The outgoing Mario Draghi was able to cool the fervor of the "bulls" on EUR/USD by stating that the harm of negative rates was greatly exaggerated, that there was no mention of a split in the ranks of the ECB, and the quantitative easing program would last until the first increase in the deposit rate. If existing rules begin to limit it, the central bank may refuse them. We are talking about the limit of 33% of the volume of bonds issued by one country and the key to capital. The derivatives market believes that the ECB will begin to normalize monetary policy only in 2022, so the euro should theoretically be weak for a very long time. In practice, everything is different.

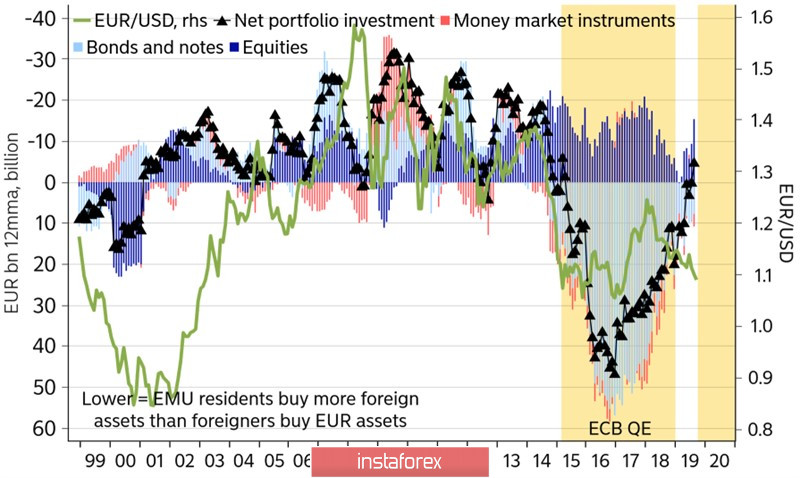

The exchange rate of any currency is determined by capital flows of investment and trade nature. The former are more mobile, the latter began to play a more significant role than before in connection with the trade wars. The European QE has not yet started, but investors have activated their actions to purchase securities issued by issuers of the Old World. Stocks seem cheap to them (in dollar terms, since January 2018, European stock indexes have lost about 14-19%), and demand for bonds is high due to QE and the weakness of the currency bloc's economy. Disappointing statistics on the eurozone are unlikely to lead to grand sales of EUR/USD, as the chances of a fiscal stimulus will increase.

In the United States, by contrast, disappointing data strengthens the risks of the S&P 500 correction and the overflow of capital from America to Europe. As a result, investment flows suggest that the euro is clearly underestimated against the US dollar, and the main currency pair should be trading at 1.3.

Dynamics of EUR/USD and investment capital flows

The three main problems of the EUR/USD bulls are Brexit, trade wars and the ECB's ultra-soft monetary policy. No matter how much Mario Draghi talks about the absence of a split in the Governing Council, this is not so. Jens Weidmann intends to oppose the abolition of existing rules, and other "hawks" of the European Central Bank will certainly support him. The potential for monetary expansion in the Old World is limited, and this deprives the "bears" on the main currency pair of one of the trump cards. I do not think that the story of Brexit will last. Yes, the transition period will be extended, but in the end, everything will be resolved safely – London and Brussels will sign an agreement. The fact that the US economy is slowing under the influence of trade wars will make Donald Trump more compliant than before.

In the week to November 1, investors' attention will be focused on the meeting of the Fed and the statistics on the US labor market. According to Bloomberg experts, the Fed will cut the rate by 25 bps to 1.75% and will signal a pause. CME derivatives give less than 25% probability of monetary expansion in December, but if the data on the States continue to deteriorate, the chances will go up, and the USD index – down.

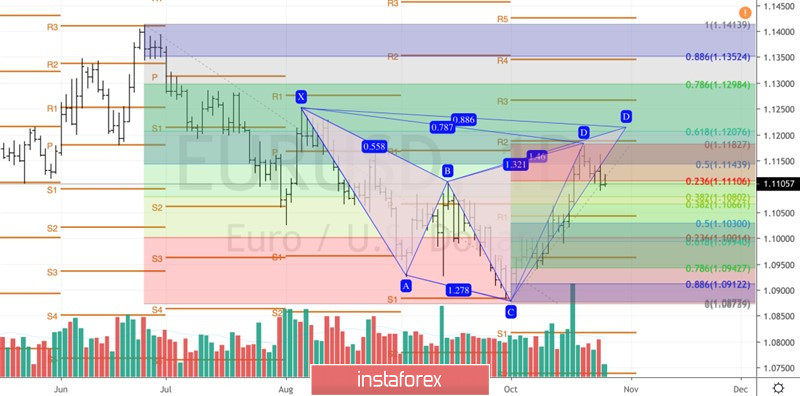

Technically, after reaching the intermediate target by 78.6% according to the "shark" pattern, the risks of a rollback in the direction of 23.6%, 38.2% and 50% of the CD wave increased. Especially promising for purchases of EUR/USD in the area of 1.1065-1.108.

EUR/USD, the daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română