Good day, dear traders! Happy New Year to all, according to the Julian calendar. I wish you good luck and good financial well-being!

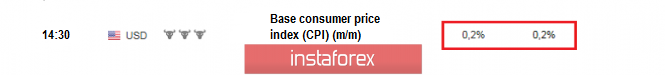

Today, we have important news from the United States: the basic consumer price index (CPI), which is forecasted to be unchanged:

Some might think that it doesn't mean anything, but it does actually. Moreover, at the moment, there is a very interesting intrigue on the dynamics of data from the States.

Let me remind you that last Friday, the NFP passed a very weak report for the dollar:

In this regard, the EUR/USD pair-strengthened its positions:

After the news of the NFP inflation in the USA, there are three possible scenarios:

1. Strong data will strengthen the dollar, and the EUR/USD pair will fall. This will cause a CONFLICT BETWEEN the NFP and the CPI, which will confuse traders and make a flat of increased volatility.

2. Weak data will weaken the dollar, and the EUR/USD pair will rise. This will lead to a trend associated with a SERIES of WEAK DATA FROM the United States.

3. Inflation will not change and will remain at the forecasted level. This is the most boring option because everything that is laid by analysts has no volatility.

Scenario 2 will show the best volatility and trend. Movements associated with an overlay or a series of unidirectional news have the brightest unidirectional trends.

In any case, I recommend waiting for the news and work based on the numbers, not on expectations.

Good luck in trading and control the risks!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română