The euro continues to trade in the side channel, and the data on the balance of foreign trade of the eurozone released in the first half of the day did not affect the market much since we are talking about February indicators when the economy was not affected by the pandemic crisis.

Amid the absence of other important fundamental statistics, economists continue to debate what should be done by the European Central Bank before the EU summit, which will be held this Thursday. There is speculation that the regulator should intervene in Italy's current debt problem, which is about to lead to a resumption of the sovereign debt crisis in the eurozone. There was a breakdown into two camps, where some believe that the ECB should start buying Italian government bonds with a yield of 2%, which will make it possible to rally leaders at the EU summit, who will once again discuss the issue of pan- European bonds, popularly referred to as "crown bonds".

However, in my forecast earlier, I already discussed what such a move on the part of the regulator could lead to. The second part of the "camp" consists of criticizing the actions of the ECB, which in recent years has been mainly focused on the redemption of debt obligations of Spain and Italy, which so far have suffered most from the pandemic. A number of experts note that if the central bank continues to buy Italian bonds, it will eventually become the owner of more than 50% of Italy's public debt. In this scenario, a split within the ECB could go into a very dangerous stage, as the bank will lose political support for Germany and a number of other countries. Against this background, an improvement in market sentiment towards risky assets may be temporary, and the euro is unlikely to be as rapid as others expect.

However, it is worth interfering with the situation, as news has already appeared about the probable downgrade of Italy by S&P Global Ratings. According to the latest forecasts of the International Currency Pound, with an additional issue of bonds worth 100-110 billion euros, the country budget deficit will jump to the level of 8% -9% of GDP. Some analysts predict that Italy will issue bonds for 245 billion euros. Currently, Italy's current S&P rating is 'BBB' with a negative outlook. However, it should be noted that if the rating is downgraded by only one notch, it will remain at the investment level, and bonds issued by Italy will be considered as highly reliable debt securities.

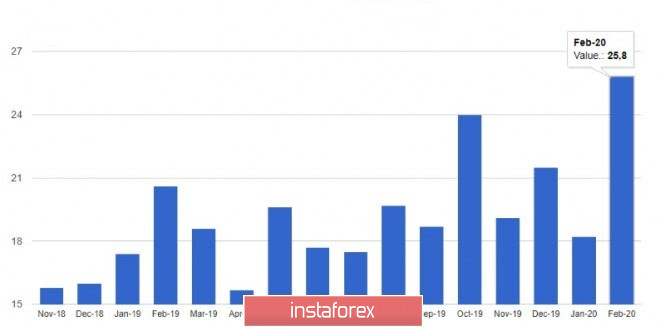

As for the fundamental data on the eurozone economy that came out today, the February report on the positive balance of foreign trade in the eurozone did not greatly impress traders. It is unlikely that growth will remain at the achieved level, given what awaits us in terms of activity in the manufacturing sector and the services sector of the region in the coming months. According to the EU Statistics Agency, the eurozone's foreign trade surplus settled to 25.8 billion euros compared to 18.2 billion euros in January. Exports grew by 1.8% compared with January, while imports, on the contrary, decreased by 2.3%. The positive balance of the current account of the Eurozone balance of payments in February amounted to 40 billion euros against 32 billion euros in January.

As for the technical picture of the EURUSD pair, it remained unchanged compared to the initial forecast. At the moment, sellers of risky assets are also aimed at returning to last week's lows at 1.0814, the break of which will increase pressure on the euro and will open a direct path to the April low of 1.0770. However, the active actions of buyers of the trading instrument, which are more characteristic for the North American session, can lead to a breakthrough of resistance at 1.0900, which will allow returning to the highs of the previous week to the area of 1.0995.

Oil

Oil quotes have already broken the lows of March 1999, almost reaching $10 per barrel for delivery in May. June futures also collapsed by more than 11% from the opening level of $25 and are now trading at $22.15 per barrel. Pressure on black gold persisted earlier this week amid oversupply and low demand, as well as an increase in US stocks. As a recent report by the International Energy Agency showed, oil demand this year will fall by more than 9.3 million barrels per day. OPEC expects a record drop in global oil demand in 2020 by 6.8 million barrels per day.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română