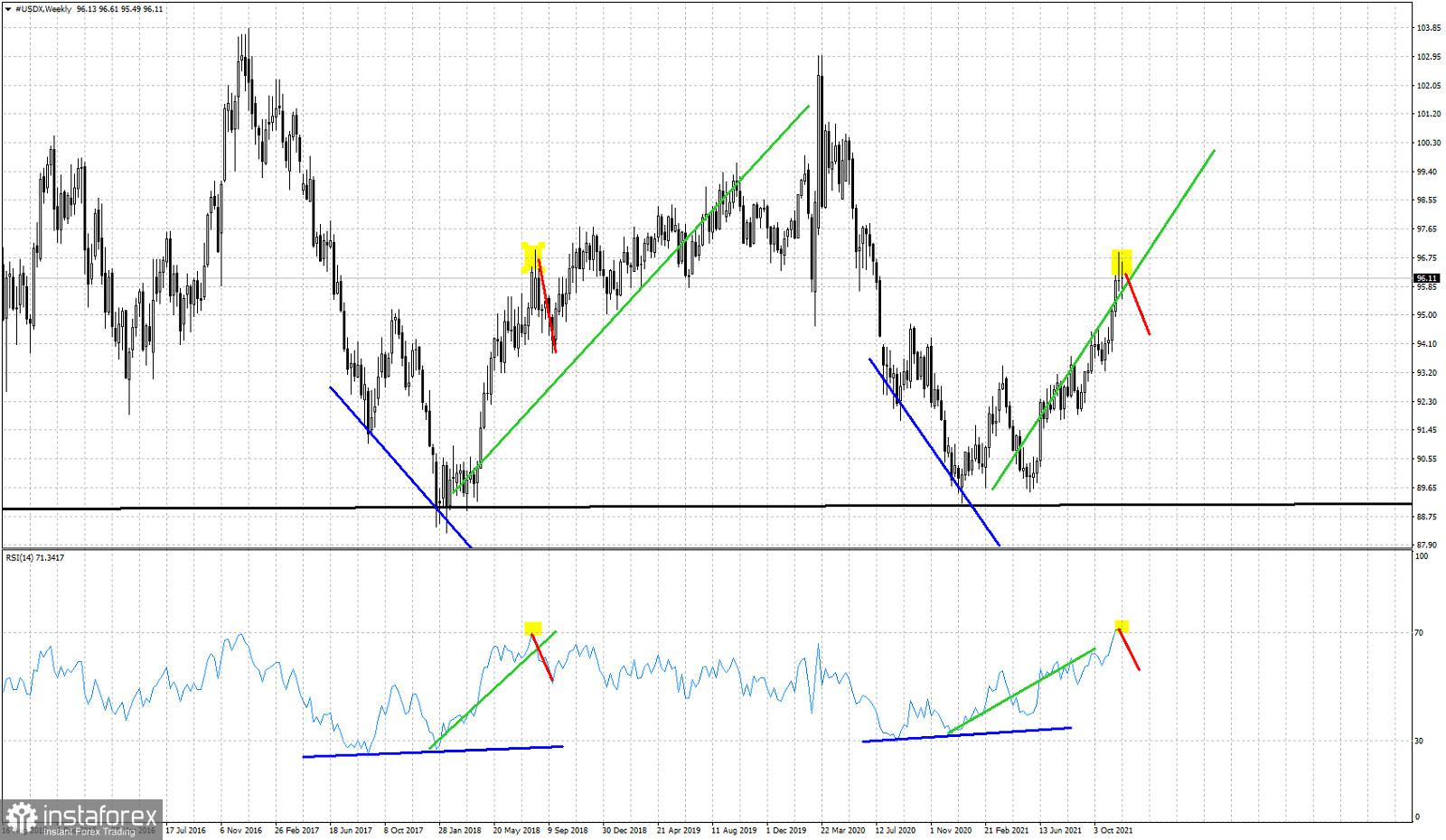

In previous posts during this past year we mentioned many times the similarities of price action now and price action back in 2017 when it made another base around 89-90 and started a new upward movement towards 103. As we expected the reversal to the upside when price was trading around 89-90, we now see similarities to 2017 and expect a pull back that could last 2-5 weeks.

Blue lines- bullish divergence

Green lines -expected path

Yellow rectangles- Price and RSI tops

Red lines- expected path

With the RSI at the overbought level, a 2 to 5 week pull back is justified if price continues to follow the roadmap from 2017. Shorter-term charts also justify such a pull back and that is why I believe there are increased chances of this happening. Maybe tomorrow's NFP announcement will be the spark that starts a move lower against the Dollar. One thing is for sure, volatility is expected to rise very soon and most probably the Dollar will be under pressure. Traders just need to be patient and watch for clues. No need to front run the market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română