Good day, dear traders!

Today is a special and very important day for the USD/CAD currency pair. The fact is that at 14:30 (London time), data on the US and Canada labor market will be published

There will be reports from the Maple Leaf Country on the unemployment rate and changes in the number of people employed. The US Department of Employment will present data for December on the creation of new jobs in the non-agricultural sectors of the economy, the growth of average hourly wages and the unemployment rate.

We can only assume that the strongest volatility will overwhelm a pair of North American dollars! I suppose sharp and strong movements, possibly in each direction.

Weekly

I think that today, the current growth will be largely determined. It is an adjustment to the previous decline or a change in the trend. To approve the latter, it is necessary to close weekly trading above the broken green support line of 1.2061-1.3041. But that's not all. As you can see, a little higher is the Tenkan line of the Ichimoku indicator, over which the 89 exponential moving average and Kijun hang. All of the above is quite able to provide strong resistance and turn the price down, so to indicate the seriousness of their intentions, the bulls on USD/CAD need to close trading above 1.3166. I must say that this task is not easy, but using such important macroeconomic statistics, everything can be.

To prevent any insinuations that they have lost control of the pair, the bears need to eliminate a significant part of the current growth and close trading below the level of 1.3040. We go further.

Daily

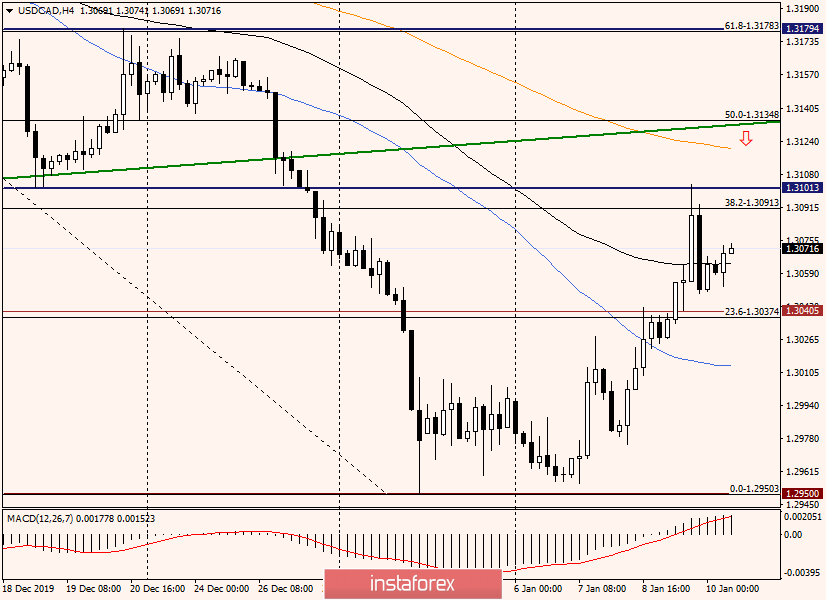

We observe a very interesting and important point in the current situation. After yesterday the pair corrected to the level of 38.2 Fibo from the decline of 1.3319-1.2950 and reached one of the key technical levels of 1.3100. Also, there was a strong rebound down.

As a result, a candle appeared with a very impressive upper shadow, several times the size of the body itself. Very often, after such candles, the quote turns to a decrease, but at the time of writing the review, the USD/CAD rate continues to strengthen.

In my opinion, the closing price of today's trading will be very important. If it turns out to be higher than yesterday's highs of 1.3103, you can count on the subsequent strengthening of the quote. If not, USD/CAD will likely resume the downward scenario and go to re-test the strong technical level of 1.2950. In the case of its true breakdown, there will be almost no doubt about the bearish direction of the instrument.

At the same time, I do not exclude a short-term increase of the price to 1.3123, where the Kijun line is located, from which a strong rebound down may occur.

H4

At the 4-hour chart, the full significance of the current moment is confirmed. Bulls on the pair need to break through the resistance of sellers at 1.3103, but this will not close all the questions. As you can see, a little higher, at 1.3121, there is a 200 exponential moving average, which together with the broken green support line of 1.2061-1.3041 is quite capable of providing decent resistance to attempts to grow and turn the quote down.

For aggressive and risky traders, I recommend looking for sales after the pair rises to the levels of 1.3123, 1.3166, and 1.3172. For those who on the last day of weekly trading do not want to take risks, and even on such important statistics, I recommend to stay out of the market and see what will be the result.

Successful completion of the auction and a good weekend!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română