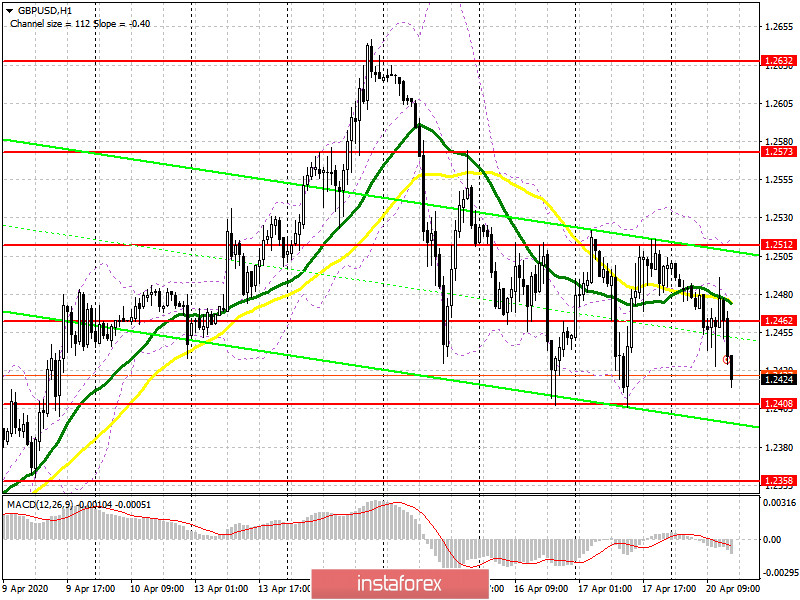

Buyers of the pound missed the morning level of 1.2462 in the first half of the day but then tried to quickly recover, which led to the formation of a buy signal, which, unfortunately, failed to work itself out, and the pair again fell below the middle of the side channel of 1.2462, which led to the demolition of a number of stop orders. At the moment, an important task for the bulls will be to break through and consolidate above the resistance of 1.2462, which will strengthen the demand for the British pound and allow them to get to the larger resistance of 1.2512, which acts as the upper border of the side channel. The longer-term goal will be a maximum of 1.2573, where I recommend fixing the profits. If the movement in the second half of the day will continue to be under the control of sellers, then it is best to look at purchases of GBP/USD only after the test of the minimum of 1.2408 and only after the formation of a false breakout there. I recommend postponing long positions immediately for a rebound until the support of 1.2358 is updated.

To open short positions on GBPUSD, you need:

Sellers of the pound coped with the morning task and pushed the pair under the level of 1.2462. While trading will be conducted below this range, we can expect to continue the downward movement in the pair to the area of the minimum of 1.2408. The third test of this area can lead to a breakdown, which will quickly push GBP/USD to the area of new lows of 1.2358 and 1.2294, where I recommend fixing the profits. You can also consider short positions after an unsuccessful attempt to return the bulls to the resistance of 1.2462, provided that a false breakout is formed there. However, as shown in the morning practice, if there is no rapid movement of the pair down, it is best to abandon sales and wait for the test of the upper border of the side channel 1.2512, where you can open new short positions immediately on the rebound.

Signals of indicators:

Moving averages

Trading is conducted below the 30 and 50 daily averages, which indicates that the advantage of sellers of the pound remains.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

Bears are trying to form a breakthrough in the lower border of the side channel of 1.2435, which will only increase the pressure on the pound. In the case of an upward correction, the sale can be viewed after testing the upper limit of the indicator in the area of 1.2512.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română