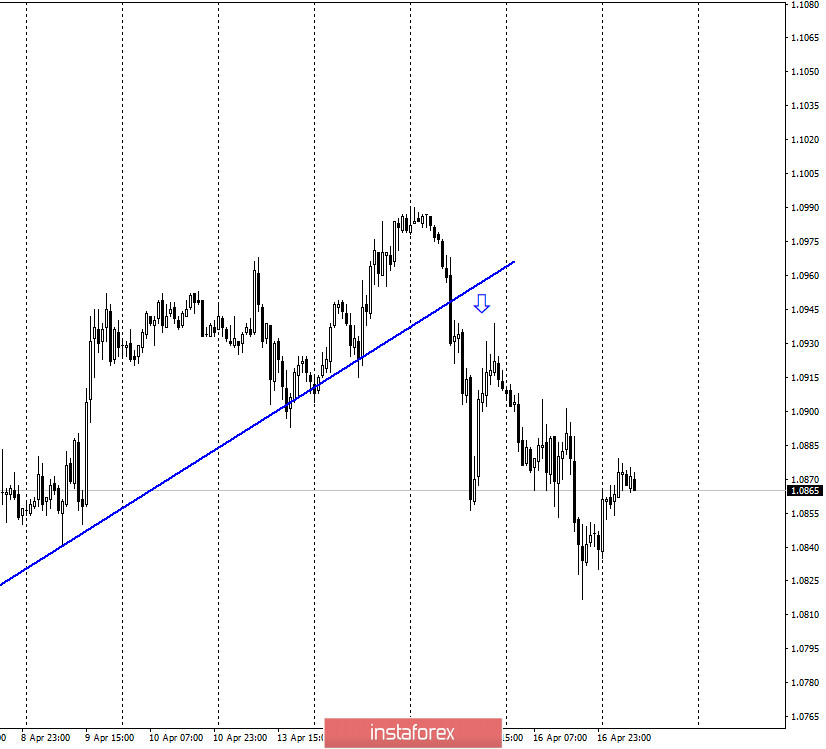

EUR/USD – 1H.

Hello, traders! On April 16, the euro/dollar pair continued to fall after the quotes were fixed under the ascending trend line. New graphical constructions are not observed now, however, the "bearish" mood of most traders remains. To determine the goals and possible reversals, you should now refer to the older charts. From the news of the past day, I would like to note the next report on applications for unemployment benefits in the US, which showed an increase of 5 million more unemployed in just one week. However, this report made no impression on the American currency, and it continued to grow. Also, according to the latest information, Donald Trump is going to break the economic blockade of his country and gradually weaken the quarantine, for which he immediately came under a barrage of criticism. The European Union is also beginning to relax quarantine measures, but only in those countries where the growth rate of the COVID-2019 virus has slowed.

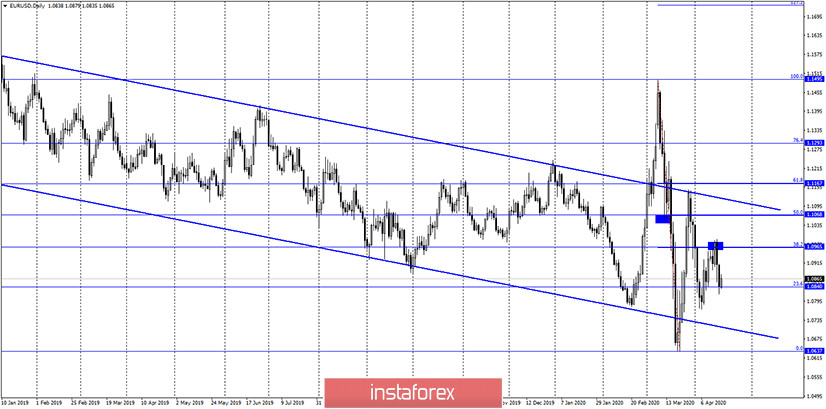

EUR/USD – 4H.

