Donald Trump, as president of the United States, simply buries a talented comedian. He is the only person with an incredible sense of humor, signing a bill aimed at supporting protesters in Hong Kong, as well as imposing sanctions on individuals and companies whose actions are aimed at undermining the autonomous status of the city, and could say that this does this out of a sense of deep respect for the head of the people's Republic of China. Then, with a sense of accomplishment, Donald Trump began to choose a turkey for Thanksgiving.

Naturally, Beijing did not leave it just like that and immediately called the Ambassador of the United States to the carpet, expressing all its indignation and threatening with retaliatory measures. However, without specifying which ones exactly. In any case, it is clear that Washington's move pushed back the possibility of a trade agreement between the United States and China once again. This is precisely the reason why investors tritely ignored macroeconomic statistics, which demonstrated simply incredible achievements of the American national economy. Thus, the second estimate of United States GDP for the third quarter showed that economic growth slowed from 2.3% to 2.1%, and not to 2.0%, as the first estimate showed. But more importantly, orders for durable goods, which were supposed to be reduced by 0.8%, suddenly showed an increase of 0.6%. Consequently, orders were reduced only for one month, which means that the current decline in industrial production will be short-term. No less important is the fact that the total number of applications for unemployment benefits decreased by 72 thousand instead of 14 thousand. In particular, the number of initial applications for unemployment benefits fell by 15 thousand, while they predicted a decrease of 7 thousand. Moreover, the number of repeated applications for unemployment benefits decreased by as much as 57 thousand instead of the predicted 7 thousand.

GDP growth rate (United States):

So it is clear that only a miracle could save the single European currency and this miracle was the actions of the United States in relation to China. Against this background, the behavior of the pound is really of interest, as it has grown. However, the reason is in politics again, or rather in sociological polls that showed that conservatives led by Boris Johnson will win the early parliamentary elections. This means that the probability of victory of Jeremy Corbyn is quite small, which means that the risk of uncertainty in the form of a possible second referendum and the like is reduced. Thus, it is much more important for investors to understand what will happen in the future, and with Boris Johnson, everything is relatively clear, well at least on Brexit.

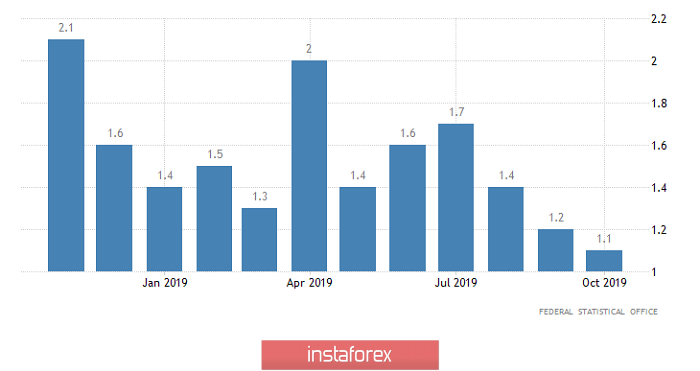

Thus, today will be extremely calm, if only for the reason that they cut turkey in the United States and thank the Indians who saved the first immigrants from the Old World. In addition, China will clearly not take hasty steps and will carefully consider everything at first. The response of China will take place in other directions. Most likely, it will take the form of additional restrictive measures for American companies. Nevertheless, a lot of interesting data are published in Europe, and inflation has already come out in Spain, which accelerated from 0.1% to 0.4%. Although this is preliminary data, the very fact of a serious acceleration of inflation in the fourth economy of the euro area is a serious help for the single European currency. Today, preliminary data on inflation in Germany will still be published, which should show the acceleration of the price growth rate from 1.1% to 1.3%. This indicates a clear increase in inflation throughout Europe, which means that the European Central Bank will clearly not be in a hurry with further measures to mitigate monetary policy. At the same time, consumer lending data will also be published, the growth rate of which may accelerate from 3.4% to 3.5%. However, all of this will not have a significant impact on the market due to a holiday in the United States.

