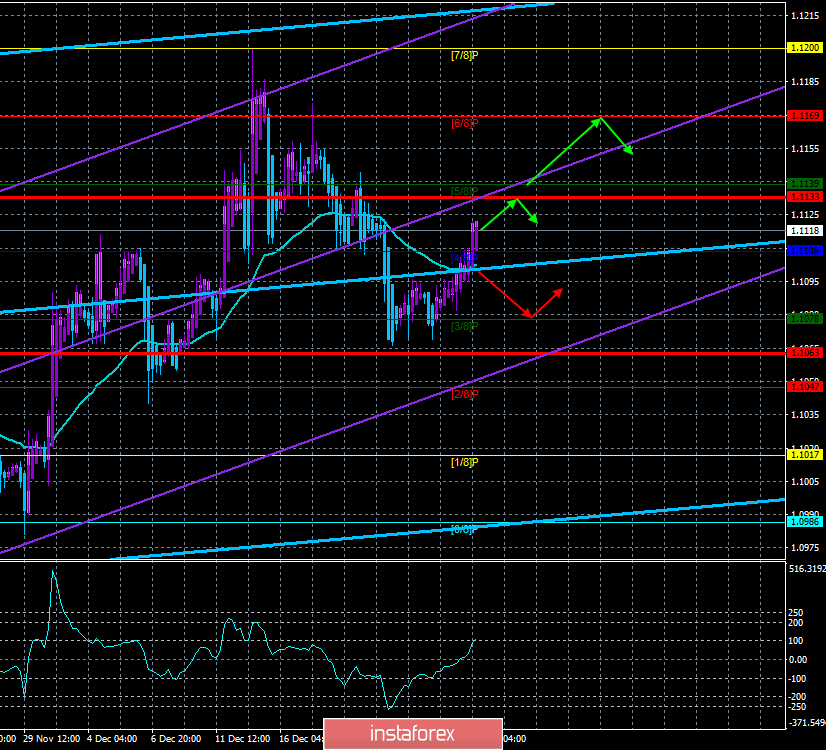

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - sideways.

CCI: 111.5009

Quite unexpectedly, the European currency "rushed" up. "Rushed" - this is, of course, loudly said, the volatility of the EUR/USD pair remains extremely weak, or rather even minimal. However, over the past few days, we have become accustomed to the fact that there is no trend movement. And in any case, how can you call a trend movement of 25 points per day, only formally. However, for the second day in a row, the euro currency shows growth paired with the US currency and at the moment even overcame the moving average line. Thus, today, on the last trading day of the week, the upward movement may continue, although it is obvious that there are no fundamental reasons for this and there cannot be. The calendar of macroeconomic events does not contain any important data until next Thursday. That is, in the coming days, traders will not receive any fundamental support, even theoretically. Based on this, there is no point in waiting for the strengthening of the movement, because at the expense of what it can happen?

The most interesting thing is that in a "thin" market, it is possible that any currency pair can show a strong enough movement with zero fundamental background. Do not forget that the currency market exists not only for currency speculation and traders. It is also used by major players to buy large amounts of currency for their purposes (international transactions, for example). Thus, if, for example, one of the major financial institutions enters the market with a large volume of a particular currency, it may be in the conditions of a small number of traders on it to have the effect of a bombshell. However, we all understand that, first, the actions of large agents cannot be predicted, and secondly, such a movement will be pure chance. Thus, we believe that traders now need to continue to build on the reasoning that the flat will continue until at least January 2-3. And even if there will be a trend, it is extremely inconvenient to trade it, and it will be possible to rely on technical indicators only when making trading decisions.

Meanwhile, Donald Trump, who, we recall, continues to be under the impeachment procedure, is struggling to put himself in front of the population in the best possible light. For example, the US President is constantly hiding behind national interests, constantly focuses on the fact that "Democrats are bad", he does not forget to recall how much he has done for America over the past three years. No one denies that Trump, like any other president, has done a lot for the country, but any president during the 4-5 years of his work does a lot for the country. The post of President is the most important in the country, being in this post it is impossible to do "little". The latest message from Trump, certainly via Twitter, reads as follows: "Despite all the great success that our country has had over the past three years, doing business with foreign leaders is complicated by the constant protection from the attacks of the Democrats and their impeachment scam. Bad for the USA."

Well, in terms of US-Chinese trade relations, nothing changes at all. Both sides are preparing to solemnly sign the "first phase", while the States continue to exert pressure on China through the adoption of the US defense budget, which contains articles on support for the protesters in Hong Kong, China continues to protest to the States in connection with their interference in Chinese internal affairs.

From a technical point of view, the Heiken Ashi indicator continues to paint the bars purple, so the upward movement may continue, but it is unlikely to be long-term since there are no fundamental reasons for the strengthening of the euro currency at the moment.

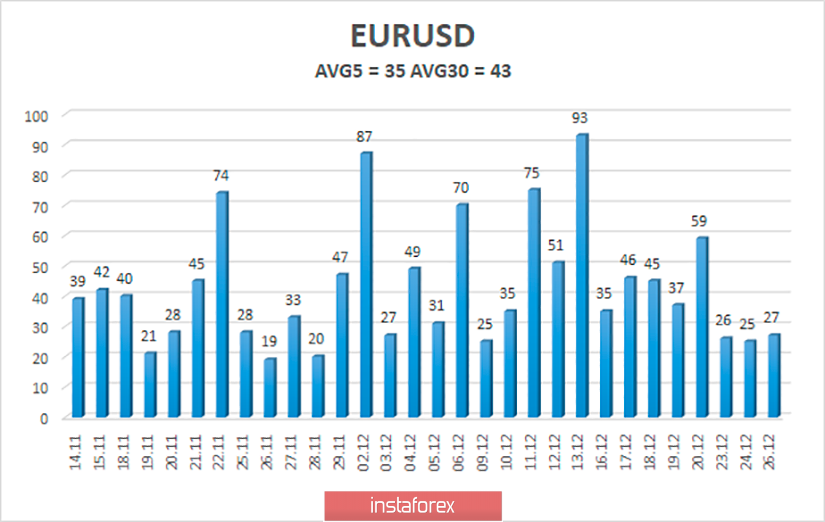

The average volatility of the euro/dollar currency pair has decreased to 35 points and tends to further decrease. Thus, we have volatility levels on December 27 - 1.1063 and 1.1133. Even despite the overnight strengthening of the European currency, we do not believe that there is a real reason to continue moving up. However, as long as the Heiken Ashi is not turned down, there were no signals to complete this movement.

Nearest support levels:

S1 - 1.1108

S2 - 1.1078

S3 - 1.1047

Nearest resistance levels:

R1 - 1.1139

R2 - 1.1169

R3 - 1.1200

Trading recommendations:

The euro/dollar pair overcame the moving average line, so formally now you can consider buying the euro currency with the targets of 1.1133 and 1.1139. A downward reversal of the Heiken Ashi indicator will indicate the end of the upward movement. The general fundamental background remains not on the side of the euro currency, so the fall of the pair is more preferable, but rather in the new year. It is recommended to return to selling the euro/dollar pair not before traders return to the area below the moving average line.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română