As seen on the 4-hour chart, the pair's quotes performed a reversal in favor of the US dollar and anchored under the corrective level of 38.2% (1.0964), after which they performed a fall to the corrective level of 23.6% (1.0840). However, the pair's rebound from this level allows traders to expect a reversal in favor of the euro currency and some growth in the direction of the Fibo level of 38.2%. Today, the divergence is not observed in any indicator. Fixing the euro/dollar pair under the Fibo level of 23.6% will increase the probability of a further fall in the direction of the next corrective level of 0.0% (1.0638).

EUR/USD – Daily.

On the daily chart, the euro/dollar pair fell to the corrective level of 23.6% (1.0840), after rebounding from the Fibo level of 38.2% (1.0965). Fixing the pair's rate below this level will increase the chances of continuing to fall in the direction of the lower line of the descending trend corridor, from which the quotes have already left twice, but each time returned to it.

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to expect an increase in quotes in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US dollar and, possibly, a new long fall.

Overview of fundamentals:

On April 16, the European Union's industrial production index for February is higher, and Germany's consumer price index for March is higher. Both indicators were weaker than a month earlier. However, the number of new initial applications for unemployment benefits in America also could not please traders - 5 million. Nevertheless, the dollar grew on this day.

News calendar for the United States and the European Union:

EU - consumer price index (11:00 GMT).

On April 17, the EU news calendar contains only a report on inflation, which is unlikely to interest traders and will be reflected on the chart of the euro/dollar currency pair. In America, the news calendar is empty today.

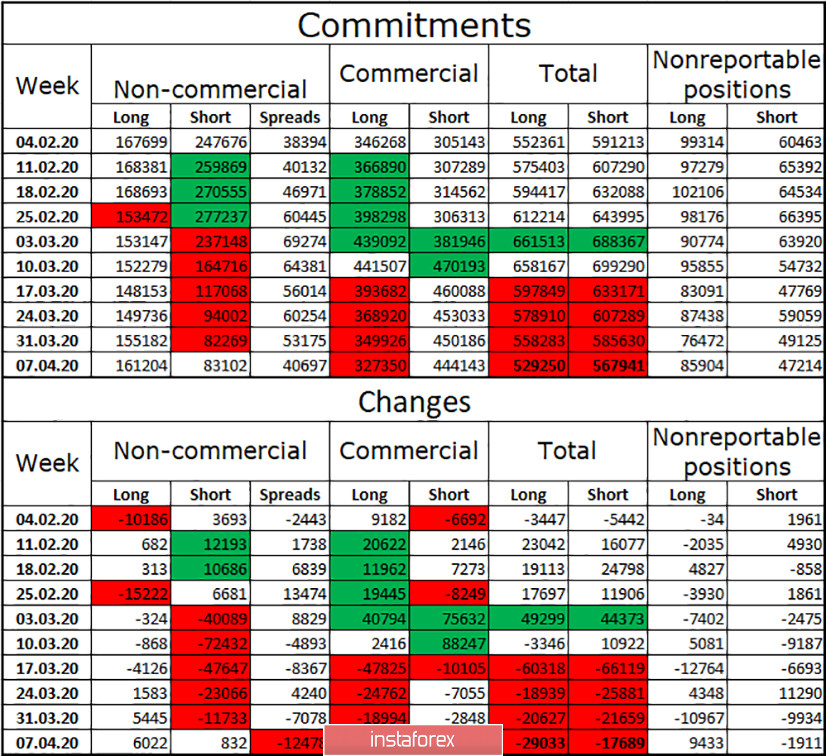

COT (Commitments of Traders) report:

The latest report from Commitments of Traders showed a reduction in the total number of both long and short contracts. The new COT report will be released tomorrow. In recent days, the pair has managed to show both growth and decline. Thus, I do not expect a major change in the ratio of buy-to-sell contracts among major market players. The total number of contracts currently remains overweight for short: 568,000-529,000. The last four weeks have shown that the number of both categories of contracts has been steadily decreasing. This means that activity among major players is falling, and the advantage remains with the bears.

Forecast for EUR/USD and recommendations to traders:

At this time, I recommend waiting for consolidation under the level of 23.6% (1.0840) on the 4-hour chart, and then sell the euro with a target of 1.0638. I do not recommend buying a pair yet, since there is not a single trading signal for this. Even the hang-up on the 4-hour chart does not look convincing yet.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română