The British pound ignored the fact that yesterday's vote on the topic of the general election in the UK in December this year failed. Boris Johnson said he would give up trying to push his Brexit bill through parliament to force liberal Democrats and the DUP to agree to elections that are due before Christmas. However, so far, the parties have not even managed to reach an agreement on the date of the election. Johnson focuses on December 12, while the opposition talks about the 9th.

As noted above, yesterday the British Prime Minister failed to get the votes of two-thirds of the deputies, which he needed to ensure elections in accordance with applicable law. Opposition parties have largely refrained from participation in voting. Immediately after the defeat, Boris Johnson said he would introduce a bill that would help him set the general election for December 12th. Thanks to this bill, the prime minister will only need a simple majority, so the election date can be set without the approval of the liberals or the Scottish National party. It has not yet been said what regulations this bill will contain.

In general, both the liberal Democrats and opposition parties are not against holding elections, but only on the condition that Boris Johnson will not try to pass through parliament the agreement he developed on Brexit, which cannot be ruled out. Jeremy Corbyn, the leader of the Labor Party and the opposition, requires certain guarantees, and the Prime Minister's promises to "freeze" the Brexit agreement until the formation of a new parliament are few.

Yesterday's EU approval to extend Britain's exit deadline to January 31, 2020, with the option to leave the EU earlier, subject to the agreement's approval, leaves Boris Johnson free to act towards his goal.

As for the technical picture of the GBPUSD pair, it is necessary to note the weak activity of buyers of the British pound after such news. This suggests the possibility of a larger downward correction of the trading instrument in the area of the lows of 1.2730 and 1.2660, but for this, sellers need to try to break below the support of 1.2800. Bulls will continue to try to get above the resistance of 1.2870, which will lead to the demolition of a number of stop orders of sellers and will allow reaching a maximum of 1.2950.

EURUSD

Most likely, volatility will remain at a rather low level until tomorrow's meeting of the Federal Reserve System.

Yesterday's statements by the US president on the subject of trade negotiations were ignored by the market, as well as other fundamental data in general. Donald Trump said that negotiations on the first phase of the trade agreement with China are ahead of schedule, and it is expected that authorities are likely to sign an agreement at the Chile economic summit next month.

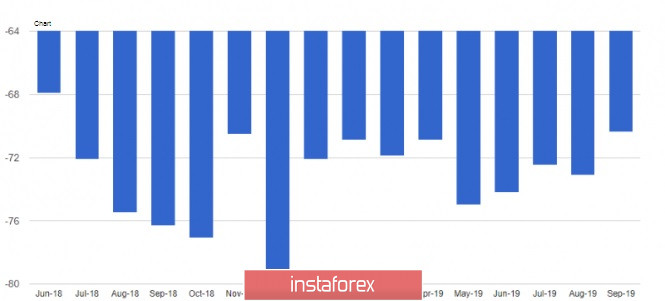

As for the fundamental data, it is worth noting the report on the deficit of foreign trade in US goods in September of this year, which was reduced due to a decrease in imports. According to the US Department of Commerce, the deficit fell by 3.6% compared to August and amounted to 70.39 billion dollars.

Imports fell by 2.3% last month to $206.29 billion, while merchandise exports fell by 1.6% to $135.89 billion, indicating a slowdown in economic growth outside the United States.

The manufacturing sector continues to lose momentum. A report by the Federal Reserve Bank of Dallas was presented yesterday, which indicated that the manufacturing index dropped to 4.5 points in October this year from 13.9 points in September. The index of new orders in October fell to -4.2 points, while the indicator of growth rates of orders fell to -5.9 points. The general index of business activity in October amounted to -5.1 points.

The Chicago Fed report also indicated that the index of national activity in September this year fell to a negative value of -0.45 points, compared with the August value of 0.15 points.

As for the technical picture of the EURUSD pair, it remained unchanged. The level of 1.1095, which was emphasized during yesterday, was completely blurred, and now support is visible in the region of the lows of 1.1060 and 1.1020, while large resistance levels will start at 1.1120 and 1.1150.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română