Hello, dear colleagues.

According to BTCUSD, the price has issued long-term initial conditions for the upward cycle of October 23 and at the moment, we expect a weekly movement in the horizontal corridor of 288.00 – 229.50. According to Ethereum, the price has issued long-term initial conditions for the upward cycle of October 23 and at the moment, we expect a weekly movement in the horizontal corridor of 201.00 – 167.50, which is more convenient to trade in the corridor than on BTCUSD.

Forecast for October 28:

Analytical review of cryptocurrency in H1 scale:

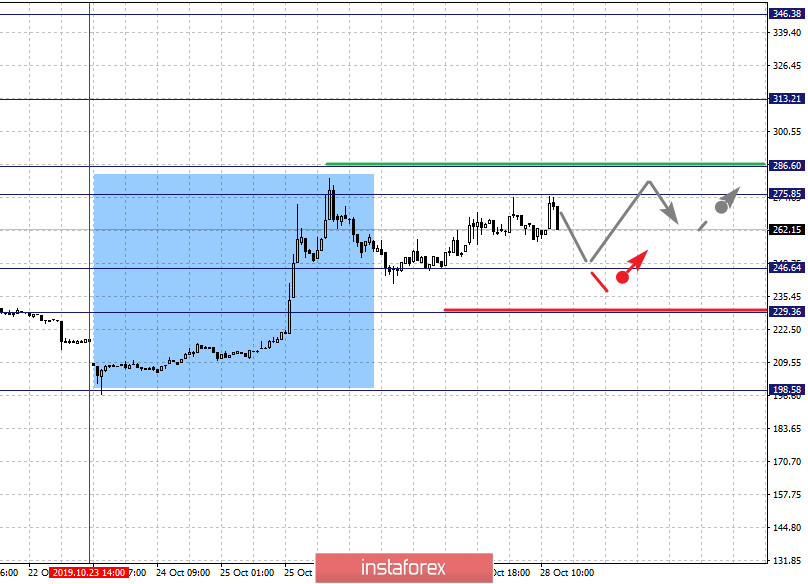

For the BTCUSD instrument, the key levels on the H1 scale are 346.38, 313.21, 286.60, 275.85, 246.64, 229.36, and 198.58. At the moment, the price has issued long-term initial conditions for the upward cycle of October 23. We expect the development of the main trend after the price passes the range of 275.85 – 286.60. In this case, the first target is 313.21 and near this level is the consolidation. The breakdown of 313.50 should be accompanied by a pronounced upward movement. The potential target – 346.38.

A short-term downward movement is possible in the range of 246.64 – 229.36, hence we expect a key reversal to the top. The breakdown of the level of 229.36 will lead to the development of a downward trend. The potential target – 198.58.

The main trend is the long-term initial conditions for the top from October 23rd.

Trading recommendations:

Buy: 286.60 Stop Loss: 246.50 Take Profit: 313.00

Buy: 313.50 Stop Loss: 276.00 Take Profit: 346.00

Sell: 246.64 Stop Loss: 286.60 Take Profit: 229.50

Sell: 228.00 Stop Loss: 247.00 Take Profit: 200.00

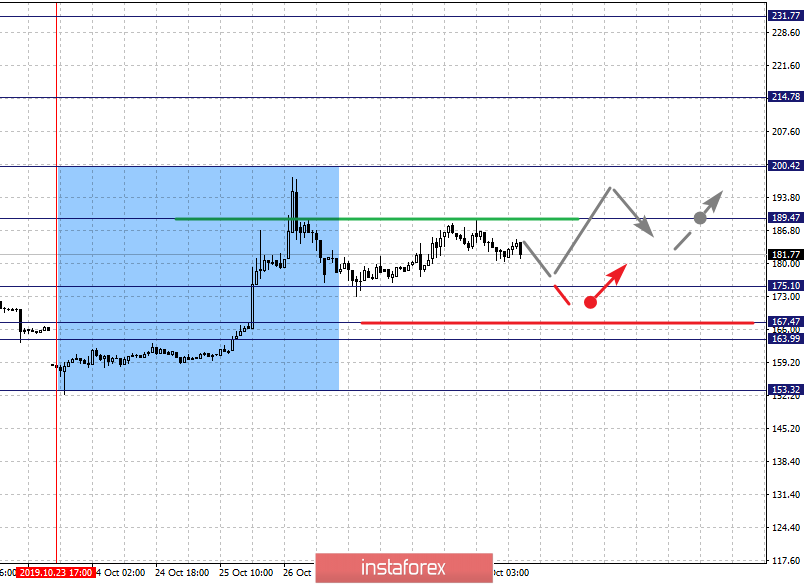

For the #Ethereum tool, the key levels on the H1 scale are 231.77, 214.78, 200.42, 189.47, 175.10, 167.47, 163.99, and 153.32. The price has issued long-term initial conditions for the upward cycle from October 23. The continuation of the upward movement is expected after the breakdown of 189.50. In this case, the target is 200.40 and near this level is the consolidation. The breakdown of 200.50 will lead to a pronounced movement. The target is 214.78 and there is also consolidation near this level. We consider the level of 231.77 as a potential value, from this level we expect a pullback to the correction.

The short-term downward movement is possible in the range of 175.10 – 167.47, hence the high probability of a reversal to the top. The passage of the price of the range of 167.47 – 163.99 will have to develop a downward trend. The target – 153.32.

The main trend is the long-term initial conditions for the top of October 23rd.

Trading recommendations:

Buy: 189.50 Stop Loss: 173.00 Take Profit: 200.00

Buy: 201.00 Stop Loss: 189.00 Take Profit: 214.50

Sell: 175.00 Stop Loss: 189.50 Take Profit: 167.50

Sell: 163.50 Stop Loss: 180.00 Take Profit: 153.50

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română