The silence that had lasted for several days, which was only occasionally interrupted by the cries of a quarrel coming from London, threatening to develop into a fight, will now be a thing of the past. Indeed, today, a meeting of the Board of the European Central Bank will take place, which will be a farewell for Mario Draghi since the next meeting will be chaired by Christine Lagarde. Although no one doubts that the monetary policy parameters of the European Central Bank will remain unchanged, today's meeting is extremely important. After all, it is quite obvious that after the deposit rate has been reduced, and the next step should inevitably be a reduction in the refinancing rate. However, it is not clear when exactly. It is hoped that Mario Draghi himself will give an answer to this question during his farewell press conference. If during his speech he expresses concern about the current state of the European economy, as well as concerns about its prospects, there will be little doubt that the very first decision by Christine Lagarde as head of the European Central Bank will be just to lower the refinancing rate to a negative value . Moreover, the state of the European economy does cause a lot of concern. To do this, just look at the dynamics of industrial production. Nevertheless, it is highly likely that Mario Draghi will essentially not say anything, although his speech will be lengthy and verbose.

In addition, one should not assume that everything that will happen today is limited only to a meeting of the Board of the European Central Bank. It turns out a lot of interesting macroeconomic data will be published. Which, incidentally, indirectly suggests that the speech of Mario Draghi will be neutral. Thus, preliminary data on business activity indices in several European countries have already been published. and, as usual, they came out somewhat different than expected. In France, everything is fine, as the index of business activity in the services sector grew from 51.1 to 52.9, and production from 50.1 to 50.5. The forecasted growth was to 51.6 and 50.3, respectively. As a result, the composite business activity index, which was supposed to grow from 50.8 to 51.0, showed growth to 52.6. In Germany, the picture is somewhat different, although there is an increase in indicators. The most important thing is that the business activity index in the production index grew from 41.7 to 41.9, which allowed the composite index to grow from 48.5 to 48.6, despite a decline in the business activity index in the service sector from 51.4 to 51.2. However, they forecasted an increase in the index of business activity in the manufacturing sector from 41.7 to 42.0, and in the service sector from 51.4 to 52.0. Thus, they were waiting for the growth of the composite index from 48.5 to 48.8. So, although there is growth, it is still not the same as we would like. But more importantly, the manufacturing index continues to remain below 50.0 points. However, data across Europe are of much greater importance, and, frankly, they resemble data for Germany. That is, they showed growth, but not as expected. Moreover, the index of business activity in the manufacturing sector remained unchanged, at a value of 45, 7 points waiting for growth to 46.0 points. The growth was demonstrated by the index of business activity in the services sector, but not to 51.9, but from 51.6 to 51.8. As a result, the composite index of business activity grew from 50.1 to 50.2, although it is forecasted to rise to 50.3.

Composite Business Activity Index (Europe):

The United States also publishes preliminary business activity index data. In particular, the index of business activity in the manufacturing sector may decline from 51.1 to 50.9. At the same time, they expect an increase in the index of business activity in the services sector from 50.9 to 51.1. As a result, the composite index of business activity can grow from 51.0 to 51.5. Data on orders for durable goods will also be published, which should be reduced by 0.6%. A similar fate awaits the sale of new homes, but they should only be reduced by 2.2%. Thus, in general, forecasts on American statistics do not cause such optimism. However, data on applications for unemployment benefits will add joy. So, the number of initial applications for unemployment benefits should decline by 11 thousand, and the number of repeated applications by another 14 thousand. In other words, American macroeconomic statistics are unlikely to allow investors to determine their sentiments due to their apparent divergence.

