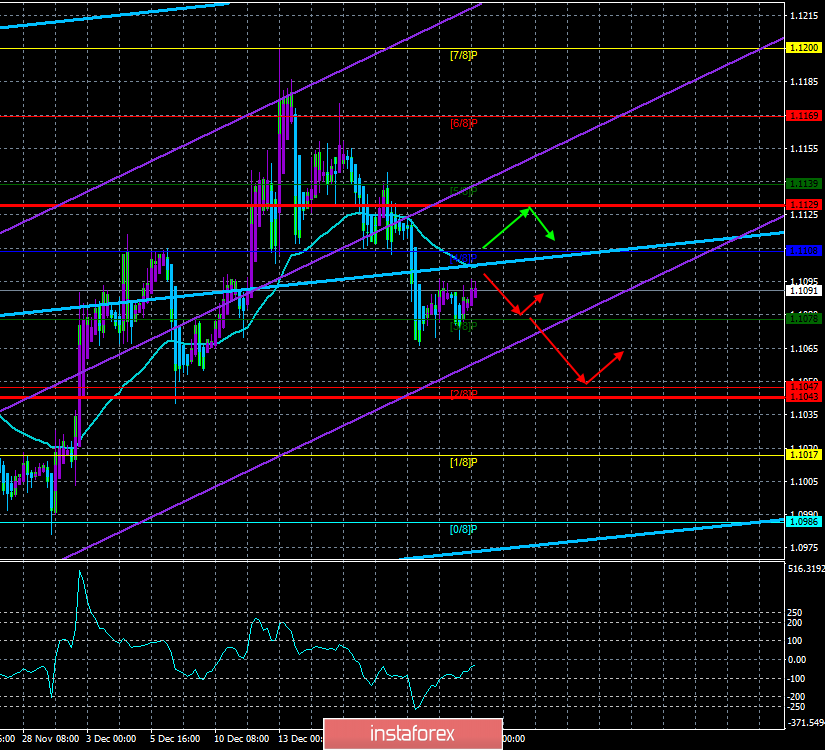

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - down.

CCI: -34.2855

Well, Christmas is celebrated in the Catholic style, and trading on the currency and stock markets has resumed. The EUR/USD currency pair has started a new round of upward correction, but the overall picture of the last two trading days is very similar to the flat. We already warned a few days ago that a flat before the New Year holidays is possible. Also, the volatility of the pair has decreased in recent days to the minimum values, about 25 points per day. Thus, trading with such volatility is extremely difficult. Based on all this, we believe that now the price will try to work out a moving average line that moves faster to the price than the price to it. After that, either the pair will go into a hard flat at all and will trade near the moving sideways, or it will still be followed by a rebound from the moving with the resumption of an extremely weak, but still downward movement. Important macroeconomic publications for today and tomorrow are not planned either in the States or in the European Union. Thus, the fundamental background will remain empty, and traders will have nothing to react to during the day.

Meanwhile, Donald Trump continues to rage and post one-by-one posts on Twitter. It's about impeachment, of course. This time, Trump said: "Why is crazy Nancy Pelosi allowed to impeach the President of the United States, if she does not have a majority in the House of Representatives? She received zero Republican votes, there was no crime, the call with Ukraine was perfect, without "pressure." According to Donald Trump, the impeachment of the President of the United States should be supported by representatives of both ruling parties. In practice, it turns out that only Democrats support impeachment. This is a very ambiguous point. On the one hand, it was always and everywhere accepted to support the leader of his party. In the UK, the conservatives consistently voted "yes" to any Brexit that was put to a vote although the majority of parliament was against and rejected it. The same situation in the States - voting by party affiliation and all. Thus, Trump is not entirely honest and outspoken in making such statements. Similarly, in the case of Democrats, they vote for the interests of their party, which differ from the interests of Republicans and Trump. So this is just a game in which Donald Trump gave a reason to start impeachment proceedings against himself, and now we are seeing the consequences of that conversation with Vladimir Zelensky, in which trump "asked" to start an investigation against Hunter Biden. Of course, Trump did not forget to insult both Pelosi and the Democrats a couple more times. "It (impeachment) was very unfair and without due process of law, without proper representation and witnesses. Now Pelosi demands from the Republicans all that they did not have in the House (enough votes to declare impeachment in the Senate - author's comment). Democrats want a Republican majority in the Senate. Hypocrites," Trump summed up.

We can only continue to monitor developments. Although this topic does not directly affect the quotes of the euro/dollar pair, the topic of the trade war between China and the United States does not directly affect either. It affects indirectly, through macroeconomic statistics in the eurozone and America. Also in the case of Trump's impeachment. So far, the impact on markets is minimal, but it may increase.

The technical picture now suggests a resumption of the downward trend, but we believe that we will see the development of this scenario after the New Year. Thus, it is recommended to conduct extremely cautious trading until January 2-3, or not to trade at all.

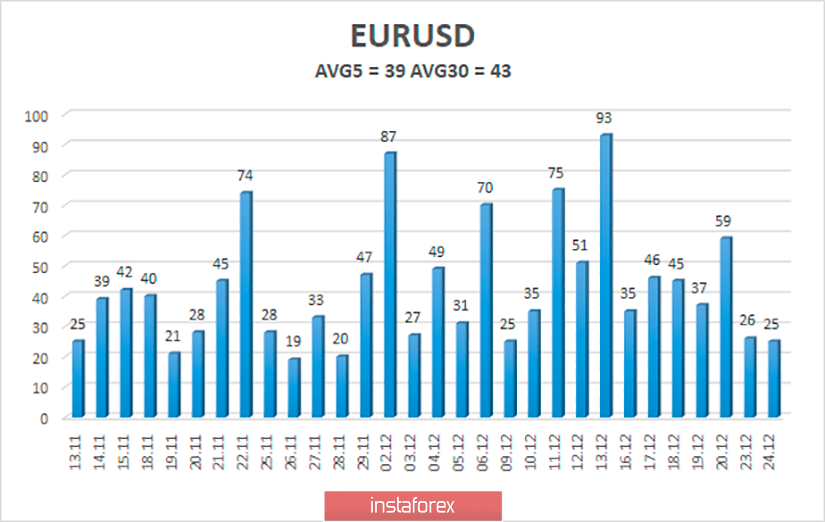

The average volatility of the euro/dollar currency pair has dropped to 39 points and is prone to further decline since most traders leave the Forex market during the holidays. Thus, we now have volatility levels - 1.1043 and 1.1129. Given the empty fundamental background and the beginning of a flat, none of these levels can be worked out until the end of the week.

Nearest support levels:

S1 - 1.1078

S2 - 1.1047

S3 - 1.1017

Nearest resistance levels:

R1 - 1.1108

R2 - 1.1139

R3 - 1-1169

Trading recommendations:

The euro/dollar pair retains the prospects of a downward movement, but soon, it is possible to continue the flat. Thus, it is formally possible to consider the sale of the euro currency with the target of 1.1047 after the reversal of the Heiken Ashi indicator down, but we recommend to be extremely careful with the opening of any positions. The general fundamental background remains not on the side of the euro currency, so the fall of the pair is more preferable, but rather in the new year. It is recommended to consider the purchase of the euro/dollar pair not before the return of traders to the area above the moving average line.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română