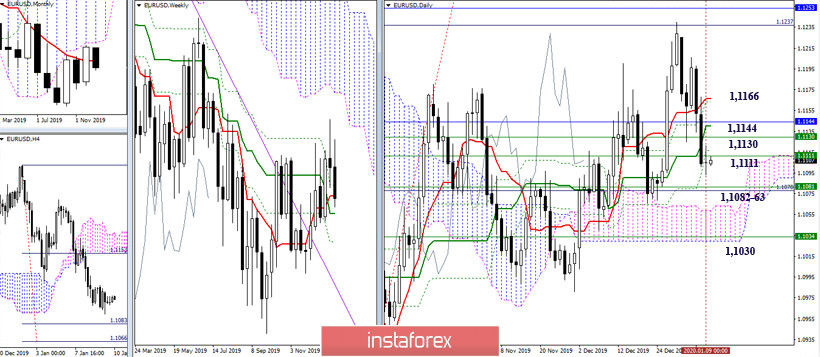

EUR / USD

Another daily close under the supports allows us to hope for a bearish character at the close of the current week. The short lower shadow of the weekly candlestick and the possible testing of the medium-term weekly trend (1.1082) are the most optimistic option for players to decline. The support zone encountered is quite wide, and at the moment, it has been completed at all times until the daytime, and its levels now form resistance at 1.1111 - 1.1130 - 1.1144 - 1.1166. On the other hand, reference points for continuing the decline today are in the same places - 1.1082-63 (weekly Kijun + upper border of the daily cloud + target for breakdown of the H4 cloud) and 1.1030 (lower border of the daily cloud + final level of the weekly golden cross).

In recent times, an upward correction was outlined, which led the pair to the zone of influence of the central Pivot level of the day (1.1106), and also contributed to the formation of a bullish advantage among the analyzed technical indicators. The next important resistance level is currently located at 1.1146 (weekly long-term trend + R3), 1.1120 (R1) - 1.1134 (R2) may be intermediate. Now, if the players on the downside are able to achieve the completion of the correction and leave its zone (1.1093 minimum extremum), then intraday support may be 1.1078 (S2) - 1.1064 (S3). These landmarks are amplified from higher halves.

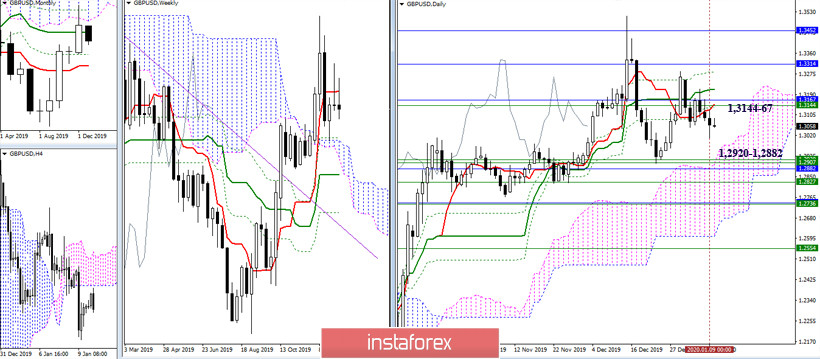

GBP / USD

Players on the downside remain below the attraction levels of 1.3144-67 (weekly Tenkan + monthly Kijun + daily cross levels), while maintaining the prospects for a decline to previously unsubdued supports located in the region of 1.2920 - 1.2882 (weekly cloud + monthly Fibo Kijun + upper border of the daytime cloud). Today, we are closing the week. On the other hand, realizing the potential of the previous week suggests the bearish nature of the current weekly candle. If the players on the rise will be able to regain 1.3144-67, then the current uncertainty next week may be replaced by bullish sentiment.

On H1, the pair is busy forming a correction, the first important level of which has already been worked out (1.3066 central Pivot of the day). The next reference point, which can affect the current balance of power, is now located in the region of 1.3106 (weekly long-term trend). The weekly long-term trend (1.3106), together with R1 (1.3120) of the classic Pivot levels, form the first significant milestone for the further restoration of positions by players to increase, then the interests of the bulls will rest at 1.3144-67 (upper times). At the same time, exiting the upward correction zone will restore the downward trend and open the direction to 1.2955 (S2) - 1.2898 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română