Stability – a sign of class. Although the strengthening of the Japanese yen against the US dollar since the beginning of the year looks modest, nevertheless, the USD/JPY pair closed in the red zone each of the past four months in 2020. This circumstance increases the confidence of speculators in the currency of the Land of the Rising Sun, because, unlike most other world monetary units, it finds the strength to resist the popular US dollar. Hedge funds have been building up net long positions on the yen for five consecutive weeks and by mid-May, it had reached 47,181 futures contracts, the highest since November 2012.

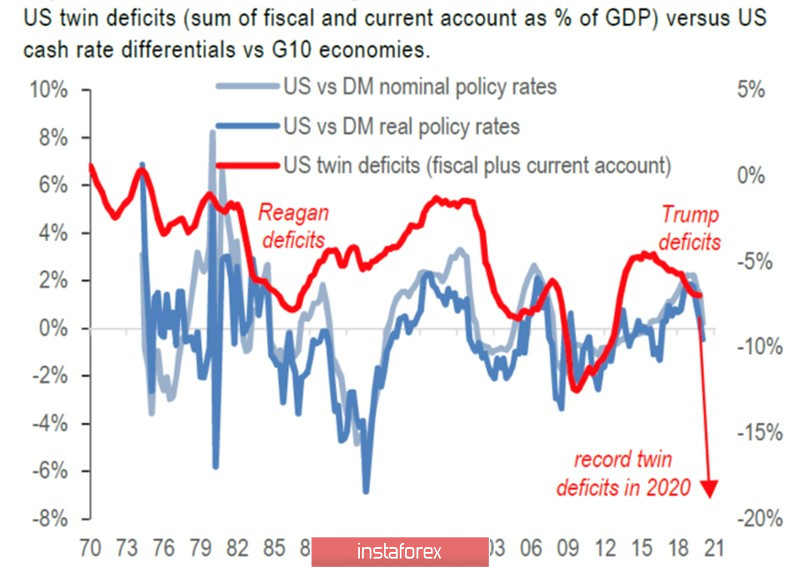

"Japanese" as a safe haven asset draws strength from the turmoil in global financial markets, pandemics, factors of the long-term weakness of the US dollar, and trade wars. Reducing the federal funds rate to almost zero, rumors about its departure to the negative area, the unlimited scale of the Fed's asset purchase program, the bloating of the Federal Reserve's balance sheet to $9 trillion and $11 trillion by the end of 2020 and 2021, as well as a large-scale fiscal stimulus that leads to a rapid increase in the US national debt, will faithfully serve the "bears" for USD/JPY on the long-term investment horizon. Double deficits (budget and foreign trade), paired with a reduction in the differential of nominal and real rates, will still affect the "American" in the future.

Dynamics of the US double deficit and rate differentials

However, the strengthening of the yen is an extremely undesirable thing for official Tokyo. Especially in the face of the first deflation in the Land of the Rising Sun in the past three years. The government and the Bank of Japan are constantly emphasizing the scale of fiscal (£117 trillion) and monetary (£75 trillion) incentives. They are afraid of repeating the history of 2009-2011 when after the crisis, the market considered that the country's leadership had done too little, and began to buy up the Japanese currency. By the way, at its meeting on May 22, the Board of Governors announced additional credit support in the amount of £30 trillion (about $279 billion). This is about providing resources to commercial banks at a zero rate to finance the government's lending program for companies affected by the pandemic.

According to CIBC World Markets, the escalation of the conflict between the US and China will extend a helping hand to the "bears" in USD/JPY, because in 2018-2019, the yen was the main beneficiary of trade wars. In my opinion, after the Fed rate fell to 0-0, 25%, the US dollar took over its status as the main currency haven, so we can not say that the escalation of the conflict will definitely lead to a decrease in the quotes of the analyzed pair. On the contrary, it can drop US stock indices and contribute to the growth of USD/JPY. Rather, the factor of a new round of trade wars should be played out in such instruments as AUD/JPY, NZD/JPY, and EUR/JPY.

Technically, if the "bulls" for USD/JPY managed to implement the "shark" pattern and achieve its target of 88.6% (it corresponds to the level of 109), traders will be able to sell the pair. In my opinion, it will remain inclined to consolidate in the range of 106-110.

USD/JPY and S&P 500, the daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română