Good afternoon, dear traders!

I think I will not surprise anyone if I say that at a very interesting time we live and trade. Recently, the market has changed a lot, and this, in my opinion, is connected with the economic crisis, which, in my opinion, is already underway. The trigger was the Chinese epidemic of coronavirus. This virus, in addition to casualties, brought incredible fear, which pushed gold to distance.

But the most affected are the currencies. Everything falls - the EUR/USD, GBP/USD, AUD/USD, and absolutely ignoring the positive news on base currencies.

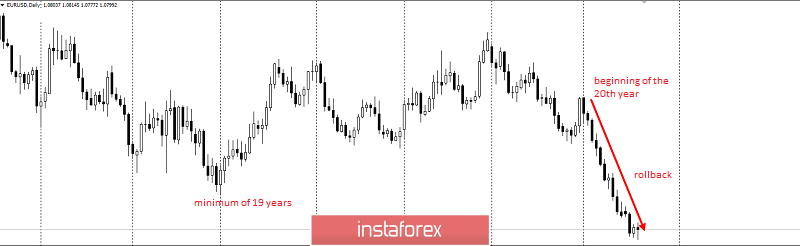

EUR/USD has been falling recoilless already on the 14th day as part of a common two-year fall! Look at the stories - when did this happen and at what events? The last time this happened is in 2018, and before that during the crisis in 2014.

You, of course, say that everything is bad in the eurozone! Let's look further.

GBP/USD completely ignores the positive news in the country's economy.

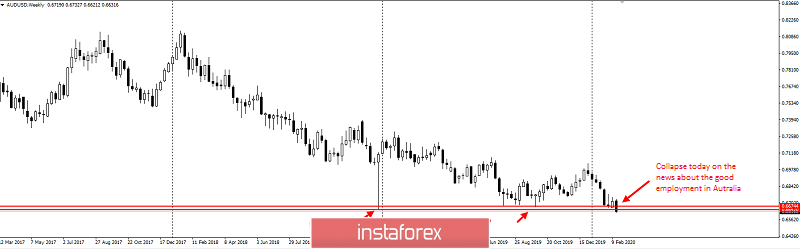

AUD/USD plummets to good employment, breaking through the lows of 2018 and 2019:

The "fear indicator", gold, is at its highest point in the last 7 or 8 years, completely ignoring all the positive dollar news:

Against this background, I recommend that you carefully select trading situations, reduce risks by at least two to three times and maximize the timeframe.

Success in trading and control the risks!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română