Economic calendar (Universal time)

The most significant events of today's economic calendar are:

consumer price index (9:30, UK),

producer price index (13:30, USA),

Crude oil reserves (15:30, USA).

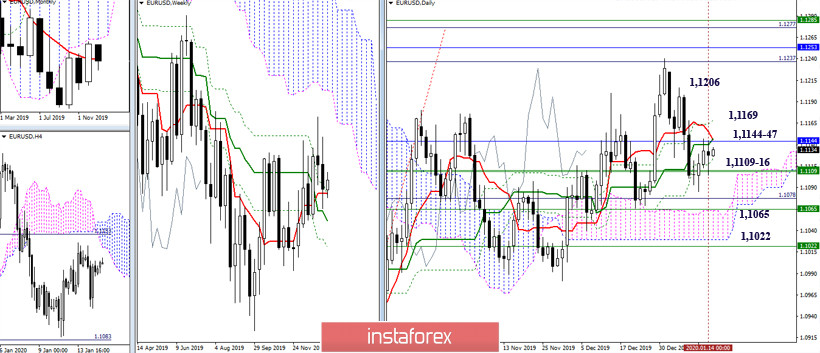

EUR / USD

Yesterday, the players on the downside made an attempt to complete the climb, but have not succeeded in achieving a reliable result. Today, we are close to the zone of important resistance (1.1144-47) again, which combines the main levels of the daily cross and the weekly short-term trend. Moreover, consolidation above may affect the current balance of power, returning hope for a longer strengthening of the bulls and continues to rise. At the same time, intermediate upward directions on the way to the key resistance zone of this section (1.1237-85) in this case can be noted at 1.1169 (daily Fibo Kijun) - 1.1206 (extreme). Today, support remains at 1.1109-16 - 1.1065 - 1.1022 (weekly Tenkan + weekly Fibo Kijun + daily Fibo Kijun + daily cloud + weekly Kijun + weekly Fibo Kijun).

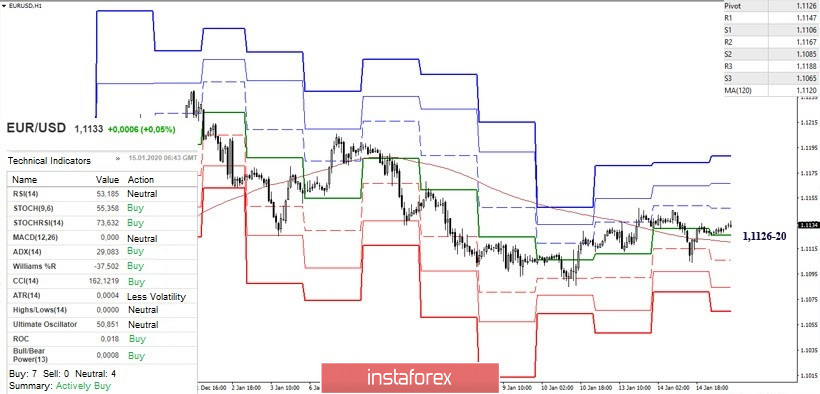

Players for promotion have not yet been able to realize their advantage and the potential of the lower halves. Key supports (1.1120-26 central Pivot level + weekly long-term trend) continue to be united, located in the immediate vicinity of the price chart. A firm hold below may affect the balance of current preferences. Today, support for the classic Pivot levels are located at 1.1106 - 1.1085 - 1.1065. Maintaining positions over key supports (1.1120-26) and the reversal of moving in the future can lead to overcoming the met resistance of the higher halves by 1.1144-47, strengthening today the first resistance of the classic Pivot levels of the day R1 (1.1147 ) In this case, new upward prospects will appear within the day. They will be R2 (1.1167) and R3 (1.1188).

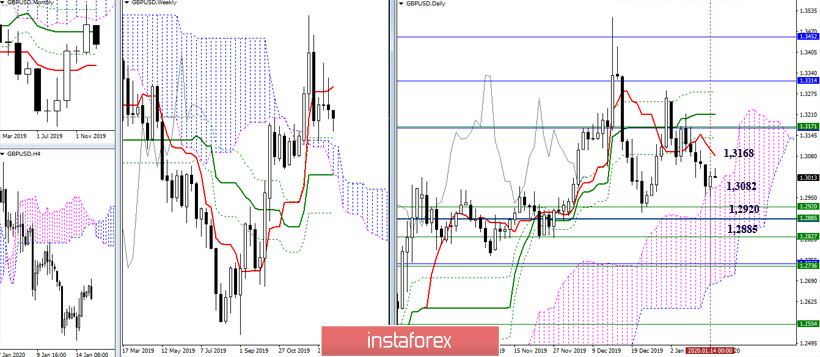

GBP / USD

The meeting with the upper border of the daily cloud (1.2981) delayed the bearish offensive, forming the premises for correction. The first reference point for the development of the correction now is the daily short-term trend (1.3082), then the most important role is still played by resistance 1.3168 (weekly short-term + monthly medium-term trend). The main focus will be on strengthening bearish sentiment and lowering to a fairly wide area of support which was indicated earlier (1.2920 - 1.2885 - 1.2827 - 1.2736) when consolidating inside the daily cloud (below 1.2981).

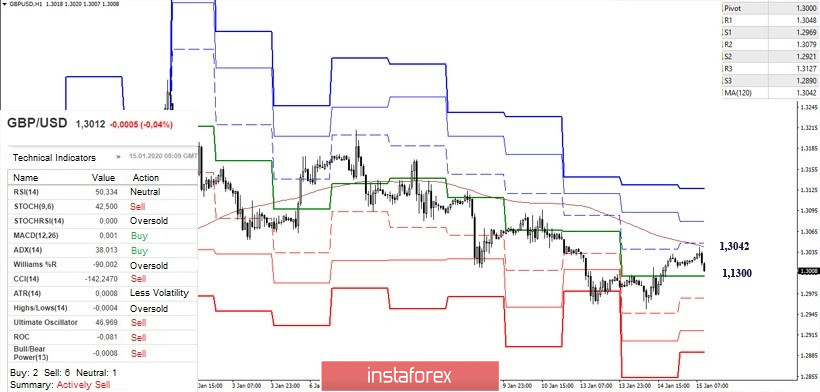

The development of a correctional upward turn led the pair to the most important resistance on H1 - a weekly long-term trend (1.3042). Now, consolidating above will allow players to move up to the upward orientations of the higher halves. It should be noted that at the moment, the analyzed technical indicators remain loyal to the bears and hope for the completion of the correctional rise. Strengthening of the bearish plans now can serve as a decrease under the central Pivot level (1.3000), then the exit from the correction zone (1.2953 minimum extremum) will have significance.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română