Sales remain the most relevant.

Hello, dear traders!

Last week, the main currencies traded against the US dollar in different directions, but most still showed a decline. Among them was the single European currency, which lost 0.56%.

The main reason for the weakening of the euro remains the contradictions between the countries of the European Union to find a solution to counteract the consequences of COVID-19. In this regard, French President Emmanuel Macron warned of the possible collapse of the EU if options are not found to overcome the negative consequences of the pandemic.

Meanwhile, US President Donald Trump is calling on his fellow citizens to get tested for coronavirus to get more information and more control over a new type of coronavirus infection. Even though the situation with the spread of COVID-19 in the United States remains extremely unfavorable, the American leader expressed hope for the imminent launch (or restart) of the world's leading economy. So far, the number of applications for unemployment benefits is steadily growing, and according to data published last week, this figure reached 22 million people.

Today's economic calendar is not full of important and significant events. The Eurozone at 10:00 (London time) will publish the trade balance without seasonal adjustments. From the US, at 13:30 (London time), the index of economic activity from the Federal Reserve of Chicago will be presented.

As noted earlier, market participants have almost ignored macroeconomic reports recently, even quite significant ones. Let's turn to the technical picture, which, in my opinion, plays a primary role in the price dynamics of the euro/dollar currency pair in the current conditions.

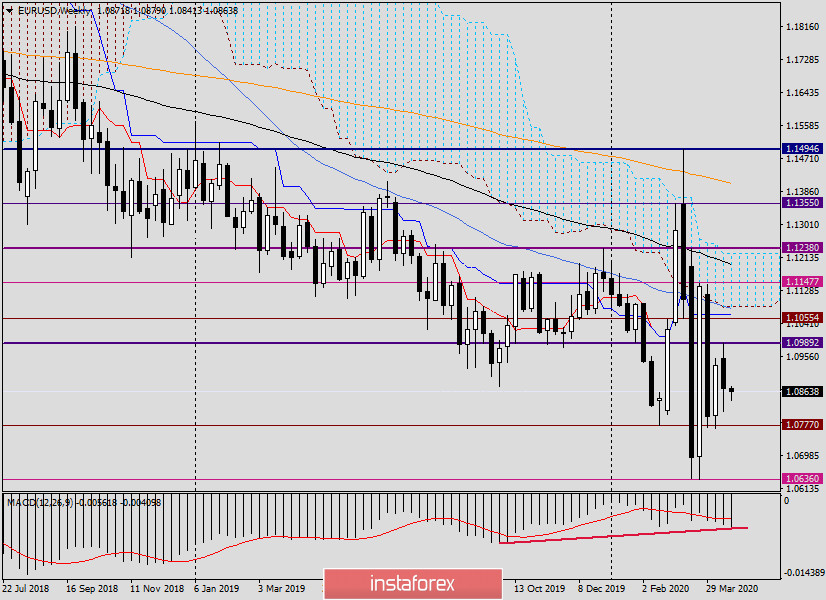

Weekly

There were no major changes in the weekly chart. As a result of the decline, trading ended at 1.0873 on April 13-17. The breakdown of one of the key support levels of 1.0777 has not been confirmed. On the other hand, the pair can't seriously and permanently gain a foothold above the important level of 1.0900.

In general, the situation in the weekly timeframe can be described as uncertain. At the same time, the warring parties have a lot to strive for. Bulls need to raise the rate above the previous week's highs of 1.0989 and then test the strong technical zone of 1.1000-1.1065, where the psychological level of 1.1000, the technical mark of 1.1055 and the Kijun line of the Ichimoku indicator, which passes at 1.1065, are located.

Bears on the euro/dollar have their tasks. To begin with, they need to firmly establish themselves under the level of 1.0777 and then re-test the support level of 1.0636 for a breakdown. Only a true breakdown of this mark will indicate the pair's readiness to continue moving in the south direction.

Despite the uncertain situation in this period, we can not exclude the possibility of strengthening the euro/dollar in the current week's trading. The bullish divergence of the MACD indicator has not disappeared and is an additional signal for the probable growth of the quote.

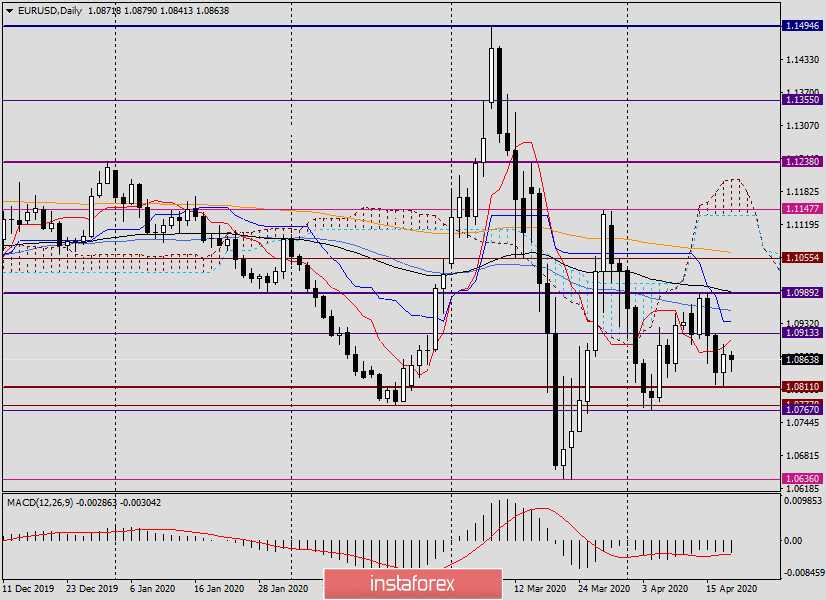

Daily

In this timeframe, the situation is also far from clear. At the top, serious resistances are represented by the Tenkan (1.0900), Kijun (1.0936), 50 MA (1.0957) and 89 EMA (1.0992) lines. The levels of 1.0911 and 1.0989 can be distinguished.

As you can see, to raise the price to the landmark mark of 1.1000, euro bulls will have to make every effort.

The bear market for the euro/dollar will be indicated by the update of the minimum values on April 17 at 1.0811, after which players will need to break through the strong support zone of 1.0777-1.0767 and consolidate below. Only then will the road open to the lows of March 20 and 23, which are at 1.0636.

Conclusion and recommendations for EUR/USD:

Despite the bullish divergence of the MACD on the weekly TF, in my opinion, sales are more relevant, the closest of which can be tried after the rise to the price zone of 1.0900-1.0940. That's all for now.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română