Hello, dear colleagues!

At yesterday's trading, the main currency pair of the Forex market continued its growth. And this is despite the caution of investors in connection with the continued distribution of COVID-19. The United States of America remains the main focus of infection with the new type of coronavirus infection, followed by Brazil and India. So, according to the latest data, the daily number of COVID-19 infections in the United States has increased to 55 thousand. However, this did not increase the demand for the dollar as a safe haven currency. As expected the day before, Wednesday's trading was mainly determined by technical factors. In addition, yesterday there was a positive mood on the stock market, and, as you know, at such times, the demand for the US currency falls and it becomes cheaper. However, optimism on global financial markets is not stable, as market participants continue to remain concerned about the prospects for the global economy.

Yesterday's speech by the representative of the Federal Reserve System (FRS) Bostik generally came down to the fact that the measures taken by the Federal Reserve to support the economy are more productive. However, there is still uncertainty about the timing of economic recovery, and this will depend on a number of factors, the main one being the strength of the second wave of COVID-19.

If you look at today's economic calendar, it is worth highlighting the meeting of the Eurogroup, which will begin at 09:00 (London time). From the US reports, investors' attention will be drawn to initial applications for unemployment benefits, which will be published at 13:30 London time. Another speech by Atlanta Fed President Raphael Bostic, which begins at 17:00 (London time), is unlikely to give investors new food for thought. However, this event should be taken into account by those who will be trading today or already have open deals. Let's go to the technical picture of the main currency pair.

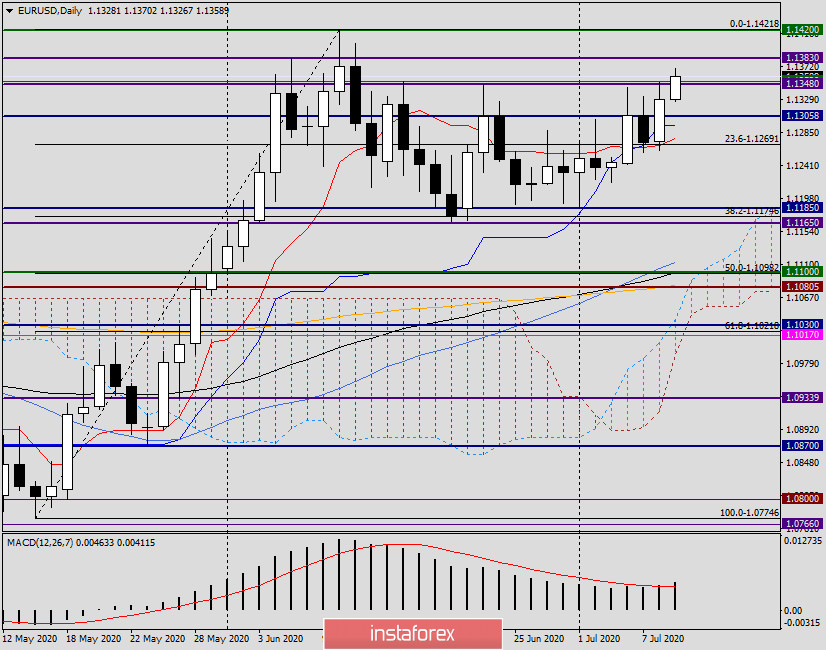

Daily

Despite yesterday's growth, it was not possible to break through the resistance of sellers at 1.1350 for the euro bulls again. The maximum values of Wednesday's trading were shown at 1.1351, and the closing price of yesterday's session was at 1.1329.

As already noted in yesterday's review, the players on the rate increase did not manage to finish the day's session above the landmark level of 1.1300. And then yesterday it happened. What are we seeing today?

At the time of writing, the euro/dollar continues its upward trend, and trading is conducted near 1.1364. That is, the hated and extremely strong resistance in the area of 1.1348-1.1352 is now breaking through. Naturally, it will be possible to determine the fact of a breakdown only after the end of today's trading. However, at the moment, the euro/dollar pair is torn up and if the rise continues, it will test the strength of the sellers' resistance at 1.1383. If the euro bulls manage to pass this mark, the road will open to the most important level 1.1422, on the ability to break through which will depend on the ability to rise to the psychological level 1.1500, right under which, at 1.1495, there is another strong resistance from sellers. If the reversal candlestick signals of Japanese candles appear below 1.1422, this will be the basis for a reversal of the quote in the south direction, which means that we will need to consider options for opening short positions on EUR/USD.

However, at the moment, the main trading recommendation is purchases that are better considered from lower prices. For example, after a short-term decline in the area of 1.1300-1.1270. But there is one important point here. If the price is fixed below the level of 1.1300 and can not return higher, there will be questions about the further rise of the quote. Another option for purchases will be a pullback to the area of 1.1350, after the pair is firmly fixed above these levels with three or more candles on H4 and(or) H1

Now for opening potential sales. In my opinion, the signal for opening short positions will be bearish candles that will appear at 1.1350 and (or) 1.1383. I also recommend considering such signals on the four-hour and one-hour timeframes. At the end of the article, the growth of the EUR/USD pair is seen as the most relevant, which means that purchases are more likely to become profitable. However, we should not forget that market sentiment sometimes often changes, and we will see what awaits us during the day.

Good luck with trading!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română