Gold dropped aggressively after reaching the 1,813.84 level on Friday. It closed the previous week at the 1,792.52 level. It remains to see how it will react after erasing some of its gains.

XAU/USD was strongly bullish as the US dollar index is trading within a downward channel maintaining a bearish bias. Unfortunately, Fed Chair Powell's remarks at an online conference hosted by the South African Reserve Bank forced the price of gold to drop aggressively.

DXY's further decline could help gold to start increasing again. The eurozone and the US services and manufacturing data turned out to be mixed on Friday. So, the US dollar Index remains vulnerable.

XAU/USD Crash!

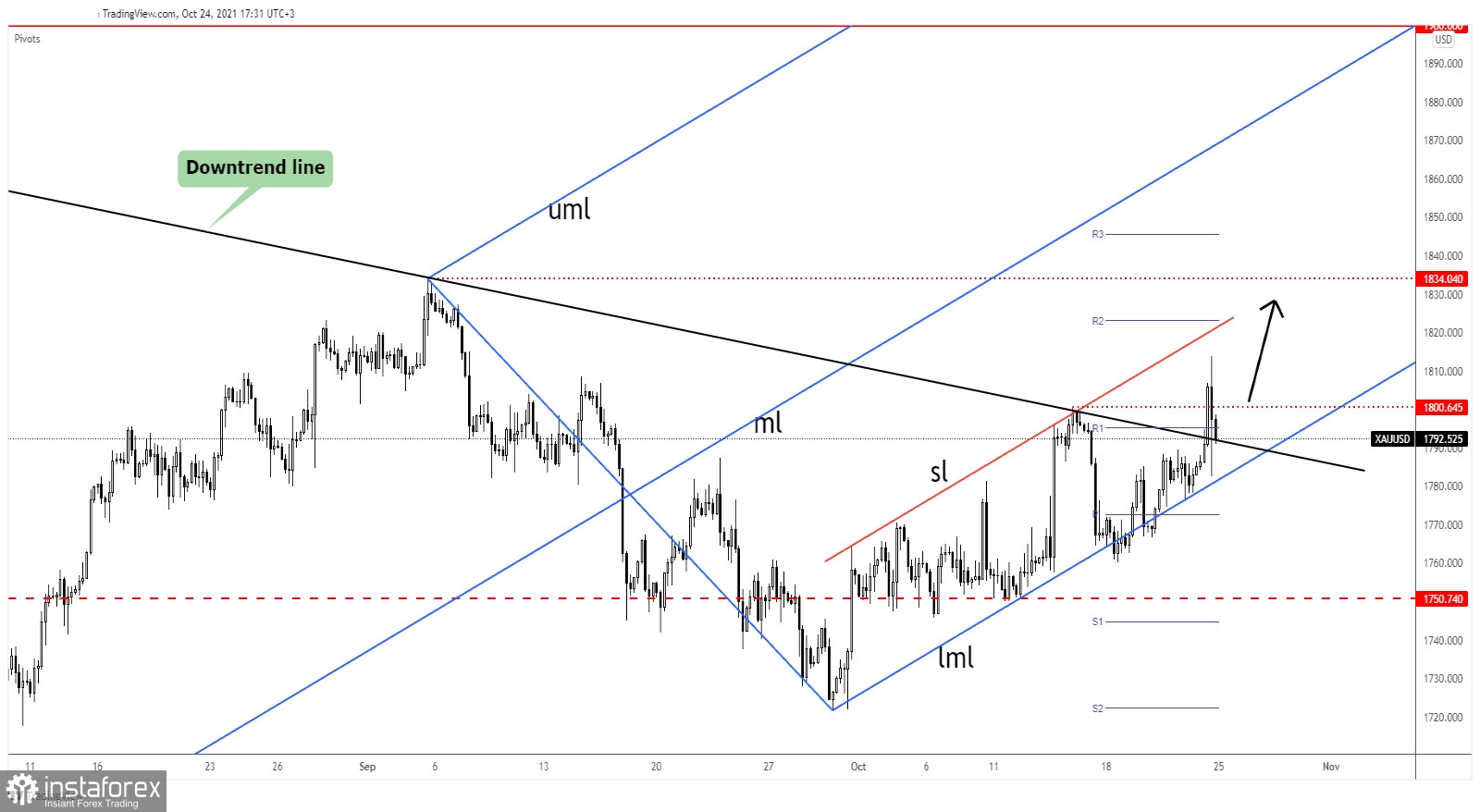

Gold is still trapped between the ascending pitchfork's lower median line (lml) and the inside sliding line (sl). After testing and retesting the lower median line (lml), XAU/USD has managed to jump far above the downtrend line.

As you can see, gold has failed to stabilize above the 1,800 psychological level and above 1,800.64 former high. Staying above the downtrend line may signal new bullish momentum.

Gold Forecast!

Stabilizing above the downtrend line, confirming its breakout, and coming back above the 1,800.64 could bring new long opportunities. It could still grow as long as it stays above the lower median line (lml). Technically, validating its breakout above the downtrend line could signal a larger upwards movement.

Only a valid breakdown below the lower median line (lml) may invalidate an upside continuation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română