Investors had high hopes for a report from the United States Department of Labor, but, as usual, all dreams fell apart like a house of cards.

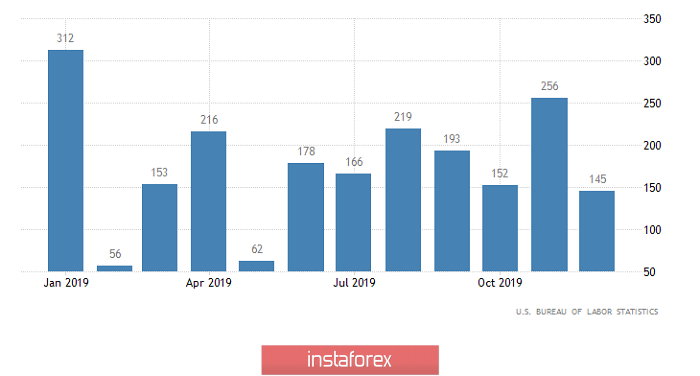

The forecasts for the contents of this very report of the United States Department of Labor were so large-scale that everyone was actively preparing for the massive sale of the dollar, but something went wrong. Of course, the first of the two main indicators met the expectations placed on it, and 145 thousand new jobs were created outside agriculture, which turned out to be even worse than the forecast of 165 thousand. It should be noted that 256 thousand new jobs were created in the previous month. That is, there is a clear decrease in the pace of creating new jobs, which should have contributed to a serious weakening of the dollar. However, the unemployment rate failed, which did not increase from 3.5% to 3.6%, but remained unchanged. This confused investors so much that they, having really no time to start getting rid of the dollar, abandoned the event with a sad look. And no matter how sad it may sound, although such behavior was yet another confirmation of the fact that people do not look at the whole picture in general, but only at the headlines or at one or two indicators. After all, a close look reveals that the content of the report of the United States Department of Labor is clearly negative. In particular, the unemployment rate remained unchanged only because the share of labor in the total population remained the same. However, its increase was predicted from 63.2% to 63.3%. Moreover, the growth rate of average hourly wages slowed from 3.1% to 2.9%. In addition to all this, the average working week decreased from 34.4 hours to 34.3 hours no matter what the statistics show and just the previous value was revised down to 34.3 hours. So, in the bottom line, we have a slowdown in the creation of new jobs amid a slowdown in wage growth. This will inevitably lead to a decrease in consumer activity, which is the main engine of the American economy.

The number of new jobs created outside agriculture (United States):

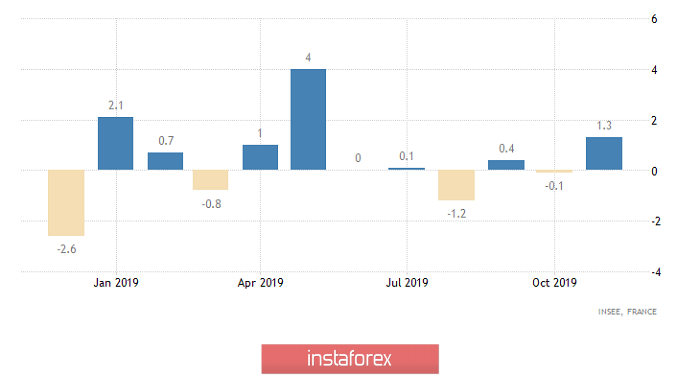

It is clear that the publication of the report of the United States Department of Labor is such a large-scale event that almost no one paid attention to data from Europe. But in France, the second economy of the euro area, the decline in industrial production by 0.1% gave way to an increase of 1.3%. Meanwhile, roughly the same thing happened in Spain, which is the fourth economy in the euro area, where a decline of 1.3% gave way to a growth of 2.1%. And about the same picture is in the third economy of the euro area, that is, in Italy, however, we are talking about slowing down the pace of decline, which is from -2.4% to -0.6%.

Industrial Production (France):

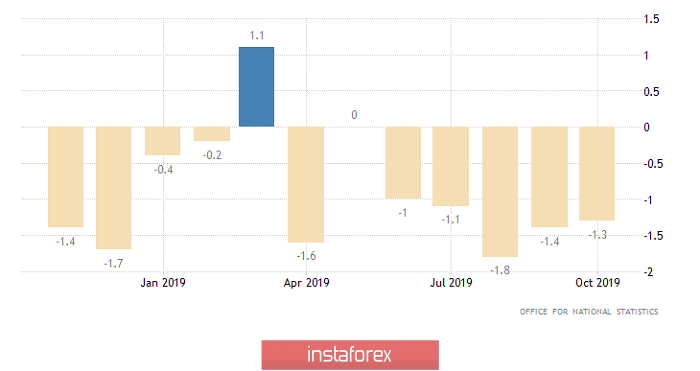

On Monday, the macroeconomic calendar is usually completely empty, but the situation is somewhat different today. Investors should pay close attention to data on industrial production in the UK, the decline of which should accelerate from -1.3% to -1.4%. Moreover, if these forecasts come true, it turns out that industrial production in the United Kingdom has been declining for the eighth month in a row. Without a doubt, this is a sad fact for the pound.

Industrial Production (UK):

For the euro area as a whole, no data is published. However, this does not mean that there is nothing to look at. For example, Germany has already recorded a slowdown in the decline in wholesale prices from -2.5% to -1.3%, which gives hope for inflation. In addition, Italy is expected to accelerate retail sales growth from 1.0% to 1.4%. Now, it is obvious that this will have a beneficial effect on sales in general given that we are talking about the third economy of the euro area.

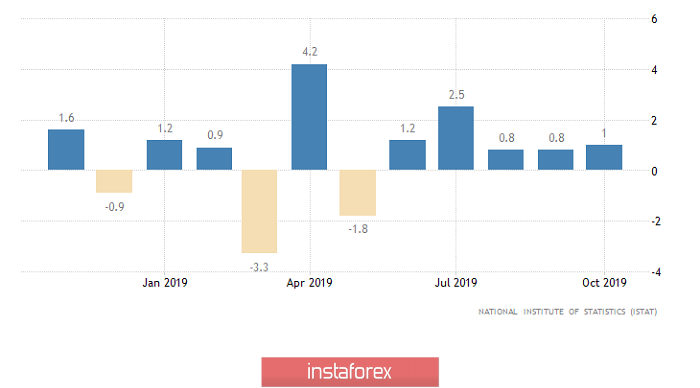

Retail Sales (Italy):

For the single European currency, today will be pretty calm despite the clearly positive data for a number of European countries and it will be in the range from 1.1100 to 1.1125.

The pound is already actively going down, so do not be surprised if it closes the day at 1.2950.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română