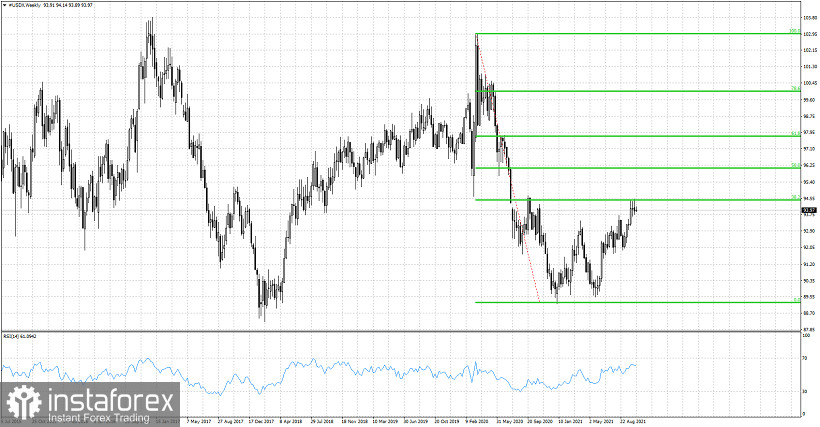

The Dollar index has tried the last three weeks to push above the Fibonacci resistance level of 94.50, but all attempts have failed. Price is now vulnerable to a move lower as the resistance of 94.50 seems to strong for bulls to break.

The Dollar index remains in a short-term bullish trend but a rejection at current levels could bring price back towards 91.70-92. If bulls manage to break above the resistance at 94.50 we should expect the index to continue towards the next target of 96.15. With EURUSD the major component of the Dollar index, having provided a bullish reversal signal and with potential to move higher, the Dollar index most probably will get rejected at the 38% Fibonacci level. Dollar bulls need to be very cautious.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română