The dollar index returned to the area of 97 points, reflecting the demand for US currency throughout the market. Such dynamics look somewhat unusual, given the weak US macroeconomic reports that were published yesterday. And although we are talking about indicators of the "second plan", they still had to alert dollar bulls, especially in light of the mixed results of the December meeting of the Fed. But the market focused on other aspects, such as on the prospects for US-Chinese trade relations where Beijing, yesterday, took another friendly step towards the Americans, and this fact provided significant support to the dollar, preventing the EUR / USD bulls from continuing their upside movement.

Let me remind you that later on last week, China and the United States reached a compromise solution and agreed on the first phase of the trade agreement, thereby preventing the development of a trade war. Washington pledged not to introduce "December duties" on Chinese imports worth $ 160 billion a year. In addition, the US promised to halve 15 percent duties on $ 120 billion Chinese goods. At the same time, 25 percent of duties on $ 250 billion in imports remain in force. Beijing, in turn, pledged to increase purchases of US goods. Both parties did not comment in detail on the deal, including Chinese commitments under the agreement. That is why yesterday's news from China could "detonate" among dollar pairs in this way: Beijing finally announced its share of obligations. The State Council of China approved the first part of the second list of American goods that will not be subject to additional duties. This decision will not be valid on an ongoing basis where the "preferential treatment" is introduced from December 26 of this year and ends on December 25, 2020, with a possibility of further extension.

The first batch of the second list included white oil - a colorless transparent liquid that consists of a mixture of liquid hydrocarbons-- food grade microcrystalline paraffin, high density polyethylene, metallocene, ethylene-propylene copolymer and "some other products". According to a statement issued by the State Council of the PRC, the Committee on Customs Duties and Tariffs will continue to compile new lists of goods that will not be subject to additional duties. However, the Chinese did not limit themselves to any time frame and according to them, the list of the second batch of the second list of goods from the United States will be published "in a timely manner".

The implementation of the first phase of the trade agreement is certainly an important signal for the foreign exchange market. The beneficiary of this situation was the American dollar, which yesterday rose in price throughout the market. Indeed, this "thaw" in relations between the USA and China will probably not be left without attention of the members of the Federal Reserve. Apparently, the regulator will continue to hold a pause in the issue of easing monetary policy.

Nevertheless, it is difficult to predict how long the optimism between the US and China's relation will last on the market. The fact is that the most complex and strategically important issues will be discussed by the parties in the framework of the second phase of negotiations. Sooner or later, dollar bulls will come to the obvious conclusion that the risk of a trade war is still high, especially in light of the upcoming US presidential election.

Furthermore, the EUR / USD traders unjustifiably, in my opinion, ignored yesterday's macroeconomic reports, which were published in the USA and which appeared in the "red zone". And although we are talking about secondary indicators, their impact should not be minimized anyway.

For example, the Fed-Philadelphia manufacturing index fell sharply in December, showing the worst growth rate for the whole year. The indicator, which is based on a survey of manufacturing companies in this region, reached 0.3 points with a growth forecast of 8.1 and a previous result of 10.4 points (the employment component grew by 17 points, whereas in November it reached 21 paragraph). In addition to this, the rate of initial applications for unemployment benefits was also disappointing. After several months, this weekly indicator came out at the same level within the range of 210-220 thousand, although, this week he jumped to 234 thousand while last week the result was 252 thousand, which is even worse. The growth of this indicator is a negative signal for the US labor market where at the same time bad news came from the US real estate market as home sales in the secondary market collapsed to -1.7% in November while there was 1.5% growth recorded in October Experts expected negative dynamics as the forecast announced -0.4%, but real numbers are worse than expected.

But the market ignored the above releases, focusing on the news of the external fundamental background. Nevertheless, I believe that today traders will turn their eyes to macroeconomic statistics. The fact is that during the American session, the main index of personal consumption spending will be published, which measures the core level of spending and indirectly affects the dynamics of inflation in the United States. It is believed that this indicator is carefully monitored by regulator members.

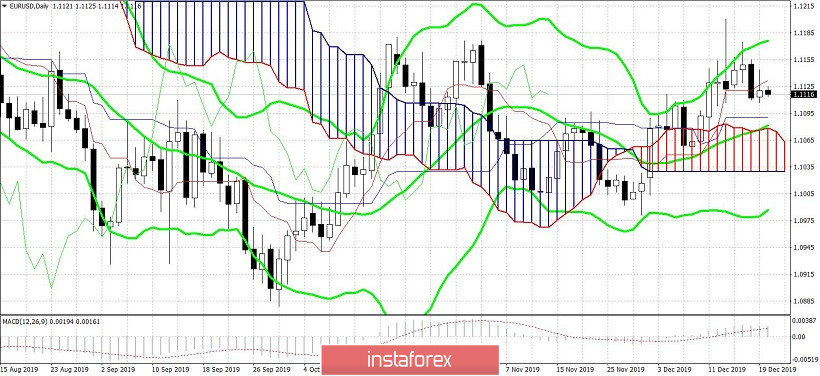

According to forecasts, the index will show contradictory dynamics, where, it will grow to 0.2% on a monthly term, while it will decrease to 1.5% annually. This release may have a corresponding effect on the EUR / USD pair if it deviates from the forecast values. The support level for the pair is located at 1.1080 presented by the middle line of the Bollinger Bands indicator, which coincides with the upper border of the Kumo cloud on the daily chart. The resistance line is the upper line of the above indicator, which corresponds to the price of 1.1180.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română