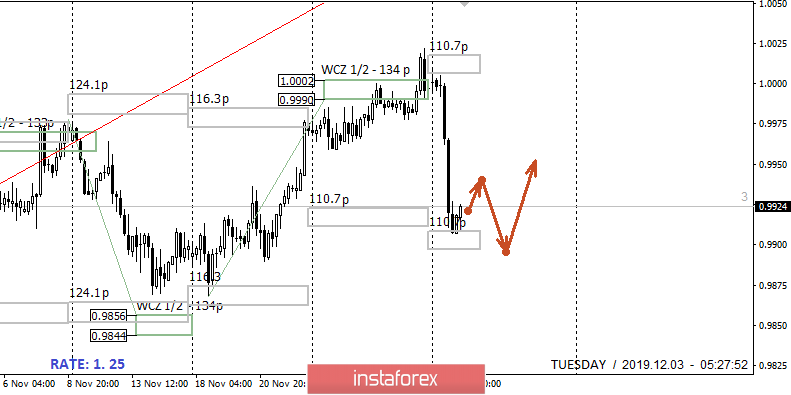

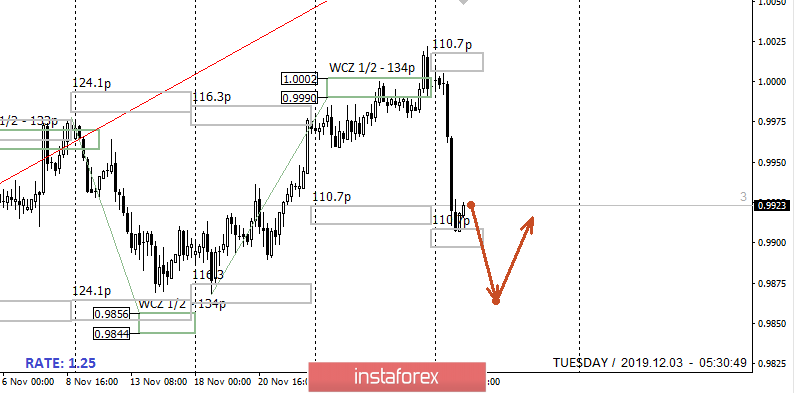

The pair's fall from yesterday led to the lower limit of the average weekly move. This makes it possible to close all sales opened during the WCZ 1/2 test. The probability of consolidation below the middle course zone is at 30% this week. This allows us to consider the formation of corrective upward movement until Friday.

Sales from current grades are no longer profitable. You need to create a false breakout pattern of yesterday's low to buy from the middle course zone.

An alternative decline model will be developed if today's trading closes lower than yesterday. This will indicate a continued decline, the aim of which will be the November low. Sales at or below average speed are not recommended, as the likelihood of a return to the range will increase to 90%.

Daily CZ - daily control zone. The area formed by important data from the futures market, which change several times a year.

Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română