To open long positions on EURUSD, you need:

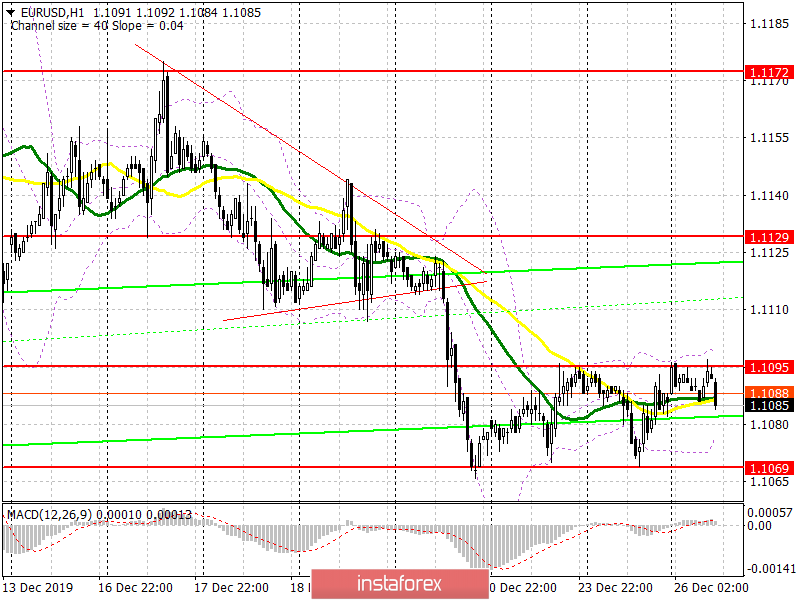

Low volatility in the pair persists after the Christmas holidays, and from a technical point of view, except that the bulls retreated from the daily highs, nothing has changed. The entire focus remains at 1.1095, but it will be very problematic to break above this range since even if the US labor market data is bad, it will not put serious pressure on the US dollar. Only fixing on the range of 1.1095 will lead to a larger upward correction of EUR/USD in the area of the maximum of 1.129 and 1.1172, where I recommend fixing the profit. If the pressure on EUR/USD persists, it is best to return to long positions only on the support test of 1.1069, provided that a false breakout is formed, or on a rebound from a larger minimum of 1.1041.

To open short positions on EURUSD, you need:

Sellers will continue to protect the resistance of 1.1095, and the formation of a false breakout there will be a direct signal to open short positions in the continuation of the downward trend to update the lows of 1.1069 and 1.1041, where I recommend fixing the profits there. If there is no pressure on the euro around 1.1095, it is best to postpone the sale until the update of the maximum of 1.129. Also, I recommend selling immediately for a rebound in the resistance area of 1.1172, the test of which will indicate the formation of a new upward trend in the euro.

Indicator signals:

Moving Averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market.

Bollinger Bands

Low volatility does not give signals to enter the market.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română