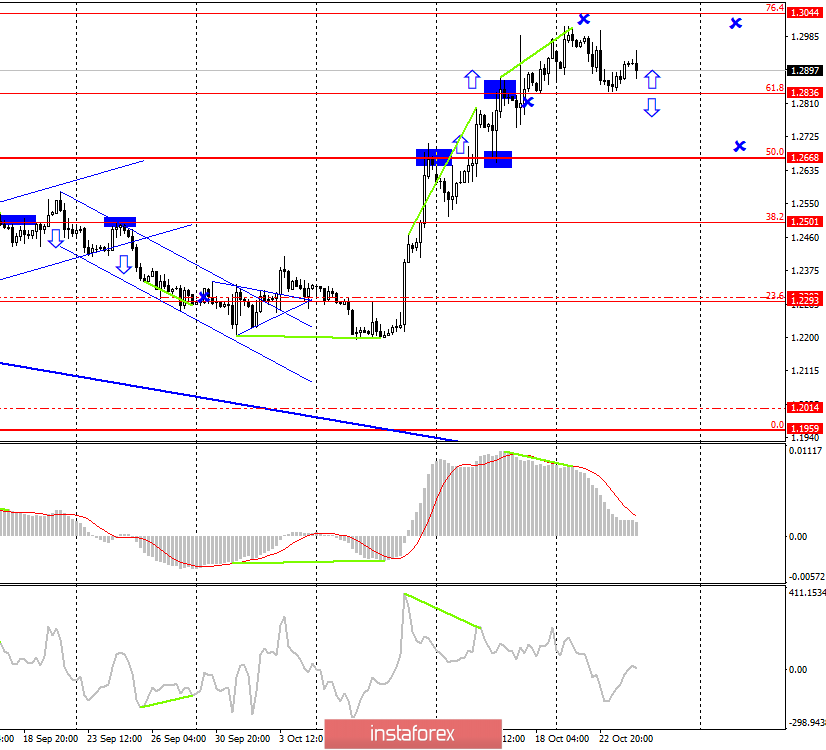

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a fall to the Fibo level of 61.8% (1.2836), however, the correction from this level of correction was not performed. Nevertheless, the growth process has begun, within which the pound/dollar pair is now located. Thus, traders have received neither the signal to buy nor the signal to sell for the past day. None of the indicators has emerging divergences today. There is a persistent feeling that the pound is preparing for a new fall.

Today, on October 24, it is almost officially possible to say that Brexit has been postponed to January 31, 2020. This date was repeatedly called a few months ago, because even then there were great doubts that the UK with Boris Johnson will leave the European Union on October 31. Now, the European Union has already declared its readiness to grant a new delay. As this is what the British Parliament sought, despite the formal approval of Johnson's deal, all parties except Johnson are fully satisfied. To postpone Brexit for 3 months, they will not even convene a summit of European countries, everything will be issued in writing shortly. Thus, Donald Tusk and Jean-Claude Juncker ignored the "additional" letters from Boris Johnson, in which he asked not to postpone Brexit. As a result, we have witnessed a stunning situation "one against all", where Boris Johnson is hiding under the word "one," who stubbornly do not want to understand that 650 deputies of the Parliament and the EU government alone cannot be beaten.

Well, the British pound will have to decide in the coming days where to move next. Since the next busy period can be considered left behind, bull traders need to decide on how to buy the pound further. I believe that there are not so many reasons for this. Today, we will closely monitor the economic reports from America, but for a long time, the pound will not be able to grow on only weak data from the USA. Moreover, the situation itself with Brexit has not been solved and remained. Nothing has changed, and the pound may begin to fall again, as it has done for the last three years. I believe that traders will sooner or later return to this scenario. It is Brexit that remains the most significant topic for the British currency, and even, for example, a reduction in the key rate of the Fed will not mean more to traders.

According to economic reports from the UK, traders have already managed to get bored. There are no reports from the Kingdom on the news calendar this week. It was already felt that it was weak reports from the United States that could affect the pound/dollar pair, but do not forget that in the UK economic figures leave much to be desired, and the Bank of England is considering lowering the key rate.

What to expect from the pound/dollar currency pair today?

The pound/dollar pair fell to the correction level of 61.8%. I am waiting for quotes to close below this level today, as I believe that the upward momentum has exhausted itself. The information background today will be in the American reports. On the topic of Brexit, I do not expect important news.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.

Forecast for GBP/USD and trading recommendations:

I recommend buying the pair with a target of 1.3044 if the rebound from the Fibo level of 61.8% with the stop-loss order below the level of 1.2836 is performed.

I recommend considering sales of the pair with a target of 1.2668 if consolidation below the Fibo level of 61.8% is performed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română