To open long positions on GBP/USD you need:

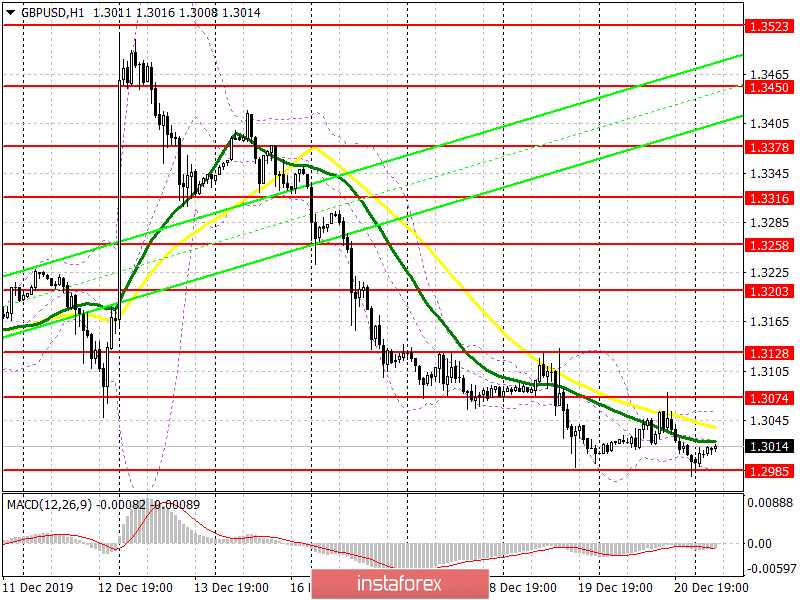

It became known on Friday that Boris Johnson managed to push the Brexit deal through Parliament. This suggests that Britain is sure to leave the EU on January 31, 2020. However, this is not enough for buyers of the pound, since all attention is now shifted to a trade deal between the EU and the UK. To reverse the downward trend, the bulls need a return to the resistance of 1.3074, which will cause the pound to sharply grow to the area of a high of 1.3128, the breakthrough of which will provide the pair with a new bullish impulse to the areas of 1.3203 and 1.3258, where I recommend taking profit. Under the scenario of GBP/USD decline in the morning, only a false breakout in the support area of 1.2985 will provide hope for an upward correction. I recommend opening long positions immediately for a rebound only after falling to December lows in the area of 1.2933 and 1.2882.

To open short positions on GBP/USD you need:

Bears are in no hurry to leave the market, and consolidating below a support of 1.2985 will put new pressure on the pair and will lead to a decrease in the area of December lows 1.2933 and 1.2882, where I recommend taking profits. In the scenario of upward correction, it is best to return to short positions only after a false breakout is formed at a high of 1.3074 or a rebound from a larger resistance of 1.3128. Bearish sentiment will continue until the British government sheds clarity on a trade deal with the EU and on a number of very important issues, the resolution of which could lead to a harder Brexit than expected.

Signals of indicators:

Moving averages

Trading is below 30 and 50 moving averages, which indicates that the pound could possibly fall.

Bollinger bands

Support will be provided by the lower boundary of the indicator at 1.2985, while growth will be limited by the upper level of the indicator at 1.3060.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română