It always seemed that we live in a world of triumphant universal education.Not all over the world, but at least in most countries of the world. And certainly in the richest countries of the world there should simply be general literacy, and every second one has a university diploma in his pocket. But looking at what periodically happens in the markets, you lose faith not only in universal school education, but also in humanity as a whole. It feels like people have mastered the letters, and even able to put them into words. However, there is a feeling that all market participants skipped literature lessons, where they were told not only how letters form words, but also what these words mean and how the name of the work reflects its essence. After all, in the mass media of agitation and misinformation, headlines appeared about that the UK's largest retailers showed the worst Christmas sales results ever, as investors began to get rid of the pound in panic. This clearly demonstrates that investors do not read further than the headlines, because it is said that the reason for such sad results lies in the increase in sales through online services and stores in all these publications. That is, sales themselves do not decrease, people just go purchasing less, preferring to order everything with home delivery. Therefore, if there is universal education in the world, then it either passed the market participants, or they teach something else in schools.

However, after some time, it began to reach some that something was wrong, and they tried to explain everything with a statement by Mark Carney. Like, preparing for his resignation, the head of the Bank of England predicted the British economy the dire consequences of Brexit. But, in this case, it is even worse, because it is not only about the fact that market participants do not read the headlines, but they also have the memory of aquarium fish. Firstly, Mark Carney has been saying this with enviable regularity from the very moment that the results of the referendum on the Brexit issue became known, that is, there is nothing new in this. And this is not the worst, since at one time he generally spoke about the pound parity with the dollar. Secondly, if you read the text of his speech, it becomes clear that it is actually somewhat more about the other. More precisely, about something else in general. It represents an ode to the merits of the Bank of England over the past twenty years and the words about the consequences of Brexit were sounded only as an answer to questions. And then, as already mentioned above, he did not say anything new.

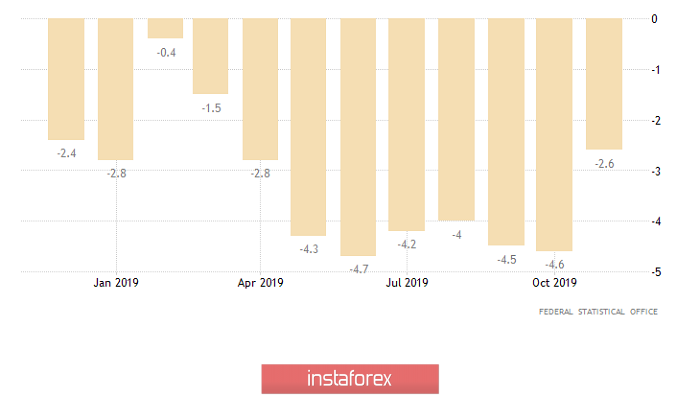

Meanwhile, the single European currency ignored European macroeconomic statistics. Apparently, investors are not able to move without a "kick-in-the-ass" in the form of high-profile headlines in the media of agitation and misinformation. However, the data on Germany, which by chance is the largest economy in Europe, can cause only sadness and gloom. Exports declined by 2.3% and imports by 0.5%. Thus, it is not surprising that the trade surplus is steadily moving towards the deficit thereof. Still, the negativity was somewhat smoothed by data on industrial production, the decline of which slowed down from -4.6% to -2.6%. Another thing is that we are still talking about a recession lasting more than a year. And although the pace of decline has slowed, this does not change the overall picture. There were also published data on the unemployment rate in Italy and throughout Europe as a whole. In both cases, unemployment remained unchanged, although it was expected to fall in Italy from 9.7% to 9.5%.

Industrial production (Germany):

