Crypto Industry News:

Grayscale Investments is planning to apply earlier this week to convert the world's largest BTC fund into a stock exchange fund (ETF) earlier this week, CNBC reported, citing an expert on the matter.

While the exact timing of Grayscale's intended application submission is unknown, the world's largest digital asset manager has made no secret of its intention to seek approval for a Bitcoin-based ETF spot as soon as the futures-based ETF releases its commission. This approval took place on Friday.

A Grayscale ETF would be backed by actual cryptocurrency units rather than linked via derivative contracts such as futures. Should the proposal be approved, it would be a further expansion of the leading cryptocurrency as an established investment asset.

Some analysts predict that the $ 38.7 billion Grayscale Bitcoin Trust (GBTC), whose shares are already traded on public exchanges, has no chance of getting approval from its current cryptocurrency-backed ETF conversion plan any time soon.

After your application is filed, the SEC will have 75 days to process it.

Technical Market Outlook:

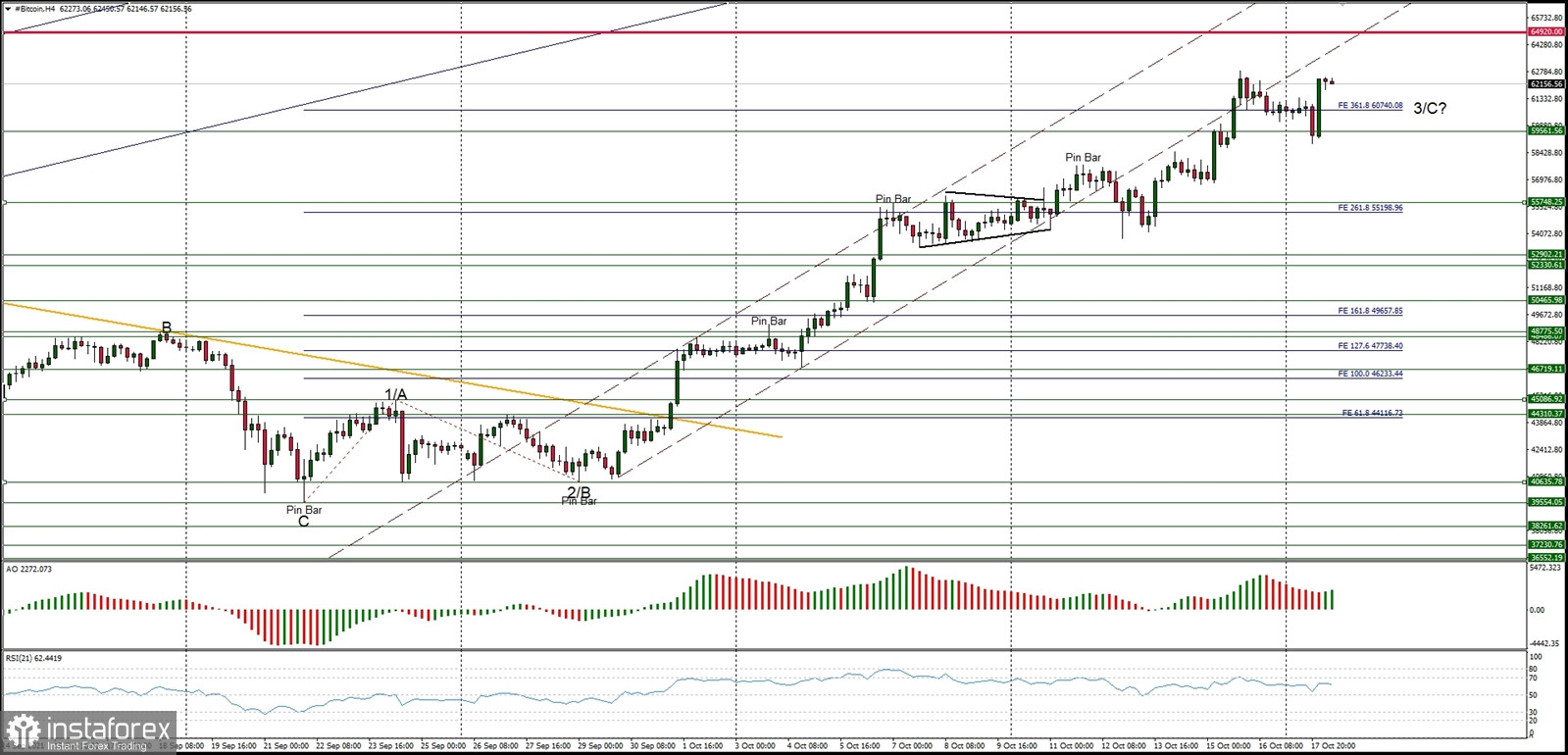

The BTC/USD pair has broke above the level of 361% Fibonacci extension seen at $60,740 and is heading towards the ATH located at the level of $64,920. The immediate technical support is seen at the level of $59,561, but the corrective cycle in wave 4 might extend lower towards the key short-term technical support is located at $52,209. Please keep an eye on this level as any violation of this level will be negative for bulls.

Weekly Pivot Points:

WR3 - $72,401

WR2 - $67,700

WR1 - $63,611

Weekly Pivot - $58,705

WS1 - $54,810

WS2 - $49,233

WS3 - $45,621

Trading Outlook:

According to the long-term charts the bulls are still in control of the Bitcoin market, so the up trend continues and the next long term target for Bitcoin is seen at the level of $70,000. The next mid-term target is seen at the level of $64,920 (the previous AT level). This scenario is valid as long as the level of $30,000 is clearly broken on the daily time frame chart (daily candle close below $30k).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română