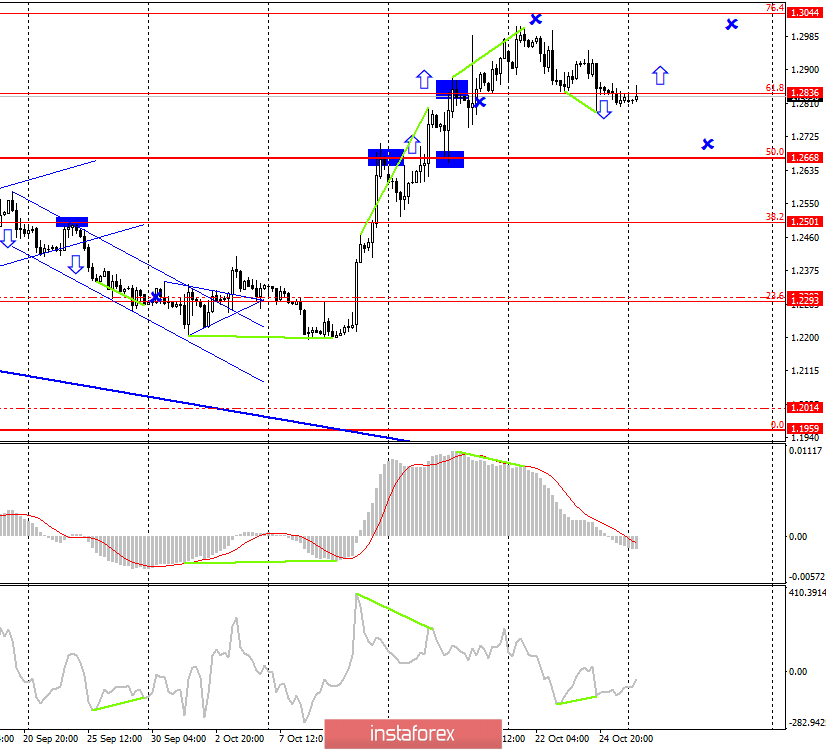

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a consolidation under the Fibo level of 61.8% (1.2836), however, the bullish divergence in the CCI indicator has not disappeared and still implies some growth of the pair. Thus, the quotes were in a "trap" when two signals are talking about the movement in different directions. Therefore, you need to wait for one of the signals to cancel or pass the low divergence, or the pound/dollar pair will close above the correction level of 61.8%.

Recent data and events continue to make us think that Boris Johnson has no support in the parliament, and even some of his fellow party members continue to support the opinion of their leader, so as not to repeat the fate of 20 party members, whom Johnson just kicked out for supporting opposition bills. Last week, Johnson furiously tried to push through his version of the agreement with the European Union, reached literally at the last moment, but Parliament refused to meet the Prime Minister and decided to take a break for about 2-3 weeks to study in detail the document submitted by the government. Thus, before October 31, Brexit will not be there, and the European Union will most likely enable Great Britain to come out later. However, Parliament needs to approve the Johnson agreement anyway for the withdrawal to take place. And for this, you need to vote and gain more than 50%. How many votes in Parliament on Johnson's proposals received more than 50% of the vote? Most likely, Johnson's deal will not be supported now, almost all the political parties of the Kingdom have already spoken out about this, and, according to opposition deputies, this deal is even worse than Theresa May's deal.

As for Johnson's desire to hold early parliamentary elections, it's still funnier. To start this process, Johnson's proposal should get at least 66.67% of the vote in Parliament. And his "ultimatum" to the deputies – the postponement of Brexit in exchange for parliamentary elections – looks ridiculous. How are these two processes related? Why would parliamentarians agree to this ultimatum? How can Johnson influence the House of Commons? Deputies simply reject the first Brexit "With Deal" for the reasons stated above, then reject Johnson's proposal for the election (by the way, not the first time), and that's all. What will Johnson do then? Set new ultimatums?

The pound remains and will remain in limbo, as a delayed Brexit is both good and bad. The Fed will lower the rate – it will be possible to count on the new growth of the British pound. But the fall of the British currency is possible almost at any time, as there are big questions over the period between October 10 and 21, when the pound soared up on information about Britain's possible exit from the EU "With Deal" before October 31. The information was not confirmed.

What to expect from the pound/dollar currency pair today?

The pound/dollar pair performed consolidation under the correction level of 61.8%. I expect the fall to continue today, but the CCI divergence reversal is also necessary. If the cancellation happens, the chances of falling will increase. Well, the information background for October 28 is missing again.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.

Forecast for GBP/USD and trading recommendations:

I recommend buying the pair with a target of 1.3044 if a close above the Fibo level of 61.8% is executed with the stop-loss order below the level of 1.2836.

I recommend considering the sales of the pair with the target of 1.2668 if consolidation under the last low of bullish divergence is completed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română