyn.

On the other hand, CBI reports that production in the UK continues to decline and over the past quarter, the decline was 10% while the total number of new orders fell by 15% in the 3rd quarter. As a result, employment in the sector declined by 9%, the maximum reduction since April 2010. Thus, forecasts are negative - Most respondents expect orders to decline at a faster pace in the 4th quarter.

Against the backdrop of gloomy prospects for manufacturers, investment plans reached a minimum after the financial crisis of 2008/09. The main problem that CBI points out is a lack of understanding on export prospects. Exit from the EU also means exit from trade agreements, which means that the UK has to fight for duty-free access to markets.

As a result, the pound fell back to the support zone of 1.2810 / 30, which remained stable, but the chances of continued growth still decreased significantly. The lack of news keeps the pound in the range with the upper limit of 1.3012, although there is no driver. Therefore, the pound may go either way, depending on what news comes in about the Brexit negotiations.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română