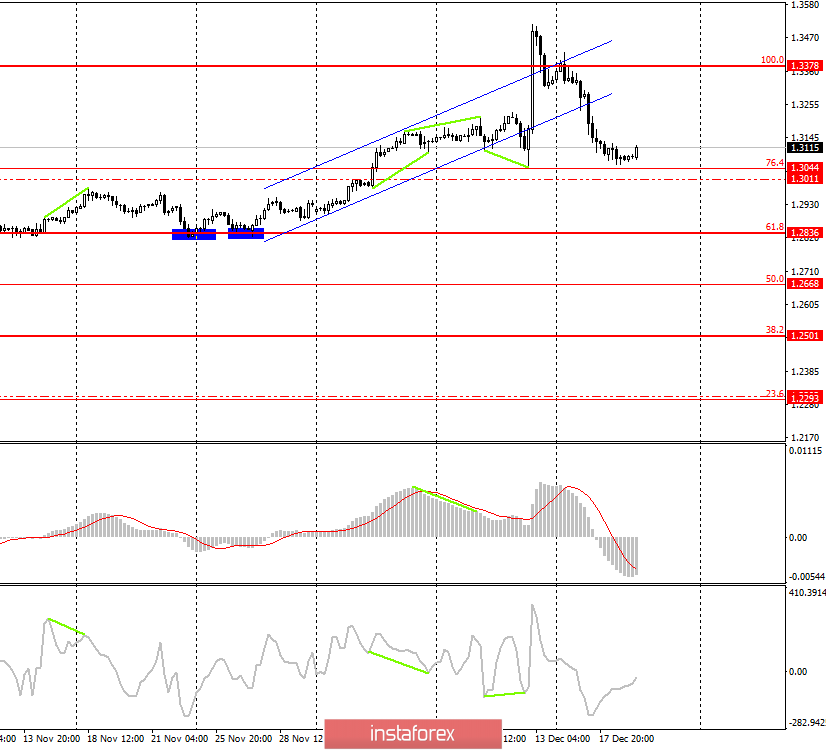

GBP/USD - 4H.

On December 19, the GBP/USD pair performed a fall almost to the corrective level of 76.4% (1.3044). Thus, the rebound of the pair's quotes from this Fibo level will allow traders to count on a reversal in favor of the English currency and some growth in the direction of the correction level of 100.0% (1.3378). At the same time, the information background does not contribute to such a development of events and the maximum will allow a small rollback. Thus, fixing the pair's rate below the Fibo level of 76.4% will significantly increase the probability of further falling towards the next correction level of 61.8% (1.2836). In addition to this? The pound-dollar pair left the upward corridor, which is also a "bearish" factor.

The main event of today for traders of the pound-dollar pair is the summing up of the meeting of the Bank of England. It is the UK that is the last of the major Central Banks to hold a meeting in 2019. The Fed and ECB have already completed in 2019. Traders will be interested in any actions of the British regulator, any hints of action in the future. After the pound completed a two-month growth, a correction is already available. Thus, a balance has been established between the dollar and the pound, and momentum is needed for a new trend movement. Economic reports from the UK continue to upset traders, so it will be very difficult for traders to wait for information from this source that will allow the demand for the pound to grow. If the Bank of England confirms that "everything is bad", and its actions or statements will hint at a willingness to lower the rate soon, it may cause a new drop in demand for the British pound. Thus, an increase in the number of votes in favor of the Central Bank's board members can be interpreted by traders as a signal for new sales of the pound. Bank of England's accompanying statements are also of interest, the emphasis of which may be shifted either to the weak economic data, or to Brexit, or to divert the attention of traders from weak statistics. The Bank of England should choose the vector of its rhetoric for the next few months and at the same time be convincing. If Mark Carney suddenly says that the British economy is recovering, no one will believe him, and the pound will collapse downwards. Thus, the "dovish" attitude of the Central Bank of Great Britain will help the pair to consolidate under the Fibo level of 76.4%. Any other scenario - will help to start the rollback up.

Forecast for GBP/USD and trading recommendations:

The pound-dollar pair continues the process of falling and only after working out the correction level of 76.4% can take a pause for some time and roll back a little upwards. However, I do not expect a strong upward pullback. Thus, I recommend selling the pound-dollar pair with a target of 1.2836 after closing under the Fibo level of 76.4%. I do not recommend buying a "Briton" soon.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română