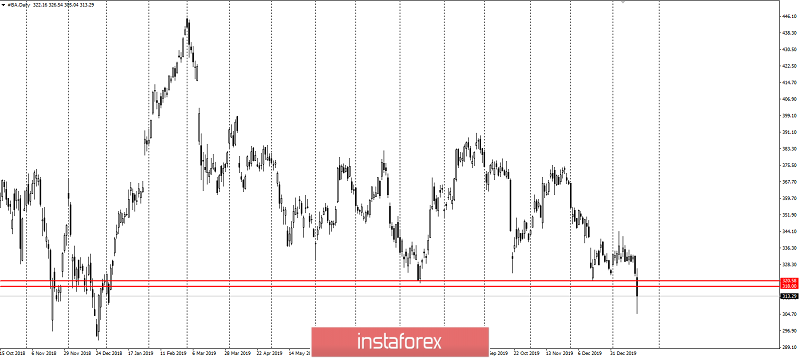

Congratulations to those who took advantage of our trade recommendation for the sale of Boeing in December. Yesterday, the stock price fell at another $14 and around this moment it reached $305. Many of my trader friends took profits yesterday and congratulated us on working out this interesting and technically competent idea that can be easily realized through CFD contracts.

After a weekend on Tuesday in celebration of Martin Luther King's Day, the Boeing's stocks plummeted at the opening of America's stock markets yesterday, following what was according to our plans, including last Monday.

Workout:

For those who did not follow the situation, let me remind you that the idea consisted of a fundamental and technical part. The fundamental negative background was associated with a series of crashes of the Boeing 737 Mach model, which as it turned out is linked with problems in the operation of sensors and software.

According to media reports, starting with the crash at Jakarta airport in 2009, representatives of the airline and US transport officials put pressure on the Commission of Inquiry, which actually blamed the pilots for the crash. After this incident, crashes with 737s became a terrible commonplace. But the most terrible series occurred with the Mach 737 model.

On October 29, 2018, 189 people were killed in Indonesia. After 3 days, 76 decided to suspend the operation of this series and ordered Boeing to modernize the systems. However, this did not end here. On March 10, 2019, 157 people were killed in Ethiopia, where both cases were found out to be caused by technical equipment failure.

After that, Mach 737 was banned from flying almost all over the world. This has cost the company almost $5 billion, and the title of the best-selling airliner in the world was passed on to the Airbus A320.

On January 20, the FICH rating agency downgraded Boeing's rating to A-. The company's debts are expected to reach $32 - $34 MRD this year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română