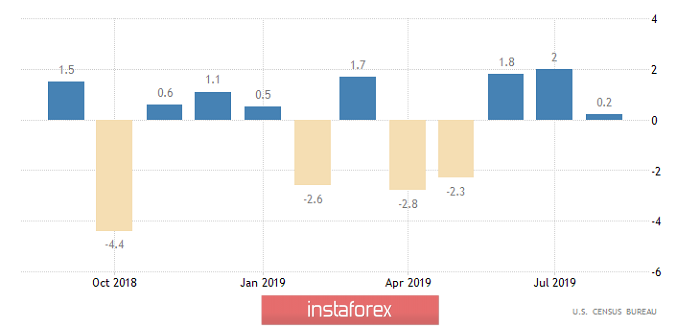

Durable Goods Orders (United States):

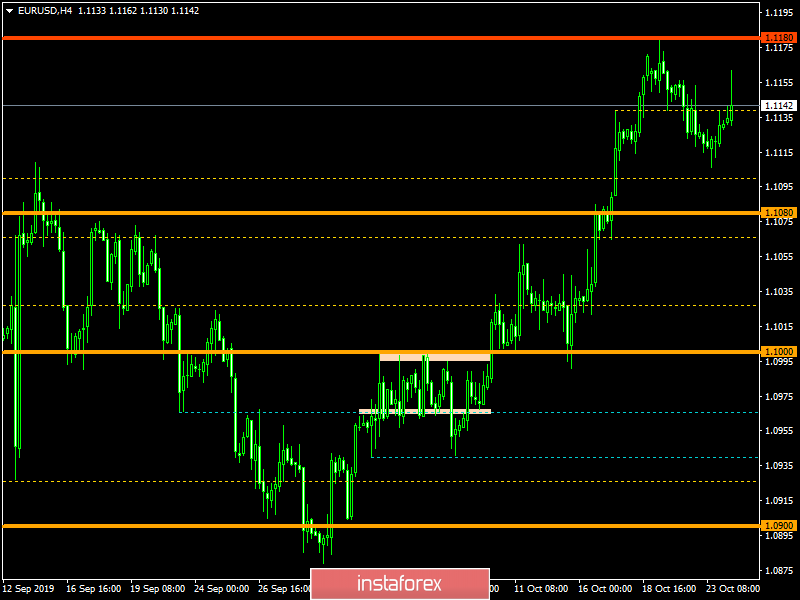

The euro / dollar currency pair found a resistance point in the face of the mirror level of 1.1180, forming as a fact a local correction in the direction of the previously passed level of 1.1100. The next step was in terms of an attempt to return buyers to the market, but the characteristic surge did not lead to anything radical, and we remained at the congestion point. It is likely to assume temporary restraint in the area of 1.1145, where in the absence of proper price fixing above a certain point, we will be temporarily drawn into horizontal fluctuations even before the release of information from the ECB.

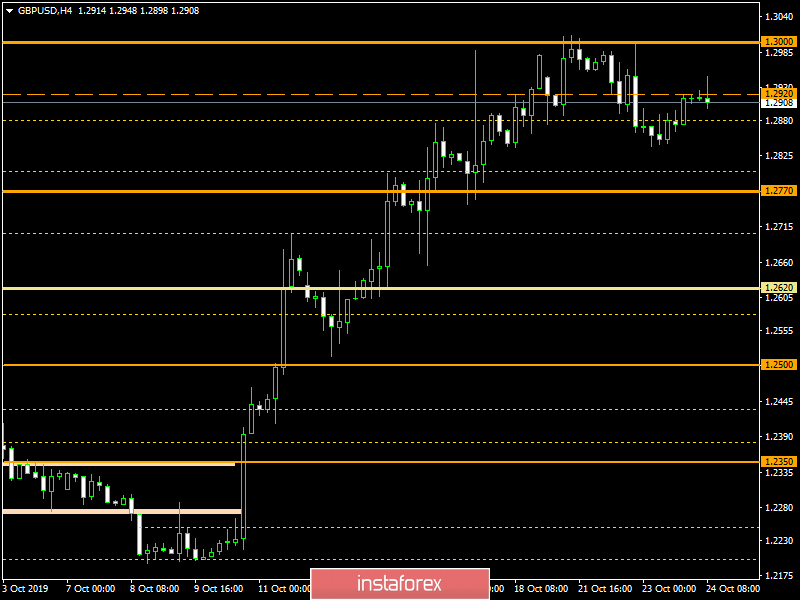

The pound/dollar currency pair, drawing a vertical movement, reached the subsequent psychological level of 1.3000, where it sensed a resistance point in front of us and locally corrected us. It is likely to assume that the fervor of buyers has not yet subsided enough, and this puts pressure on sellers. Thus, a temporary ambiguous chatter within 1.2835 / 1.2945 can form in the market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română