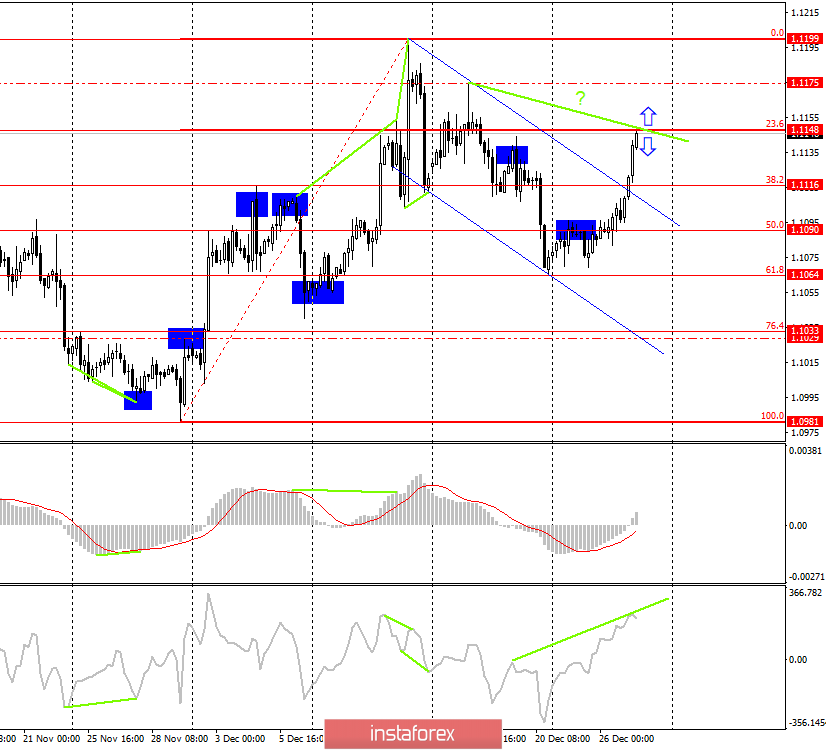

EUR/USD - 4H.

On December 26, the EUR/USD pair resumed the growth process in the direction of the correction level of 23.6% (1.1148) after fixing the quotes above the downward trend corridor and the correction level of 38.2% (1.1116). At the moment, the pair's rate has reached 1.1148, and now two options are possible. The rebound of quotes from this level will work in favor of the US currency and resume the process of falling. Closing above the Fibo level of 23.6% will increase the probability of further growth towards the next correction level of 0.0% (1.1199) and the intermediate level - the peak of 1.1175. At the same time, a bearish divergence is brewing for the CCI indicator, which is visible from the current chart. Bearish divergence significantly increases the probability of rebound from the Fibo level of 23.6%. Thus, given the empty information background, today and early next week, when trading the EUR/USD pair, you can rely on the level of 23.6%.

Forecast EUR/USD and trading recommendations:

The trading idea is to sell the pair at the rebound of quotes on the current or next candle with the targets of 1.1116 and 1.1090. The downside is buying when closing above 1.1148 with targets of 1.1175 and 1.1199.

On December 27, traders will try to resume selling the pair, as near the level of 1.1200 with a high probability of the upward trend is completed. At the same time, the breakout of the level of 1.1148 will allow traders to earn another 25-50 points.

The Fibo grid is based on the extremes of November 29, 2019, and December 13, 2019.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română