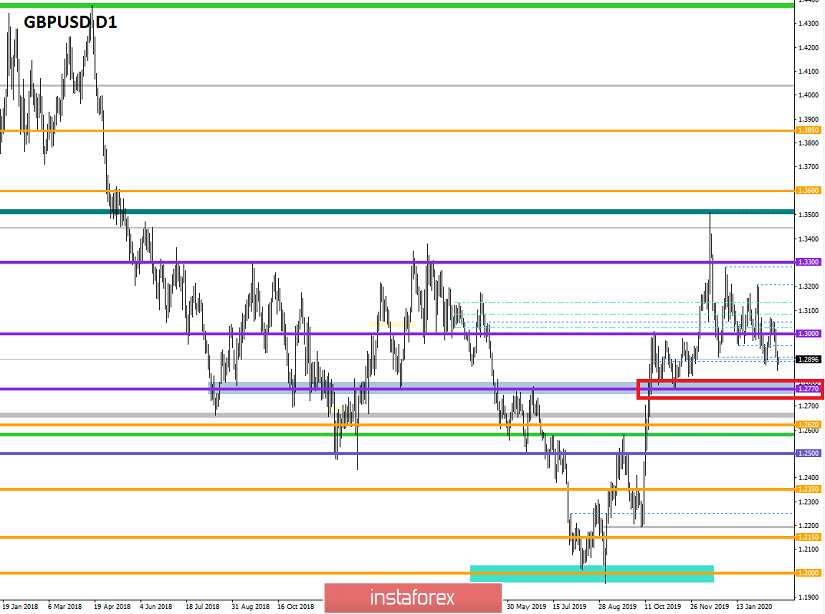

From the point of view of a comprehensive analysis, we see an update of the lows of the current year with local slippage towards 1.2848, and now let's talk about the details. The assumptions regarding the downward move come true, the quote resumed the initial move after a short correction, where it declined at least on February 10, and after it the average level of the range 1.2770 // 1.2885// 1,3000. In fact, we have confirmation from sellers who are increasingly considering short positions and the prospect of a more significant decline. There was an overheating of short positions at the moment of the pulse code of the past day, I doubt it, since the activity was within the acceptable range, wherein the correction was 100% developed. Thus, the foundation of February 10, paired with the level of 1.2885, is no longer such dangerous coordinates for sellers, where only a regrouping of trading forces is needed to resume the downward move.

Regarding the theory of the development of the downward move, we see that the next price fixation below the average level of 1.2885 gives a round of judgments regarding the speediest move to the main coordinate 1.2770. In fact, the level of 1.2770 is the key in terms of the development of the theory, since a change in the clock component has already occurred, but the restoration of the downward movement relative to the medium-term trend has not yet arrived. Thus, fixing the price lower than 1.2770 will give the first round of judgments about the restoration, which will lead to an even more significant reduction in the pound.

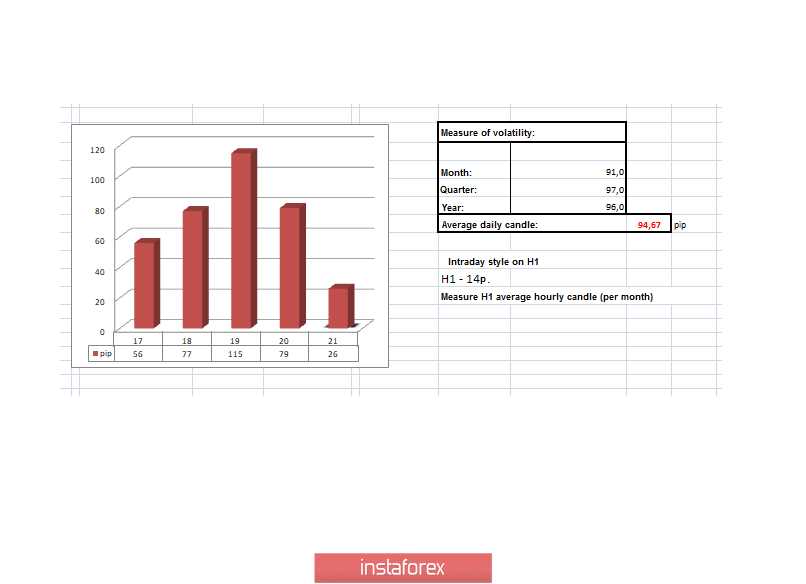

In terms of volatility, we see a regularity of several weeks, where the activity of a currency pair systematically tends to the values of 70-80 points. It is worth considering that it is possible to maintain stability even with activity below the average daily market.

Details of volatility: Thursday - 79 points; Friday - 79 points; Monday - 74 points; Tuesday - 74 points; Wednesday - 44 points; Thursday - 125 points; Friday - 62 points; Monday - 56 points; Tuesday - 77 points; Wednesday - 115 points; Thursday - 79 points. The average daily indicator, relative to the dynamics of volatility is 94 points [see table of volatility at the end of the article].

Detailing minute by minute, we see that the main surge of activity occurred in the period 8:30–12:30 [UTC+00 time at the trading terminal], where downward interest prevailed. The subsequent fluctuation was in terms of partial recovery, with stagnation in the form of accumulation.

As discussed in the previous review, medium-term and intraday traders are working on the decline, which is currently the most relevant.

