The euro only instantly strengthened, like the British pound, after it became known that the EU agreed to postpone the release of the UK. Considering that this news was quite expected, this did not lead to serious market changes, and now it is up to the British prime minister and his actions in Parliament.

GBPUSD

According to statements by European Council President Donald Tusk, the EU agreed to postpone the Brexit date to January 31, 2020. This decision opens up the possibility of holding early elections in the UK, however, it also retains the possibility of adopting a Brexit deal if Prime Minister Boris Johnson manages to force the opposition to agree to such a scenario. However, Donald Tusk also said that the extension would be flexible, and the postponement of the Brexit deadline means that the UK could leave the EU before January 31 if the Brexit deal is ratified. Considering that overcoming a delayed exit is positive news for buyers, any movement towards a new agreement through the House of Commons will lead to the strengthening of the pound against a number of world currencies.

The further short-term direction of the pound will also be determined by the struggle between the Tories and the Labour Party on a vote related to the date of the general election, which the British prime minister is focused on.

The technical picture in the pair remained unchanged. An unsuccessful attempt to return the resistance of 1.2860 by the bulls may lead to the formation of another downward wave in the trading instrument with the update of the lows of 1.2760 and 1.2600. If the bulls are able to overcome the level of 1.2860 today, we can expect purchases and updates of the resistance at 1.2950.

EURUSD

The European currency attempted to grow above the resistance level of 1.1095 today, but failed to gain a foothold at this level. The good news on rising import prices in Germany, as well as data on lending in the eurozone, is far from a reason for the European Central Bank to at least think about changing its super-soft monetary policy.

According to the report, import prices in Germany in September of this year immediately grew by 0.6% after falling by 0.6% in August of this year. On an annualized basis, prices fell by 2.5%, which is slightly better than forecasts of economists who expected prices to fall by 2.7%.

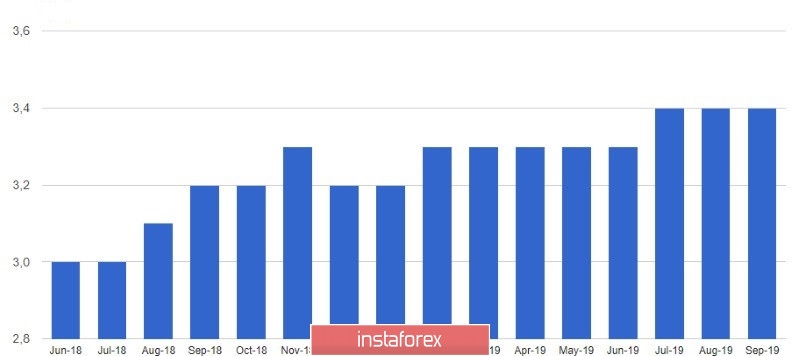

But the growth in lending to companies in the eurozone in September this year slightly slowed amid increased external risks. According to the report of the European Central Bank, the annual growth in lending to companies in September was 3.7% compared to 4.3% in August. But lending to the private sector remained unchanged and amounted to 3%, as in August. Considering that the policy of the European Central Bank is rather soft, the availability of financing is not a problem, as it is now observed in the US. However, bank lending has not recovered to the rates of pre-crisis levels in 2007 and 2008, when growth in lending to the eurozone exceeded 12%.

As for the M3 money aggregate, in September it showed a decrease, it amounted to 5.5% against 5.8% in August. Economists predicted that the indicator growth in September will be at the level of 5.7%.

Nothing significant has happened from a technical point of view. Only a breakout of the resistance of 1.1100 will lead to a larger upward trend in the area of highs 1.1150 and 1.1210. As for the pressure on the euro, which will gradually return as the Federal Reserve meeting approaches, it will be limited to key support levels in the region of 1.1060 and 1.1020.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română