Economic calendar (Universal time)

There are no important indicators in today's economic calendar.

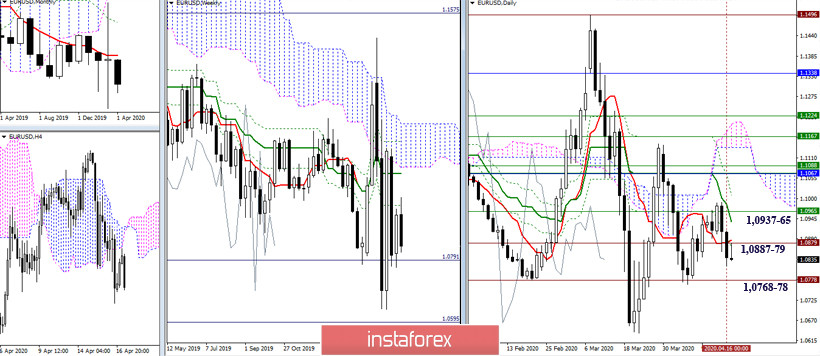

EUR / USD

The pair maintained a bearish mood yesterday and continued to decline. The next bearish reference point is now in the area of 1.0768-78 (minimum extremum + historical level). The attraction in the current situation is 1.0887-79 (daily Tenkan + historical level). The zone of 1.0937-65 (daily Kijun + weekly Fibo Kijun) continues to be a significant resistance in this area. We are closing the week today and uncertainty currently dominates the weekly chart. Therefore, there are no clear priorities and directions. Today's trading is unlikely to change the state of the week time frame.

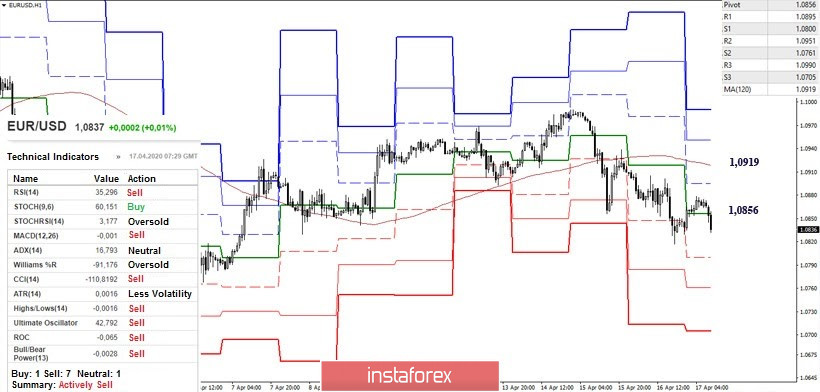

The advantages at lower time intervals now belong to players to decline. The primary task of these players is to restore (1.0817) and continue the downward trend. The classic Pivot levels S1 (1.0800) - S2 (1.0761) - S3 (1.0705) can be intraday supports. A change in the situation, moods and the existing balance of forces can be outlined with reliable consolidation above the key levels, which at H1 are the central pivot level of the day (1.0856) and the weekly long-term trend (1.0919).

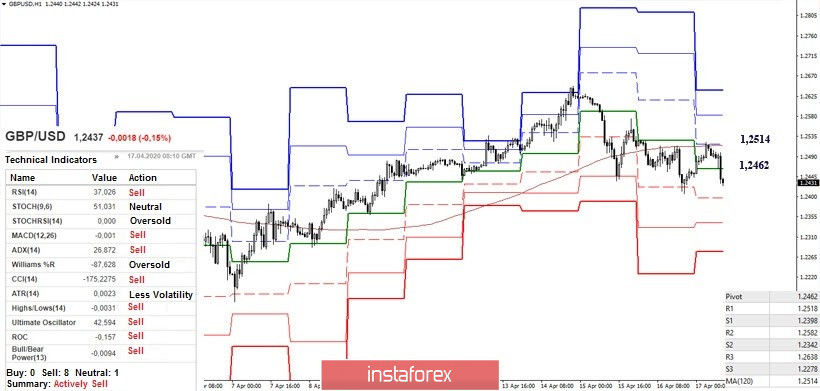

GBP / USD

The pair maintained its location and work in the attraction zone, combining many levels of different time intervals 1.2540 - 1.2450 - 1.2406 (monthly Tenkan + weekly Kijun and Senkou Span A + monthly Fibo Kijun + daily Tenkan). Slowdown and consolidation in this area retains good chances for players to increase to continue the rise. The next significant resistance is located at 1.2670 - 1.2711 (the upper boundary of the weekly cloud + the final boundary of the weekly dead cross). The loss of the daily short-term trend (1.2406) will allow us to consider the strengthening of the bearish sentiment and the development of the decline, the reference points of which will be the support of 1.2305 (weekly Tenkan) - 1.2213 (weekly Fibo Kijun) - 1.2029 (daily Kijun), etc.

The pound has already tested the strength of the key level of the lower halves for several times - a weekly long-term trend. Today, it is located at 1.2514, but still remains not defeated, while maintaining the main advantage for the players to decline. On the other hand, the intraday supports are currently located at 1.2398 (S1) - 1.2342 (S2) - 1.2278 (S3). Reliable consolidation above the level of 1.2514 will swing the scales in favor of players to increase. Among the reference points in this case, it will be possible to note 1.2582 (R2) - 1.2638-47 (R3 + maximum extremum).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română