A new week begins with moderate optimism in global markets. The reason for this is the expectation of the signing of the "first phase" of a new trade agreement between the United States and China, which will be held on Wednesday.

If the main factor influencing investor sentiment at the beginning of the year was the escalation of the Middle East crisis between Washington and Tehran, then after the publication of weak data on employment in America, the attention of market players turned to the state and prospects of the American economy again.

The absence of a negative background from the Middle East became the basis for a partial recovery of markets and increased risk appetite for investors. Moreover, interestingly, the dollar was under pressure again, although it remained fairly confident during the escalation of the Middle East crisis. And there are two reasons for this. One, as have previously indicated, is of a fundamental nature – the actual implementation of the quantitative easing program by the Fed since the fall of last year, although the regulator did not talk about this, but it's real actions point to this. And the second reason is already local in nature, but perhaps, one that will become long-lasting is the weak data on the number of new jobs that the American economy received in December last year. According to the data presented, the number of new jobs amounted to 145,000 against the forecast of 164,000, and importantly, there was a downward adjustment of the previous November data to 256,000.

In addition, negative were the values of the average hourly wage. The average hourly wage on a monthly basis decreased in growth to 0.1% in December against the expectation of an increase of 0.3%. In annual terms, growth declined to 2.9% from 3.1%. It seems that it is forcing investors to believe that the growth rate of the US economy in the fourth quarter will also decrease, which may force the Fed to return to lower interest rates in the future, if these trends continue. This will already be a serious negative for the dollar, which will strengthen the downward momentum.

Given this, we believe that the positive news from the signing of the agreement between Washington and Beijing will weaken the dollar, contributing to an increase in demand for risky assets. Assessing this scenario, we believe that commodity and commodity currencies will be in limited demand in the near future, but gold and safe haven currencies - the yen and the Swiss franc - are likely to be under pressure.

Forecast of the day:

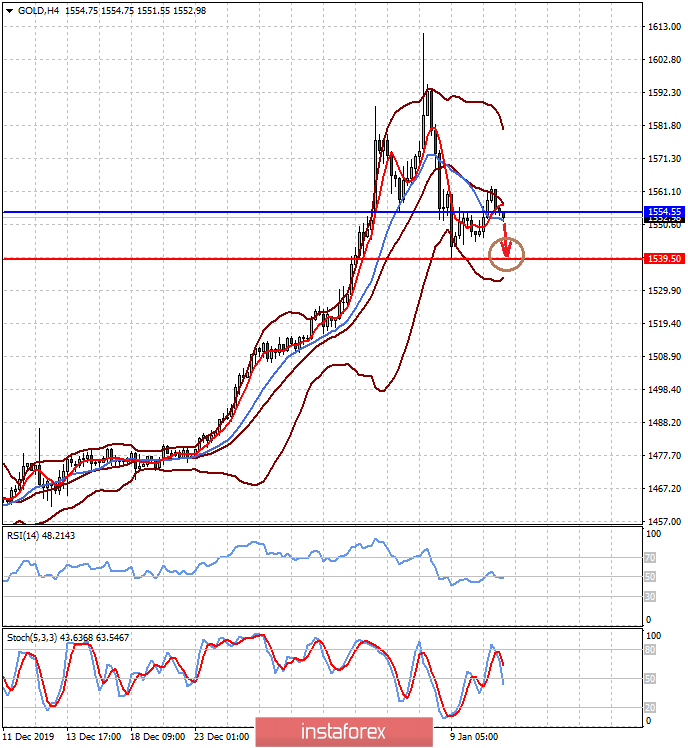

Gold on the spot is trading below the level of 1554.55. There is a possibility of a decline to 1539.50 if it does not rise above this level.

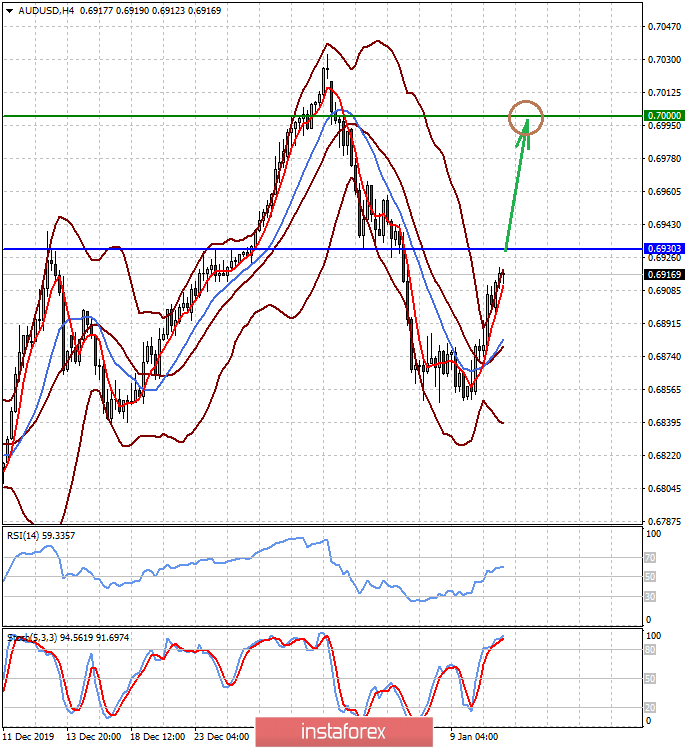

The AUD/USD pair has every chance to continue to grow amid the signing of the "first phase" of a trade agreement between the US and China. Increasing the price above the level of 0.6930 will lead to its growth to 0.7000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română