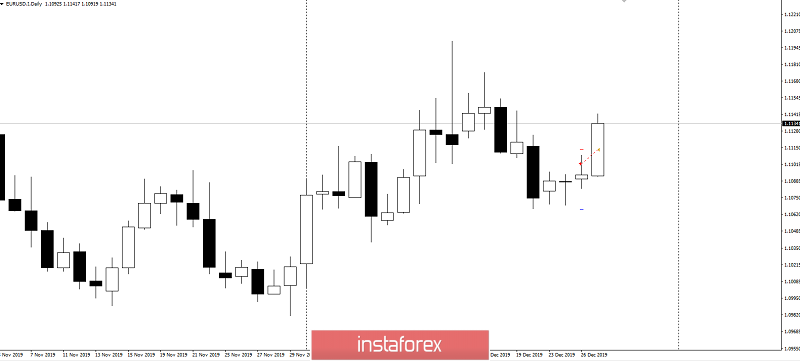

Good day, dear traders! As usual, on New Year's Eve, for many years in a row, the market gives surprises - some pleasant, some not. Every end of December, the dollar unexpectedly has strong movements across many currency pairs. This year, Asians were the driver, taking advantage of low liquidity in the market, stretched the most popular instrument EUR/USD by 500p – this is almost the limit for the Asian session.

Yesterday, we gave a recommendation to work on lowering the euro at the close of the day: /en/analysis/24246...

There were good chances with a ratio of 1 to 2, however, the Asians worked out the weakening of dollar on all fronts, updating the quote of yesterday's top in particular, thereby canceling the short scenario for this instrument.

It should be noted that dollar is losing ground on all instruments - against yen, franc, and the Canadian dollar. All this can be attributed to the "New Year's Rally" of USD, regularly met at this time.

The clearest example of a weakening dollar is gold. As you know, global gold mining is stable, so we can say that there is nothing other than the dollar in this tool. Hence, if the dollar weakens, gold goes up sharply. For the last 3 days, the price of gold soared from 1470 to 1510, stopping at the October "platform" of $ 1519. We do not envy those sellers who hide their feet behind this level:

Good luck in trading and control the risks!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română