Inflation (Germany):

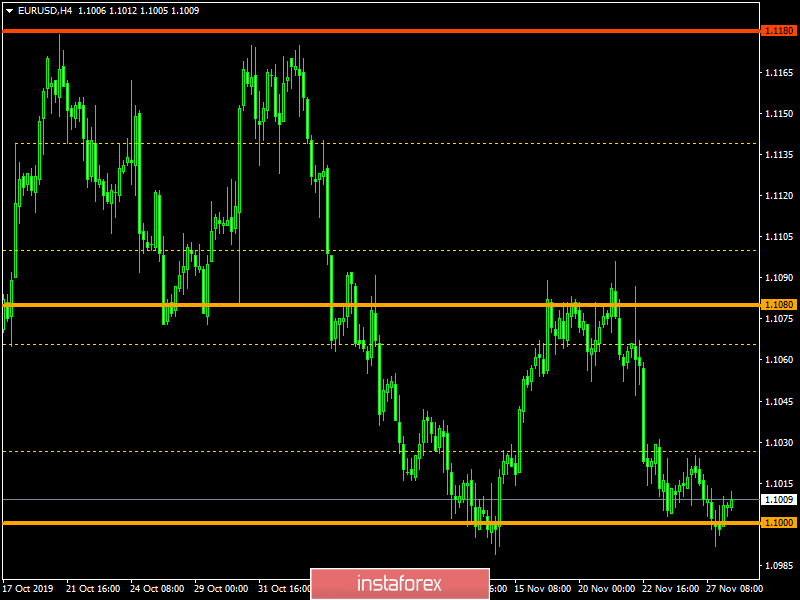

The euro/dollar currency pair found a foothold in the area of the psychological level of 1.1000 once again, where the movement slowed down and accumulation formed as a fact. It is likely to assume that the swing within 1.0990 / 1.1030 will still last some time, where work should be carried out to break the specified boundaries.

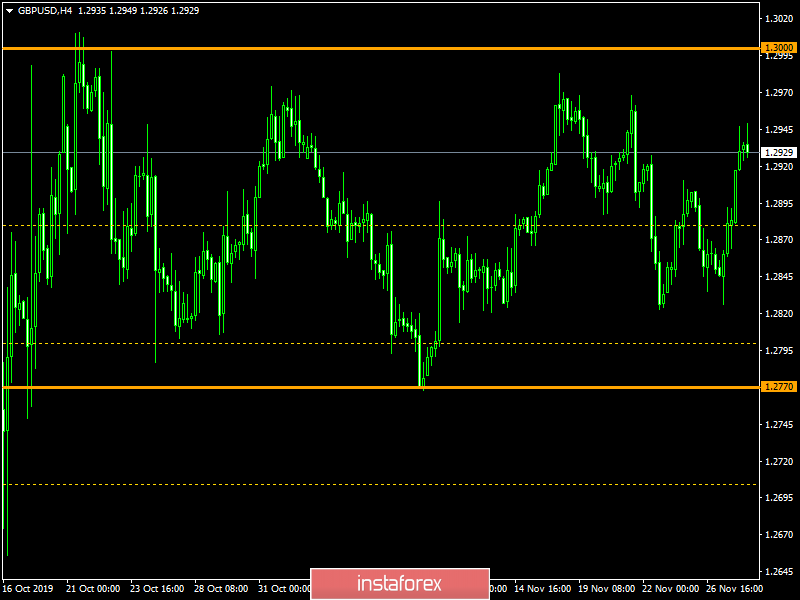

The pound/dollar currency pair managed to jump to the resistance area of 1.2950 once again, where, against the backdrop of the recent rally, a local overbought is felt. It is likely to assume that a pullback towards 1.2900 -> 1.2885 is possible in the current situation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română