To open long positions on GBP/USD, you need:

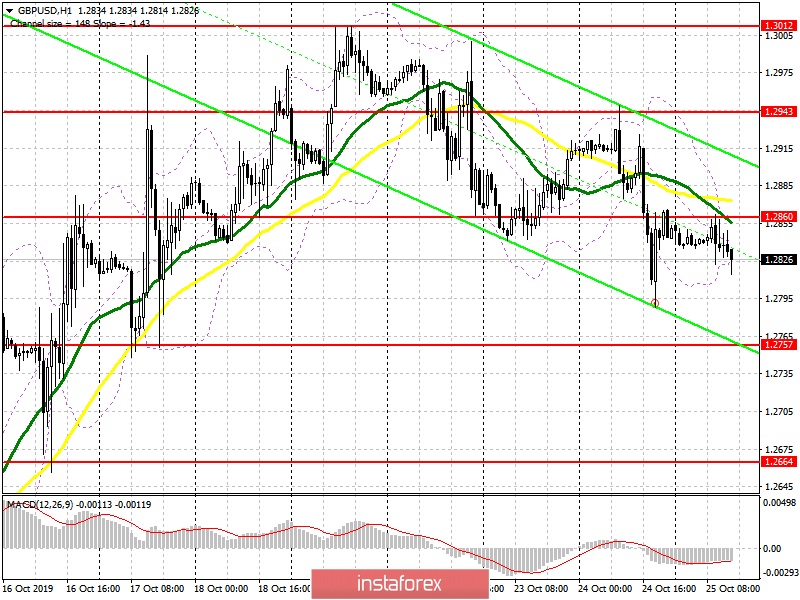

From a technical point of view, nothing has changed compared to the morning forecast. The lack of Brexit news also limits the volatility of the pound. In the first half of the day, the bulls failed to regain the resistance of 1.2860, which may lead to a new wave of decline of the pair. The main task for the US session remains a breakthrough and consolidation above this range, which will be a signal to open long positions capable of updating the highs of 1.2943 and 1.3012, where I recommend taking the profits. If the pressure on the pound continues, only the formation of a false breakdown near the lower border of the current correction channel, as well as the support test of 1.2757 will be a signal to open long positions. Otherwise, it is best to buy GBP/USD on a rebound from the minimum of 1.2664.

To open short positions on GBP/USD, you need:

Today, a vote will be held on the proposal of Boris Johnson to hold general elections on December 12 this year. If such a decision is made, which I personally doubt, the pressure on the pound may increase. The bears did not allow today to get above the resistance of 1.2860 in the first half of the day and formed a false breakdown there, which keeps the pair's downward potential. The bears' target remains below the support at 1.2757, which coincides with the lower boundary of the current correction channel, where I recommend taking the profits. The EU has already said that the vote on granting the delay has been postponed to next week, which limits the upward potential of the pound. However, in the case of a breakdown of the resistance of 1.2860, it is best to consider short positions in GBP/USD from larger highs around 1.2943 and 1.3012.

Indicator signals:

Moving Averages

Trading is below the 30 and 50 daily averages, which indicates a possible decline in the pound in the short term.

Bollinger Bands

If the pound rises and the upper limit of the indicator breaks in the area of 1.2860, it can expect further upward movement along the trend.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română