The euro remained trading in a narrow channel with the US dollar after the release of the data on manufacturing activity in the US. According to the preliminary report, it was almost unchanged in December this year compared to that of November. The service sector also remained at a fairly good level. On the other hand, the British pound has lost some ground against the US dollar and remains under pressure. This is due to the weak report on the UK services sector, and consequently suggests that there will likely be a reduction in interest rates by the Bank of England at the beginning of next year.

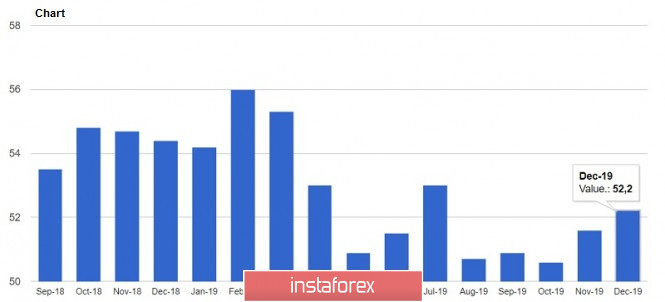

As noted above, according to the Markit statistics agency, the preliminary Purchasing Managers' Index (PMI) for the US manufacturing sector in December of this year fell to 52.5 points, from 52.6 points in November of this year, indicating a continued pace of growth in activity. On the other hand, the PMI for the US services sector in December was 52.2 points, higher than its 51.6 points in November.

These data once again confirm the fact that despite the general slowdown in global growth and the reduction of activity in many other countries, the American economy is feeling much better, continuing to show recovery. Let me remind you that the index value above 50 points indicates an increase in activity.

Yesterday, good data on the indicator of home builders in the United States was also released. It rose in December this year, indicating the stabilization of the market. According to a report by the National Association of Home Builders, the housing market index in December was 76 points against its 71 points in November this year. Economists had expected the index to reach in only 70 points in December. Low mortgage rates maintains the demand, which is a sure lead to further growth of the market at the beginning of next year. This will help in holding out until the spring period, when the recovery begins.

As for the technical picture, the EUR/USD pair remains unchanged. At the moment, the bears are continuing to push the trading instrument below the support of 1.1110, which will lead to the lows of 1.1070 and 1.1040. With the upward correction, which can be continued today after the data on the balance of foreign trade of the eurozone releases, the problems of buyers of the euro could begin in the area of resistance at 1.1160. Larger players will prefer the protection of the 1.1200 level, which is kind of a psychological mark. Its breakthrough will lead to the continuation of the upward trend of the European currency.

GBP/USD

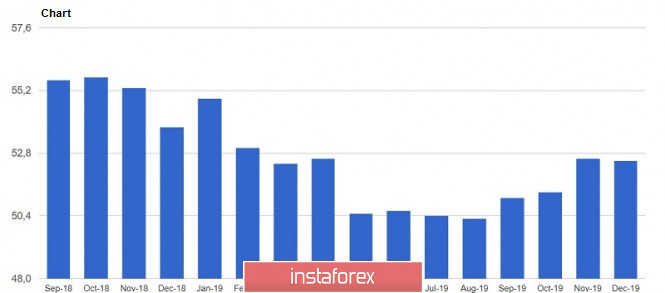

The pressure on the British pound remains. Yesterday's report on the services sector and the challenges that await the British pound economy after the general election all point to the cautious approach of pound buyers to the market, especially with the risks associated with Brexit. One of the concerns is the transition period designed for 2020, from which British Prime Minister Boris Johnson may refuse, leading to an unfinished deal and a tough Brexit.

The weak report on the services sector also returned to the market a talk of a possible change in the Bank of England's interest rates policy, and a possible reduction in the spring of next year. This will happen if the PMI indices do not rise and return above 50 points.

As for the technical picture of the GBP/USD pair, buyers are now focused on the level of 1.3260, wherein a breakthrough of which will create additional problems for the pound. You can count on the formation of the lower border of the rising channel in the support area of 1.3160, from where large buyers will return to the market. If the bears fail to maintain the downward correction and break below the support at 1.3260, demand can quickly return, especially if good fundamental statistics on the state of the UK labor market are released. Growth will be limited by the highs in the areas of 1.3460 and 1.3380.

USD/CAD

The Canadian dollar fell against the US dollar after the Bank of Canada reported yesterday forecasts of higher deficits in the next five years compared to previous ones. A budget deficit of $ 26.6 billion is expected in 2019-2020. Canadian Finance Minister Morneau said during his speech that there is a lot of work to be done in order to create a strong economy. The Central Bank has space in the fiscal sphere in order to respond to global shocks.. Currently, according to Morneau, there are no signs yet of an imminent recession of the economy.

In support of this are yesterday's data on foreign investors that bought Canadian securities for three months in a row in October 2019. The main focus was mostly on bonds. According to a report by the National Bureau of Statistics of Canada, foreign investors purchased Canadian securities worth 11.32 billion Canadian dollars in October. On the other hand, Canadian investors were net buyers of foreign securities worth 2.03 billion Canadian dollars in October.

As for the technical picture of the USD/CAD pair, problems with growth may begin at the resistance area of 1.3190. The downward movement will be limited to the support of 1.3115.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română