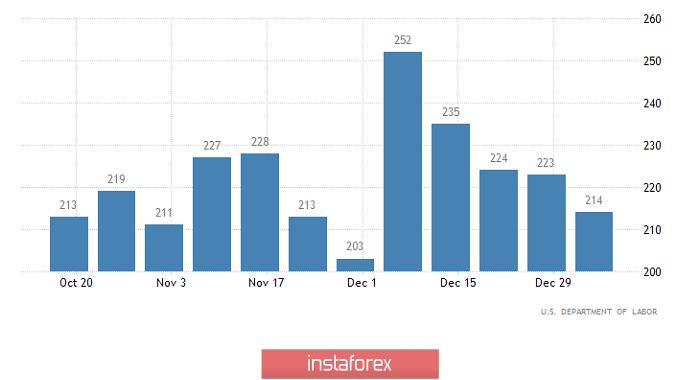

Nevertheless, justice had triumphed and the pound had returned by the evening, and the single European currency, not having time to fall in price, realized that it did not need it. In turn, investors were seriously surprised, or rather scared, by the data on applications for unemployment benefits in the United States. Of course, the number of initial applications for unemployment benefits fell not by 4 thousand, but by 9 thousand. The only trouble is that the number of repeated applications for unemployment benefits, which should have been reduced by 31 thousand, increased by 75 thousand. more frighteningly, all this is in anticipation of the publication of a report by the United States Department of Labor.

Initial Jobless Claims (United States):

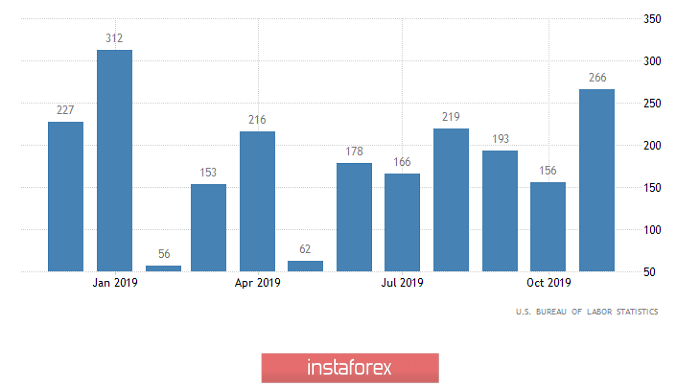

Curiously, the incredibly weak unemployment claim data did not cause a revision of forecasts regarding the contents of the report of the United States Department of Labor. Thus, it is expected that 165 thousand new jobs were created outside agriculture, compared to 266 thousand in the previous month. From this alone, investors should already have hair on their heads standing up, but the data on the unemployment rate, which should grow from 3.5% to 3.6%, will become an additional reason for panic. And it is clear that no one will look at the fact that the increase in unemployment should occur due to an increase in the share of labor in the total population from 63.2% to 63.3%. We do not forget that there is a high probability that the data will turn out to be worse than forecasts.

The number of new jobs created outside of agriculture (United States):

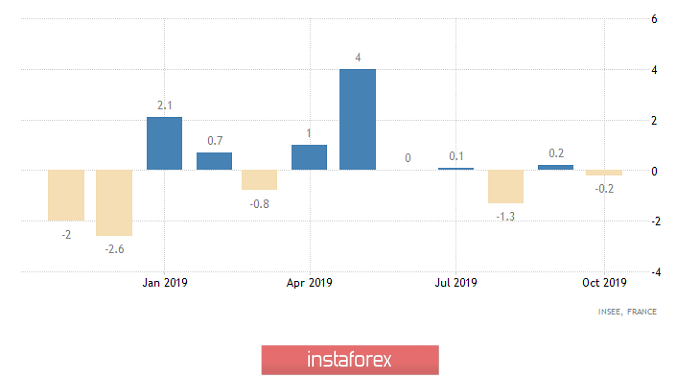

At the same time, investors are only waiting for the report of the United States Department of Labor, as they generally ignored industrial production data for a number of European countries. In France, in particular, the second eurozone economy, industrial production growth of 0.2% gave way to a decline of 0.2%. But in Spain, that is, the fourth economy of the euro area, the opposite is true, since the decline in industrial production by 1.3%, which was supposed to increase to -1.8%, unexpectedly gave way to a growth of 2.1%. However, Spain is clearly not as significant as France. In addition, in Italy, and this is the third eurozone economy, a slowdown in the decline in industrial production is expected from -2.4% to -0.4%.

Industrial Production (France):

Therefore, we should expect a single European currency to increase to 1.1150, given the negative outlook on the contents of the report of the United States Department of Labor as well as the high probability that the data may turn out even worse.

Exactly for the same reasons, the pound can grow to 1.3150. Just for a pound, the level of nervousness is significantly higher due to the ongoing fuss around Brexit and the prospects for the British economy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română