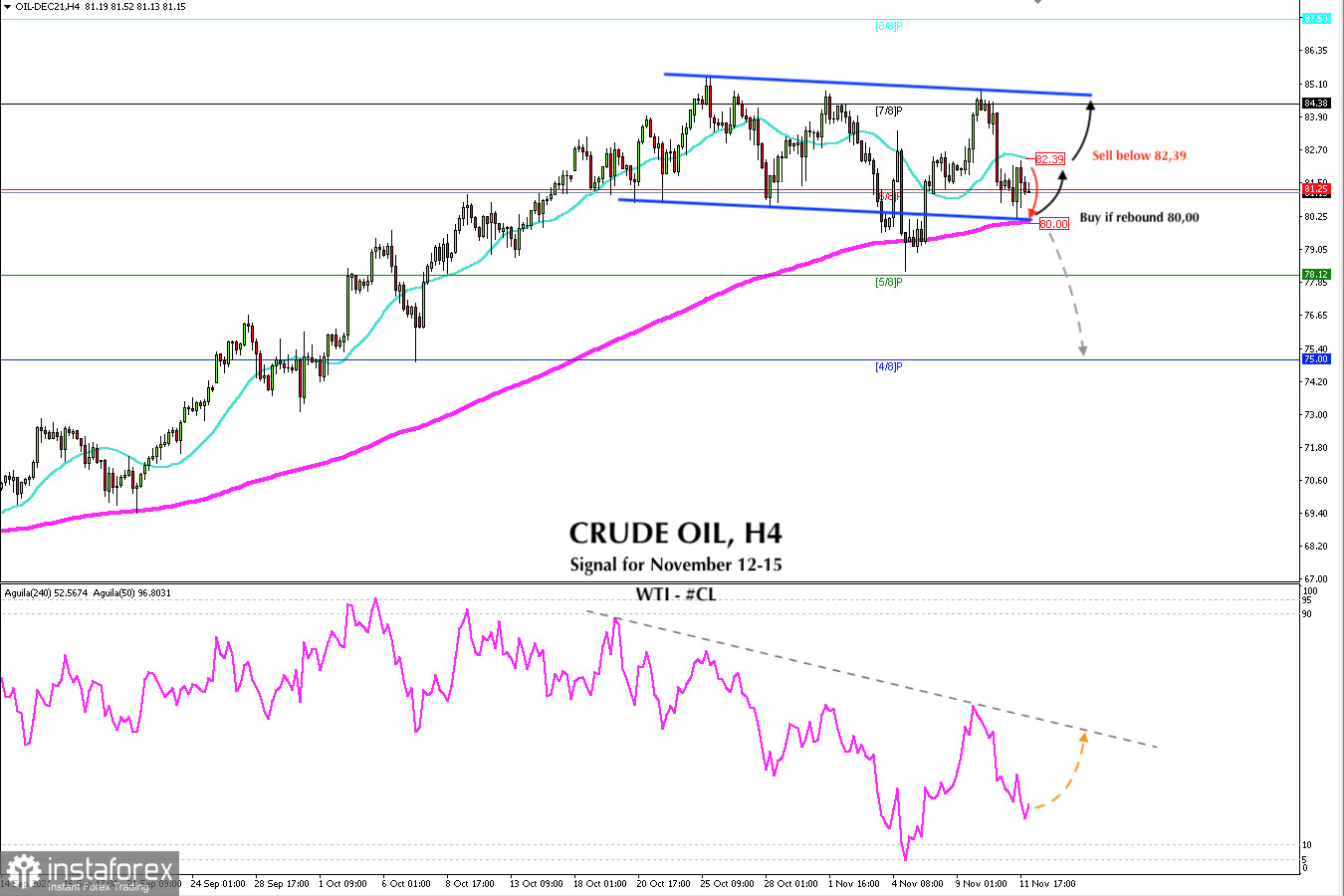

A barrel of oil (WTI, #CL) is trading at 81.25 below the SMA of 21 and below the 6/8 support of murray. It is showing a bearish bias which is limited by the EMA of 200 located at 80.00.

Since October 20, WTI has been oscillating within a slightly sloping downtrend channel. Crude oil has moved in a price range of about 450 pips. This consolidation is likely to continue in the coming days and return the price to the level of 84.38.

The US inflation data, which exceeded analysts' forecasts, delivered a strong blow to oil prices and raised expectations that the Federal Reserve could withdraw monetary stimulus more quickly.

Another factor that has exerted pressure on oil is the strength of the US dollar and the decline in the Wall Street indices. WTI has a positive correlation with the equity markets. As they have been going through a correction in recent days, the price of crude has also weakened.

In order for Crude to resume its uptrend, it has to overcome and settle above 84.38 (7/8). If it continues to move below this level, certain limitations will be expected and it will continue to oscillate within the price range of 84.38-80.25.

For a bearish scenario and a change in the trend, WTI should have a daily close below the 200 EMA located at 80.00. From this level, it may fall to the support level of 5/8 of murray at 78.12 and to the support of 4/8 around 75.00.

Iraqi Oil Minister Ihsan Abdul-Jabbar Ismail said on November 11 that the Organization of the Petroleum Exporting Countries (OPEC +) is expected to maintain its policy of gradually increasing oil production per 400,000 barrels per day.

In the next few hours, we expect a technical bounce around the 200 EMA which will be a signal to buy. Our primary target will be at 82.39. On the other hand, a consolidation above the 21 SMA will be a bullish sign, and the price could rise to 84.38.

Below we leave the support and resistance levels for the next two days.

Support and Resistance Levels for November 12 - 15, 2021

Resistance (3) 83.33

Resistance (2) 82.25

Resistance (1) 81.50

----------------------------

Support (1) 80.14

Support (2) 79.11

Support (3) 78.12

***********************************************************

A trading tip for CRUDE OIL for November 12 - 15, 2021

Sell below 82.39 (SMA 21) with take profit at 80.00 (EMA 200) and stop loss above 82.95.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română