Hello!

Recently, the voices of representatives of the Federal Reserve System (FRS) are increasingly heard that next year interest rates in the United States will not change and will remain at current levels.

In particular, this position is expressed by the President of the Federal Reserve Bank of Dallas Robert Kaplan, the President of the Federal Reserve Bank of Boston Eric Rosengren and some other officials of the Federal Reserve. However, to assume that these statements support the US dollar or, conversely, lead to pressure on the US currency, it would not be entirely correct.

The market has long been accustomed to such comments and lives its own life. That is why the technical picture, in my opinion, gives much more insight into the further direction of the quote. Today's EUR/USD analysis will start with the daily chart.

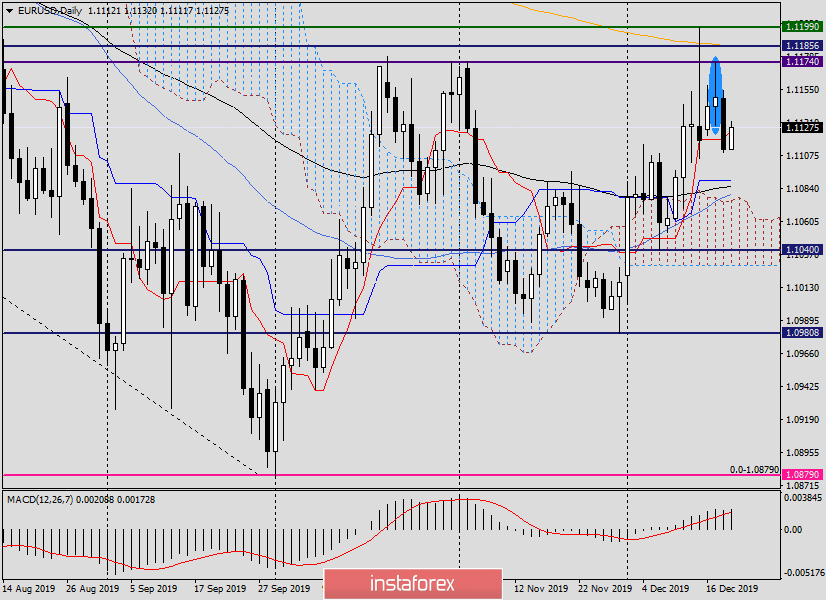

Daily

As you can see, the circled candle for December 17 did not go unnoticed by market participants, and yesterday, the euro/dollar pair showed quite a strong weakening. As a result of such a pronounced downward dynamics, the Tenkan line of the Ichimoku indicator was broken, under which the trading ended on December 18.

However, today, at the moment of writing this article, the euro/dollar is recovering from yesterday's losses and shows a positive attitude. If the market sentiment does not change and the pair continues to rise, its targets will be yesterday's highs of 1.1154, the census of which will open the way to resistance sellers at 1.1174, 1.1185 and possibly to the key resistance at the moment near the significant mark of 1.1200.

In case of a change in market sentiment to bearish, the pair will turn in a southerly direction and continue yesterday's downward trend. In this scenario, the targets at the bottom will be yesterday's lows of 1.1110, and their update will create prerequisites for a deeper depreciation in the area of 1.1090-1.1075, where the Kijun line, 89 EMA, 50 MA are grouped, as well as the upper boundary of the Ichimoku cloud passes.

I believe that all of the above can provide EUR/USD with strong support, so purchases from the dedicated zone, from the technical point of view, look quite justified.

At the same time, I do not exclude the high probability of a downward scenario. This, in particular, indicates the last weekly candle with an extremely long upper shadow, as well as daily candles since December 12. Given the fairly high probability of a bearish scenario, I propose to move to smaller timeframes and look for points to open sales there.

