Data on manufacturing activity in the eurozone once again proved the fact that the start of the 4th quarter in the eurozone is on a minor note. Therefore, all the attention of traders today was focused on the publication of the decision of the European Central Bank on interest rates, as well as on the last speech of the head of Mario Draghi.

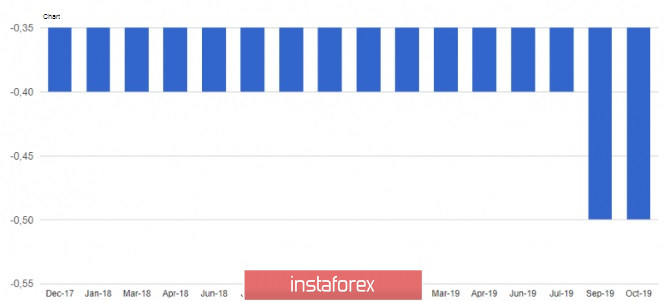

According to the data, the European Central Bank left the refinancing rate unchanged at 0.0%, as well as the deposit rate at its negative level of -0.5%. This decision provided some support to the euro.

The ECB said that the key rate will remain at the current or lower level until inflation moves confidently to the target level of about 2.0%. The purchase of bonds, as previously stated, will begin on November 1 for 20 billion euros per month, and will continue for as long as necessary.

This suggests that the regulator is laid for a sufficiently long period of low-interest rates and soft credit policy, and at least 2-3 years, you cannot expect changes in it.

During a press conference, ECB President Mario Draghi said he was ready to adjust all instruments to achieve the inflation target, as the latest data indicate the continued weakness of the eurozone economy, thereby hinting that by the end of the year, the regulator may further reduce the already negative interest rates.

According to Draghi, downside risks for economic growth and inflationary pressure appear restrained, but the slowdown is due to the weakness of trade, as well as the threat of protectionism (it is about trade duties from the United States) and the current geopolitical processes (it is about the situation with Brexit).

Draghi also appealed to EU countries, saying that governments with space for fiscal maneuvering should take timely action, rather than waiting for support from the ECB.

Given that the further growth of the euro will remain quite weak, and mainly the upward movement will be due to the weakness of the US dollar, support for risky assets in the medium term can be provided by the new head of the ECB Christine Lagarde. First of all, her actions will be aimed at finding balance among several leaders of the ECB Governing Council, however, Christine Lagarde will likely try to convince the governments of the eurozone countries to reform fiscal policy.

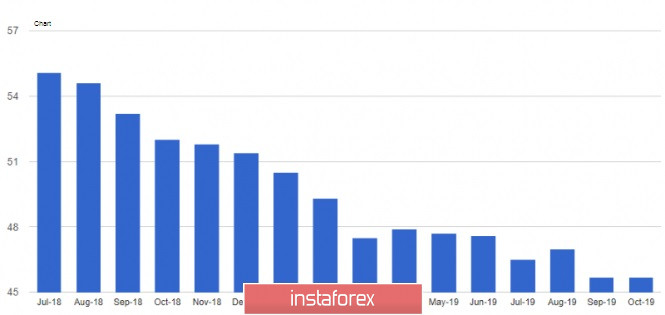

As noted above, the publication of the eurozone purchasing managers' indices (PMI) for October led to a decline in the EURUSD pair in the short term.

The only country where there was an acceleration in industrial activity was France. According to preliminary data, the purchasing managers' index (PMI) for the French manufacturing sector in October this year rose to 50.5 points against 50.1 points in September. Economists had expected the index to be at 50.3 points. The service sector remained at a fairly good level. There, the PMI for the services sector rose to 52.9 points in October from 51.1 points in September. The index was forecast at 51.6 points.

In Germany, things are not as fun as we would like. As the preliminary report showed, the purchasing managers' index for the manufacturing sector in October remained at a record low of 41.9 points against 41.7 points in September. Economists had forecast a figure of 42.0 points.

As for the services sector, there was a slight slowdown, although the index remained above 50 points. According to the data, the preliminary purchasing managers' index (PMI) for the German services sector in October fell to 51.2 points against 51.4 points in September.

As for the overall indicator for the eurozone, the purchasing managers' index for the manufacturing sector in October remained unchanged at 45.7 points, although economists had expected an increase to 46.0 points. The sphere was slightly better, showing a level of 51.8 points in October, against 51.6 points in September.

The eurozone composite purchasing managers' index rose to 50.2 points in October from 50.1 points in September.

It has been repeatedly noted that the problem in the eurozone manufacturing sector is directly related to the trade war that the United States is waging with other countries. The decline in exports and the slowdown in the world economy add to the overall negative picture in production.

As for the EURUSD pair, further growth is still limited by the resistance of 1.1150. Its breakdown will renew demand for the euro, which will lead to an update of the local maximum around 1.1180, and then to an update of the larger resistance levels of 1.1225 and 1.1270. In the scenario of a decrease in risk assets after the ECB meeting, you can count on support only at the minimum of 1.1090, as well as from the local zone of 1.1050.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română