Considering the trading chart in general terms [the daily period], we see that the change in the clock component moved into the movement within the range 1.2770 // 1.2885 // 1.3000, where a breakdown of the level of 1.2770 could give the prospect of a move in side 1.2620 --1.2500 --- 1.2350.

The news background of the previous day contained data on retail sales in the United Kingdom, where the slowdown was from 0.9% to 0.8% with a forecast of 0.7%. After that, the data on applications for unemployment benefits in the United States was released, where the total growth was 25 thousand: Primary +4 thousand.; Repeated +21 thousand.

The market reaction was surprisingly calm, where the pound did not receive support from statistics, which led to a further decline.

In terms of the general informational background, we see that the degree of the upcoming negotiations between England and Brussels is growing, and the first official meetings will begin with proposals literally in a few weeks, where we will probably encounter disagreements that will stir up the mood of investors and, as a fact, the market.

Today, in terms of the economic calendar, we have preliminary data on the PMI of Britain, where in the manufacturing sector a decrease is expected from 50 to 49.7, and in the services sector a decrease from 53.9 to 53.4. In the afternoon, similar PMI data will be released for the United States, but they also do not expect anything positive.

The upcoming trading week in terms of the economic calendar is quite measured, the only day that may interest us is Thursday, where a package of statistical data for the United States is waiting.

The most interesting events displayed below --->

Wednesday, February 26

USA 15:00 Universal Time - New Home Sales (Jan): Prev -0.4% ---> Forecast 1.5%

Thursday, February 27

USA 13:30 Universal time - basic orders for durable goods

USA 13:30 Universal time - applications for unemployment benefits

USA 13:30 Universal time - preliminary GDP data: Prev 2.1%

Further development

Analyzing the current trading chart, we see a slight rollback from the low of the past day, where the quote without excessive activity produces accumulation in the region of the average level of 1.2885. In fact, we see a stop where sellers regroup trade forces, and the levels below [1.2885 and 1.2850] are no longer so dangerous and can be broken in the course of a normal move.

From the point of view of the emotional mood, we see that the downward move made it possible for many to return to the market, where the emotional component of the market participants is positive.

By detailing the time interval per minute, we see a rollback of 1.2848 ---> 1.2901 with available accumulations in the form of small ranges of 10-15 points.

In turn, medium-term traders as well as intraday traders, are considering a further downward move after the process of regrouping trading forces.

Having a general picture of actions, it is possible to assume that accumulation in the variable frameworks of 1.2850 / 1.2915 will still remain for some time, but if the price is fixed lower than 1.2850, the direction will open for us towards the main level of 1.2770. If there is an upward trend, it will be in terms of local movement, but the downward trend strategic deals remain.

Based on the above information, we derive trading recommendations:

- Local buy positions were considered in case of price fixing higher than 1.2915, towards 1.2930-1.2950.

- Positions for sale in the medium-term are already being conducted by traders in the direction of the level of 1.2770. At the same time, some intraday traders also hold short positions, but if we don't have any deals, then we are waiting for the price to pass lower than 1.2850.

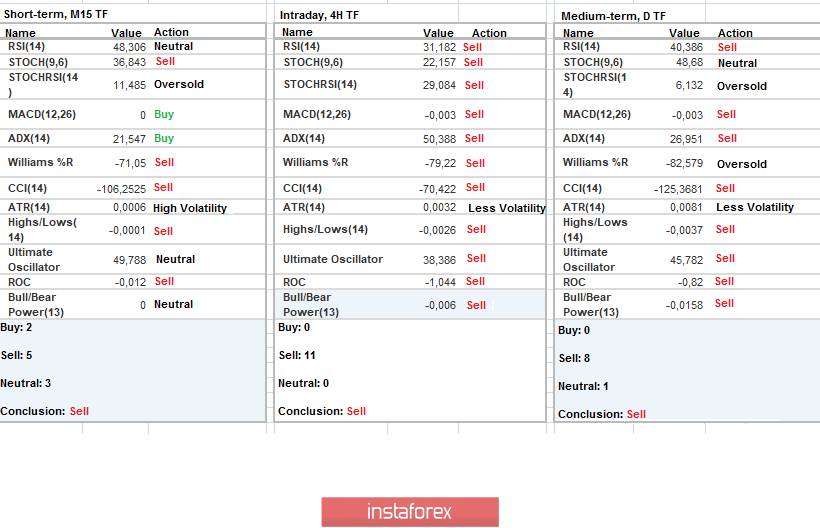

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that indicators unanimously took a downward position due to the movement within the level of 1.2885, which corresponds to the general mood of the market.

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for Month / Quarter / Year.

(February 21 was built taking into account the time of publication of the article)

The current time volatility is 26 points, which is a low value and acceleration is still possible. It is likely to assume that the volatility of the day will be at least around 70 points, in accordance with the pattern.

Key levels

Resistance Zones: 1.2885 *; 1.3000; 1.3170 **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support Areas: 1.2885 *; 1.2770 **; 1.2700 *; 1.2620; 1.2580 *; 1.2500 **; 1.2350 **; 1.2205 (+/- 10p.) *; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **.

* Periodic level

** Range Level

*** Psychological level

**** The article is built on the principle of conducting a transaction, with daily adjustment

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română