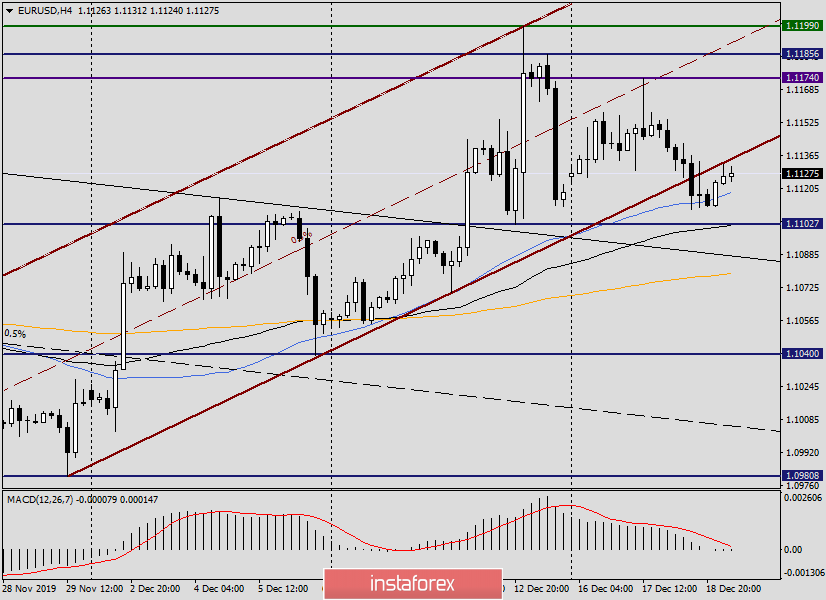

H4

What had to happen happened. The pair fell out of the brown upward channel and secured under its broken support line.

At the time of writing, the price is trying to return to the abandoned channel, but its broken lower border now resists these attempts. The last closed candle with a long upper shadow only emphasizes the inability of the pair to return to the limits of the channel. I propose to wait for the form and closing price of the current four-hour candle, and, in the case of its bearish affiliation, sell EUR/USD with the targets of 1.1105, 1.1090, 1.1075.

If the euro/dollar returns to the channel and gains a foothold within it, the breakdown of the lower border will have to be recognized as false and prepare for purchases when falling to the false broken support line of the channel.

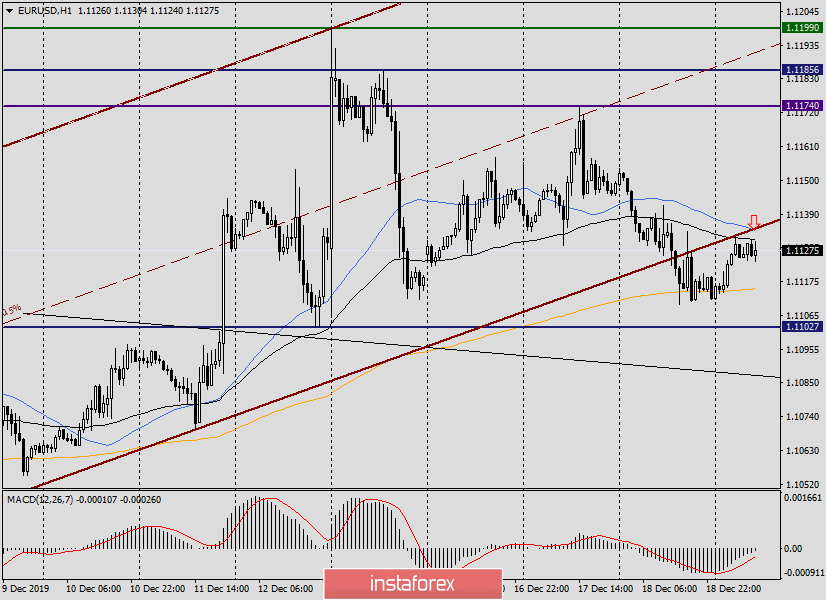

H1

The picture on the hourly chart confirms the idea of selling the euro/dollar on the rollback to the brown broken support line of the channel and attempts to return to its limits.

At the same time, additional and sufficiently strong resistance can be provided by 50 MA and 89 EMA, which are near the broken support line of the channel. Thus, the closest reference point for opening short positions on EUR/USD can be considered the price zone 1.1130-1.1135.

Possible revival and impact on the course of today's trading may have at 14:30 (London time) data from the United States on the number of initial applications for unemployment benefits, the production index of the Federal Reserve Bank of Philadelphia and the balance of payments.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română