Good evening, dear traders! I congratulate everyone on the beginning of the trading week. I present to your attention a trading idea for the EURUSD pair.

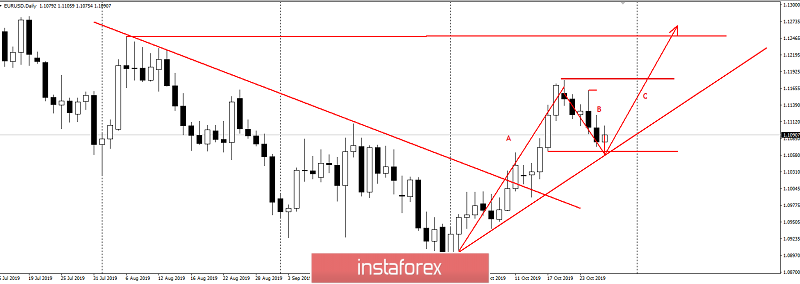

The global weakening of the US dollar, associated with weak macrostatistics and a high probability of an interest rate increase at the next meeting of the Fed, pushed the pair EURUSD for the quote 1.1, and in the first half of October, we observed a steady trend in the euro, which broke through the downward trend of the instrument and, thus, formed a wave A, the classic three-wave ABC. After the ECB press conference, we see a pullback wave of "B", which, in my opinion, is in its final phase:

Within this large structure – general recommendations – for purchases in order to update quotes 1.11783 and 1.12500.

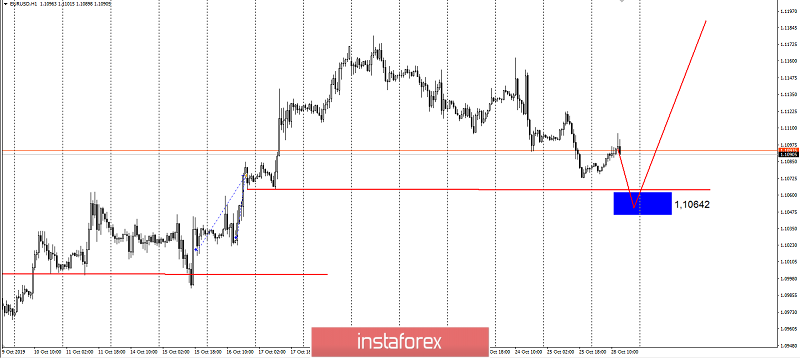

But before that, EURUSD can capture the stops of buyers presented in the screenshot below:

It is possible to work out both a decrease to the goal in the short term and an increase in the medium term.

There's a lot of important news this week like the FOMC on Wednesday and the NFP on Friday.

Be careful when trading at this time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română